From Seward & Kissel

Driven by our ongoing commitment to understanding the dynamics of the hedge fund marketplace and bringing the latest industry color to our clients and friends, each year Seward & Kissel conducts various studies of the most important trends we are seeing that are impacting the hedge fund community. This year, for the second year in a row, we have conducted a study covering side letters negotiated by our hedge fund manager clients during the period July 1, 2016 through June 30, 2017 (the “Study”).

In our 2015/2016 Study, 87% of the side letters were with managers in business for two or more years at the time of execution (“Mature Managers”), and 13% were with managers less than two years old (“Newer Managers”), while the current Study showed a change to 80% of the side letters being with Mature Managers and 20% being with Newer Managers. Given the rising trend for side letters with Newer Managers, this Study, unlike the 2015/2016 Study, will also cover key data points on the Newer Managers. We believe, however, that the continuing under-representation by Newer Managers in this statistic is attributable primarily to the increase in the use of founders’ classes over the past several years which decreases the need for side letters with Newer Managers.

The Study is broken down into four parts: the Managers, the Investors, the Terms, and a newly added Comparison to Separately Managed Accounts. The four parts of the Study, when read together, provide valuable insights into the negotiation with hedge fund investors in the current

environment.

Key Takeaways

■ The average regulatory assets under management (“RAUM”) of the Mature Managers in the Study was $4.37 billion. With respect to Newer Managers, other than some outlier data, none of the managers were SEC-registered, and thus we estimate that their average RAUM was less than $150 million;

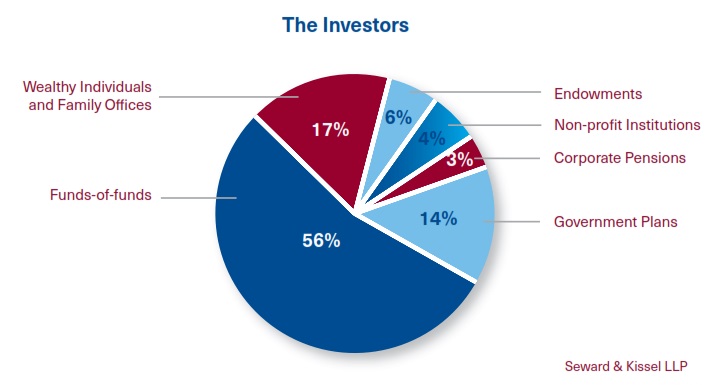

■ Funds-of-funds were the most commonly seen category of side letter investor by far, representing 56% of all side letter investors;

■ The average dollar amount invested via side letter with Mature Managers was $82.62M, while the average for Newer Managers was $53.65M;

■ Fee discounts and most favored nations (“MFN”) clauses were the two most frequent side letter business terms; and

■ Similar to side letters, in the context of separately managed accounts, funds-of-funds were the most frequently seen type of investor.

(I) The Managers

The average RAUM for the Mature Managers within the Study was $4.37 billion (based on their most recently filed Forms ADV) and approximately 90% of them were registered with the SEC as investment advisers, with the remainder qualifying as exempt reporting advisers. With respect to Newer Managers, other than some outlier data, none were SEC-registered, and thus we estimate that their average RAUM was less than $150 million.

(II) The Investors

The six principal types of side letter investor categories that consistently appeared within the Study, in order of frequency, were: (1) funds-of funds; (2) wealthy individuals/family offices; (3) government plans; (4) endowments; (5) non-profit institutions; and (6) corporate pensions.

The most frequent category of side letter investor seen in the Study was the fund-of-funds category, making up a significant 56% of all side letter investors (which is almost double their 30.5% figure in the 2015/2016 Study). Note that for purposes of the fund-of-funds category, we included side letters with fund platforms that various banks now offer, as well as side letters with allocator firms where the beneficial owners were not listed. The second largest investor category was wealthy individuals/family offices, which represented 17% (as compared to 13.5% in 2015/ 2016) of all side letter investors, and government plans represented the third largest investor category with 14% of all side letter investors (down significantly from 27.1% in 2015/2016). The next largest side letter investor category was the endowments category, which made up 6% of all side letter investors in the Study (as compared to 15.2% in 2015/ 2016). The final two side letter investor categories were non-profits which remained at 4% and corporate pensions at 3% (versus 8.5% in 2015/2016) of the side letter investor total.

Analyzing trends for Mature Managers and Newer Managers across the three largest investor categories, some interesting takeaways were that: (1) 100% of the side letters with government plans were with Mature Managers; (2) the wealthy individuals/ family offices category was evenly split between the two types of managers and represented 1/3 of all Newer Manager side letters; and (3) 61% of the Newer Manager side letters were with funds-of-funds.

