From FRM Investment Management With many of this year’s themes continuing, as discussed above, November was a positive month for hedge funds. The majority of strategies were positive over the month, with very few outliers on either the positive or negative side (given adjustments for volatility). The HFRX Global Hedge Fund Index returned 0.55%. […] Read more »

HSBC Review of Hedge Funds in 2013 and Outlook for 2014

By Dean Turner, Investment Strategist, HSBC Private Bank Hedge funds reviewed Hedge funds have delivered healthy risk-adjustedreturns over the last few years, and have been a useful diversifier for portfolios. In our view, the macroeconomic and investing environment should remain supportive for managers across equity, credit and macro strategies. We have been positive on the […] Read more »

GAM Insight – Equity Hedge and Event Driven Managers Ride Trends to Gains in October

From Global Asset Management October got off to a tentative start, with investors focused on the US debt ceiling impasse. This issue was temporarily resolved by mid-month and markets broadly rallied from there, with equities, credit and bonds all moving higher. Many equity hedge and event driven managers reaped the rewards from keeping their gross […] Read more »

The Event-Driven Asset Class in a Rising Rate Environment

By Paul Hoffmeister and Thomas F. Kirchner, CFA, of Quaker Funds One of the most common concerns today among financial advisors seems to be the prospect of rising long-term interest rates in the United States and what to do with U.S. fixed income exposures. In search of a potential solution, we examined the history of […] Read more »

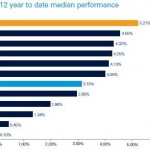

Why Emerging Hedge Fund Managers Outperform

Andrew Beer, Chief Executive Officer of Beachhead Capital, wrote an excellent research note recently affirming that the widely known conception that emerging hedge fund managers outperform their more seasoned and larger peers was supported by the available data. This graphic is the nub of the explanation of why this can happen in the case of […] Read more »

FRM See A Strong CTA Bounce Back As Unlikley In Monthly View

From FRM Investment Management The HFRX Global Hedge Fund Index was positive in September, +0.96%, the majority of strategies ending the month with positive returns. Equity Long-Short managers were amongst the best performing strategies, benefitting from the equity market rally across regions in the first half of the month. Given the large moves seen in […] Read more »

Investing Institutions and the Persistent UCITS Hedge Funds Performance Gap

By Simon Kerr, Publisher of Hedge Fund Insight It was noted in Hedge Fund Insight in May this year that most of the capital raised by European hedge funds in 2013 had gone into UCITS versions of the funds rather than the offshore versions of those hedge funds. At the time the comment was […] Read more »

European Equity Managers Adding Value From Bottom Up

According to Deutsche Bank the median return of European-based hedge funds in the first 4 months of the year was 3.15%. Just looking at Equity L/S strategies, over the same period global L/S funds were up 4.25%, and European Equity L/S were up 4.13% on a median basis. For comparison the STOXX 600 was up […] Read more »