By Brian Schneider and Matthew Noll of Fitch Ratings

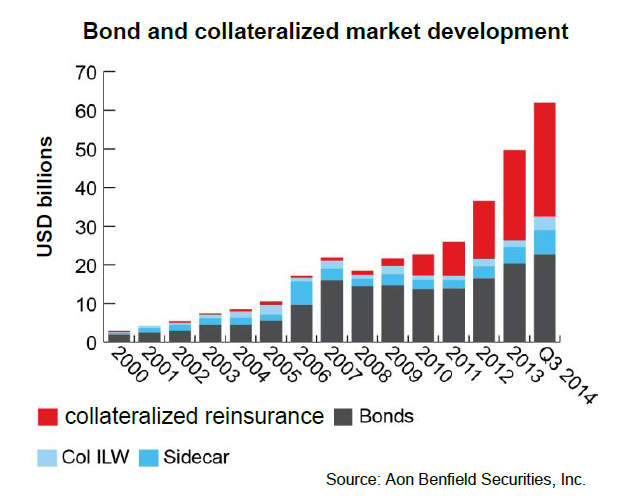

The expansion of alternative capital sources within the reinsurance market is likely to contribute to lower returns on equity across the reinsurance sector and sustain the market’s M&A wave, particularly among Bermudan firms, says Fitch Ratings. Alternative sources of capital push the sector’s capitalization levels higher and pressure pricing. According to Aon Benfield alternative capital has grown in influence to become a price maker rather than a price taker.

The timing of the alternative capital influx is especially challenging given the pronounced absence of large catastrophe losses since 2012, which by itself has held reinsurance pricing down. Combined with low interest rates, the industry’s returns have the potential to trend meaningfully lower over the coming years. The Bermudan market as a whole had a combined 11.1% net return on average equity through the first nine months of 2014, down from 12.9% in 2013.

Up to a point, Fitch sees alternative capital sources as beneficial to the industry. However, excessive capital capacity and expanding coverage options amid shrinking premiums are factors that have combined to drive intense, industry-wide competition. They are also factors that contributed to our negative outlook for the reinsurance market globally.

Traditional, stand-alone Bermudan property catastrophe reinsurers compete most directly with the alternative reinsurance market. Their business models have fewer diversified sources of earnings, thus they face the greatest threat from alternative capital sources.

Alternative sources of reinsurance capital are coming from hedge funds and private equity managers seeking to expand the breadth of investment opportunities by structuring risk-transfer solutions, or “sidecars.” Previously, the sidecars that write property catastrophe risk have been adopted by Bermuda-based reinsurers. However, the vehicles have not established a lasting impact on market capacity.

Sidecars took an evolutionary step forward in 2014 through Arch Capital Group Ltd.’s co-sponsorship (11% ownership interest) of a new Bermuda-domiciled reinsurer, Watford Re Ltd. (Watford). The Watford deal brought $1.1 billion of new capital to market, but became especially noteworthy because the entity will write predominately longer tail, multiline casualty reinsurance business. Highbridge Principal Strategies, L.L.C. (owned by JPMorgan Chase), a private equity and credit investment hedge fund company launched in 2007, manages Watford’s investments.

Fitch believes there is a higher potential for more partnering deals where an established reinsurer pairs with an established hedge fund. The Validus and PaCRe, Ltd. partnership in 2012 was among the earliest examples of established players partnering. These deals face fewer challenges in establishing track records, launching operations and attracting new customers. Potentially more credit threatening, however, is the point that hedge fund-backed reinsurers are more likely to employ alternative investment strategies for the reinsurer, where higher returns may be viewed as providing greater flexibility on premium pricing.

Other examples are: specialty excess and surplus lines insurance firm James River is backed by hedge fund firm D.E. Shaw, which has a liking for insurance and reinsurance including having been a provider of fully-collateralized reinsurance and retrocessional reinsurance coverage utilising investor capital. Greenlight Capital is backed by David Einhorn’s Greenlight. HBK Investments has backed Glacier Re and Citadel has put capital into CIG Reinsurance. Steve Cohen put $500m into SACRe, and George Soros has been involved in reinsurance via Bermuda. BlackRock has been working with global insurer Ace to build a captive reinsurer.

Other cases where hedge funds have backed reinsurers include AQR Capital Management’s backing of AQR Re Ltd. (2012), Two Sigma’s backing of Hamilton Re, Ltd., Paulson & Co.’s backing of PaCRe, Ltd., and Third Point LLC’s backing of Third Point Reinsurance Ltd., each in 2012. In addition to Highbridge’s backing of Watford, these deals have added about $4.4 billion in total capital to the Bermuda reinsurance market since 2012, a significant enough boost to the sector to have a meaningfully incremental impact on pricing in the market, in our view. Total shareholders’ equity of Bermuda’s reinsurers amounted to $89.5 billion, as of Sept. 30, 2014.

The alternative capital influx has to some degree been a contributing factor to the various M&A deals that have been completed or announced thus far in the Bermudan reinsurance market in 2014 through early 2015. Historically, one of the largest impediments to M&A has been a lack of willing sellers, but excess capital and soft pricing conditions have grown to outweigh sellers’ concerns.

Recent M&A deals include PartnerRe Ltd.’s recently announced merger with AXIS Capital Holdings Limited, XL Group plc’s expected acquisition of Catlin Group Limited and RenaissanceRe Holdings Ltd.’s agreement to acquire Platinum Underwriters Holdings Ltd. Along with the threats of more alternative sources of capital, Fitch expects that the current wave of M&A could drive still more activity in 2015.

For more information about the Bermudan reinsurance market, please see “Bermuda 2015 Market Update, Market Conditions Promote Consolidation Pressure,” dated Jan. 27, 2015.

April 2015 – AQR Capital has exited the reinsurance business.

The company’s AQR Re unit ceased writing new or renewal business as of April 1st, according to media reports. The firm has been operating Bermuda-based AQR Re Management for approximately three years, and has around $440 million invested in the space primarily through two insurance-linked funds it manages.

AQR cited changes in the reinsurance market’s fundamentals as the core reason for the decision. Although the diversification and relative returns of reinsurance remain attractive, the company believes consolidating market dynamics will result in difficulties putting larger amounts of capital to work, according to the company.

AQR’s reinsurance business achieved annualized net returns of 4.7% and 15.8% respectively, since inception, the company said.