by Seth Bancroft, Research Consultant, Hedge Funds at NEPC If abrupt shifts in prices are what keep CTA (or managed futures) investors up at night, then they are likely sleep-deprived, given the recent market volatility. Up until recently, equity markets have been on a tear. Thus, not surprisingly, most CTAs–strategies designed to capture trends in asset […] Read more »

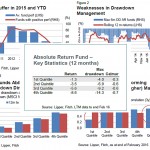

Beta Component of Returns Hits Absolute Return Funds – Fitch

By Manuel Arrivé and Alastair Sewell of Fitch Ratings Returns Reveal Beta Exposures in Absolute Return Funds Absolute Return (AR) funds showed their poorest performance since 2008, with average 12-month rolling returns sinking to – 5.2%, principally as a result of poorly managed drawdowns. Only 11% of funds showed positive performance over 12 months […] Read more »

Reinsurance as an Alternative Investment Strategy

By Donald A. Steinbrugge, Managing Partner Agecroft Partners, LLC Reinsurance is one of the few hedge fund strategies that has almost no correlation to the stock or bond markets and has the potential to generate high single digit to low double digit returns on average over the next 5 to 10 years, regardless of […] Read more »