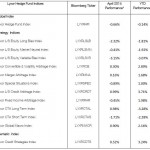

From Lyxor Asset Management The Lyxor Hedge Fund Index was down -0.7% in April (YTD -0.1%). 6 out of 12 Lyxor Indices ended the month of April in positive territory, led by the Lyxor L/S Credit Arbitrage Index(+1%), the CTA Long Term Index (+1%) and the Lyxor Global Macro Index (+0.9%). Data published in […] Read more »