By Nadia Papagiannis, Director of Alternative Investment Strategy at Goldman Sachs Asset Management, with editing by Hedge Fund Insight staff

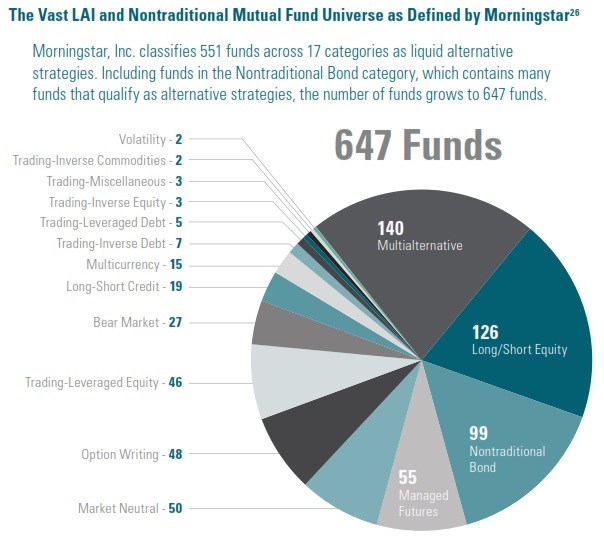

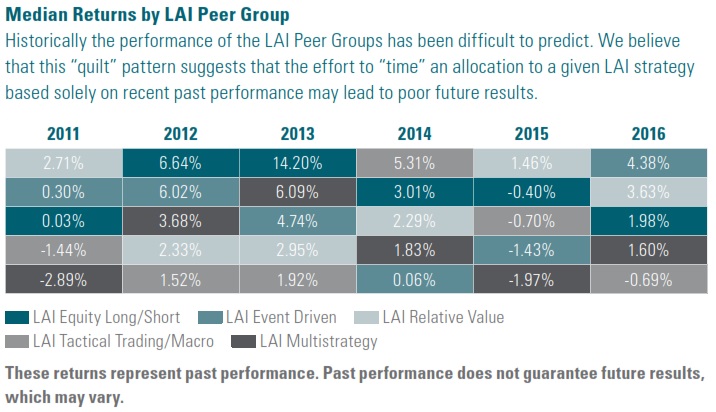

In a recent paper Goldman Sachs Asset Management analysed alternative mutual funds. In this analysis, we narrow down the vast universe of liquid alternatives to the funds that may better provide the differentiated return and risk characteristics of hedge funds. We then categorize those funds into “LAI Peer Groups,” which align with the five major hedge fund categories: equity

long/short, event driven, relative value, tactical trading/macro, and multi-strategy. Investors can use these LAI Peer Groups to evaluate alternative mutual funds relative to other LAI and similar hedge fund strategies.

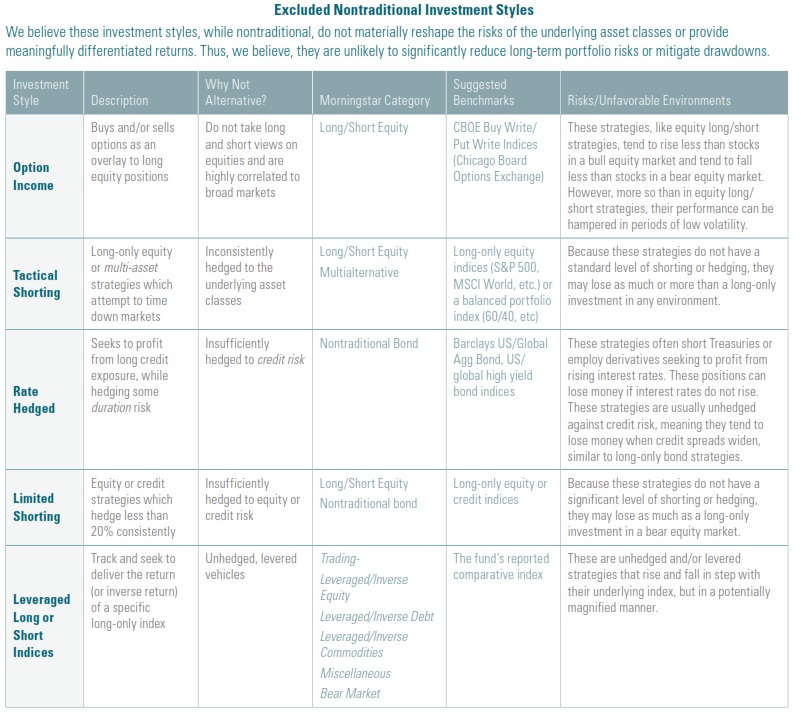

From this universe as defined by Morningstar GSAM has eliminated from further consideration investment strategies that don’t provide sufficiently differentiated returns. These are given in the table below:

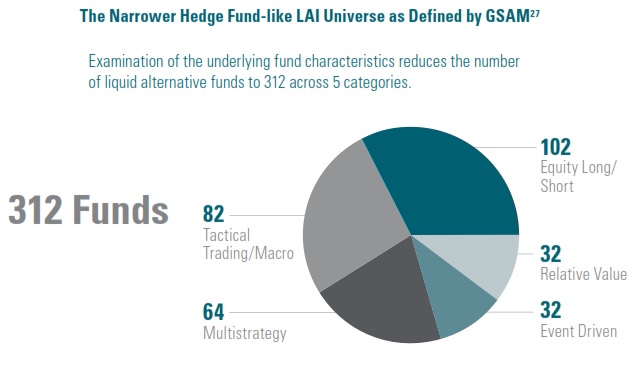

This leaves the Morningstar liquid alts universe with this breakdown (by number of funds):

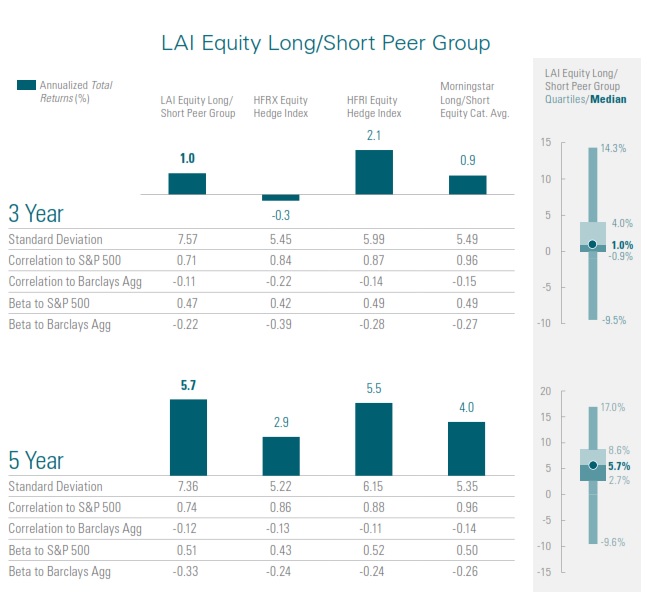

GSAM has compared the returns, risk, and diversification benefits of the five LAI Peer Groups (as in the pie chart above), relative to the most relevant hedge fund indices and Morningstar category averages, over the past one, three, and five years (ended December 31, 2016). An example of the 3 and 5 year analysis is given below for equity long/short.

The LAI Event Driven Peer Group Funds invest in equity or debt securities in order to potentially profit from corporate events, such as mergers and bankruptcies. Please note that these strategies include merger arbitrage and long/short credit.

HOW HAVE LIQUID ALTERNATIVE INVESTMENTS PERFORMED RELATIVE TO PRIVATE PLACEMENT HEDGE FUNDS?

Considering our narrowed universe of funds, we find that equity long/short, tactical trading/macro, and multi-strategy liquid alternative solutions historically have provided mutual fund investors with a reasonable proxy for traditional hedge fund strategies. However, event driven and relative value strategies historically have translated less effectively to a daily liquid format. We therefore believe that mutual fund investors looking to achieve some of the potential portfolio benefits of event driven and relative value strategies may be better off accessing them through a multi-strategy solution.

Liquid Alternatives Center: Learn more about liquid alternatives from GSAM professionals and portfolio managers online at GSAM.COM/LAC

related content

Millennials Open to Persuasion on Retail Hedge Funds (June 2016)

A Case for Liquid Alternatives from K2 Advisors (Aug 2015)

The Case for Liquid Alts from Credit Suisse Asset Management (Dec 2014)