The average dollar amount invested via side letter with Mature Managers was $82.62M, while the average for Newer Managers was $53.65M. The biggest investment amounts by far came from government plans, with an average investment of $163.4M, followed in descending order by funds-of-funds with a $73.19M average, non-profit institutions with $47M, endowments with $40M, wealthy individuals/family offices with $17M and corporate pensions with $10M. Finally, looking deeper at funds-of-funds and wealthy individuals/family offices, as between the two types of managers, the average investment size for the funds-of-funds category was $81M for Mature Managers and $57M for Newer Managers, while for the wealthy individuals/ family offices category, the average amounts were $21.6M for Mature Managers and about $5M for Newer Managers.

(III) The Terms

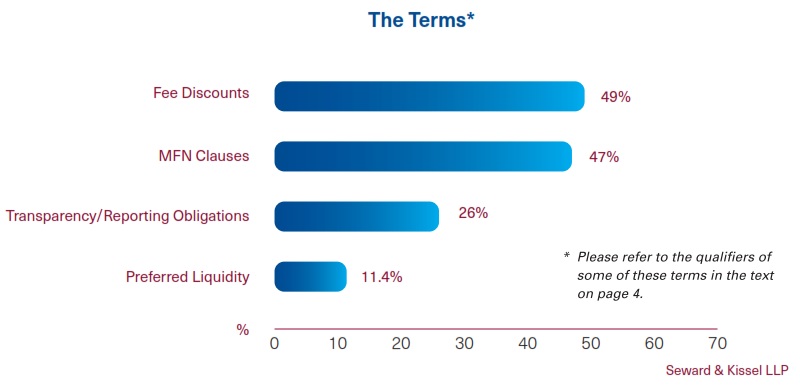

The Study focused on four principal business terms: (1) fee discounts; (2) some form of most favored nations protection (“MFN clause”); (3) transparency/ reporting obligations (of portfolio positions and/or portfolio exposures); and (4) preferred liquidity terms.

With respect to liquidity, the Study solely focused on an investor’s ability to redeem from a fund earlier than other investors (i.e., preferred liquidity), and not on other commonly seen liquidity-related side letter terms such as clarifications relating to gating, in-kind distributions and/or suspension clauses. The Study also did not cover other terms often seen in side letters that are of a regulatory or similar nature.

The most frequently observed business term within the Study was a fee discount, which appeared in 49% (up from 40% in 2015/2016 Study) of the side letters (and which displaced MFN clauses as the most commonly seen term). Of the side letters with fee discount clauses, 65% lowered both the management fee and the incentive allocation, 29% reduced just the management fee and 6% discounted only the incentive allocation. Note that, similar to the prior Study, in about a third of the side letters that included fee discounts, the discounts were contingent upon the side letter investor agreeing to a longer lock-up. MFN clauses were seen in 47% of side letters (down from 56% in the 2015/2016 Study), and all of them contained a bundling or package concept providing that if a preferential term (e.g., a lower fee) was given to another investor contingent upon a less favorable term (e.g., a longer lock-up), the MFN holder would have to accept the bundle or package of rights, and could not select just the favorable term.

The third most frequent side letter term was some form of transparency/reporting obligation, which was in approximately 26% of the side letters (about the same as in the 2015/2016 Study), and of which more than 2/3 simply involved monthly risk and exposures reporting. Lastly, preferred liquidity terms appeared in 11.4% of the side letters (nearly twice the 6.8% rate in the 2015/2016 Study).

(IV) Comparison to Separately Managed Accounts

Certain institutional investors prefer investing with hedge fund managers via a separately managed account (“SMA”) as opposed to directly investing through a hedge fund for a variety of reasons, including due to customized investment strategy, portfolio transparency and asset segregation preferences, among other things. Therefore, as part of the Study, we decided to look at SMAs entered into by our clients during the same period. The pertinent results were that:

(1) 76.9% of the SMAs were with Mature Managers,

(2) 69.2% of the SMAs were with funds-of-funds and 23% were with wealthy individuals/family offices, and

(3) over 80% of the SMAs had fee structures typically not found in the non-founder classes of hedge funds, including for example, lower rates, sliding scale rates and/or hurdles on incentive fees.

If you have any questions, please contact your primary attorney in Seward & Kissel’s Investment Management Group – New York office 212-574-1200 | Washington,DC office 202-737-8833.

related article: