By Manuel Arrivé and Alastair Sewell of Fitch Ratings

Returns Reveal Beta Exposures in Absolute Return Funds

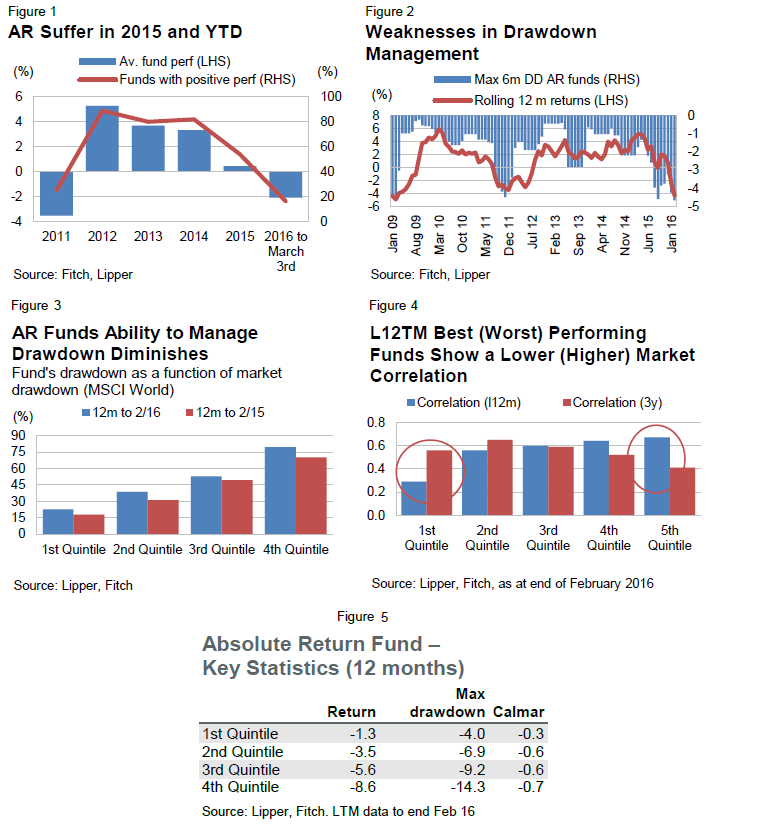

Absolute Return (AR) funds showed their poorest performance since 2008, with average 12-month rolling returns sinking to – 5.2%, principally as a result of poorly managed drawdowns. Only 11% of funds showed positive performance over 12 months to end-February 2016.

AR funds’ long risk asset (particularly credit) and short volatility bias made them vulnerable to the change in market regime in 2015, although this was a strong performance driver in prior years. The past 12 months of lower systematic returns and higher risk of capital loss was more supportive of pure alpha AR strategies and revealed hidden beta in many of AR funds, as Fitch anticipated in its January 2015 AR dashboard.

What to Watch

- Risk Asset Correlation: Persistent positive correlation to systematic market exposure (beta) reveals unwanted pro-cyclicality or style drifts that may not be consistent with the investment approach of a given AR fund claiming to be agnostic to investment cycles.

- Drawdown Management: Risk-budgeting mechanisms struggled to protect portfolios from large drawdowns at an acceptable cost. Differentiating factors include: calibration of stop losses, cost/benefits of option strategies and dynamic use of risk budget to capture a market rebound. The Calmar ratio (excess return/max. drawdown) is a key indicator to watch.

- Trading and Execution: More volatile and less liquid markets have impaired the ability of AR managers to monetize trade ideas. Superior technical and trading skills are increasingly needed not only to lock in profits but also to size positions and generate actionable investment ideas.

Rating Impact: Negative

Recent market dynamics had a negative impact on some Fund Quality Ratings of AR funds. The funds’ varying ability to produce positive, lowly correlated returns and mitigate drawdowns has led and will most likely continue to lead to more differentiation between funds’ performance metrics. This in turn has led to selected rating actions. Fitch has reviewed its qualitative opinion of some funds’ investment processes, based on their recent ability to diversify sources of returns and size risk budgets through robust portfolio construction and trade execution.