by Hedge Fund Insight staff,

Approximately 70% of Millennial investors are interested in alternative mutual funds, and wish they knew more about the benefits of alternative investing, according to a recent survey by AMG Funds, the U.S. retail distribution arm of global asset management company Affiliated Managers Group, Inc. (NYSE: AMG). The survey polled approximately 1,000 affluent individual investors with over $250,000 in household investable assets – including over 100 “Millennials” between the ages of 18 and 35 – on their forward expectations regarding equity markets and the macroeconomic environment, as well as their mindset and behaviors around investing.

Key Highlights from the Survey

According to the analysis, Millennials believe that:

- Macroeconomic conditions will improve, and global markets will appreciate: 73% of Millennials anticipate that the U.S. economy will improve, and a majority expect U.S. and non-U.S. equity markets to rise (74% and 56%, respectively).

- Alternative investments are appealing: 83% of Millennials are open to a broader approach to investing, including alternative strategies, compared to only 52% of investors over age 35. (For the purposes of this study, alternative strategies were defined as investments other than traditional stocks, bonds, or cash – e.g., hedge funds, private equity, real estate funds, or other non-traditional investments). In addition, while more than half of Millennials currently invest in alternative strategies, 69% wish they knew more about the benefits of alternative investing, and 70% believe that a “liquid alternative” mutual fund would benefit their current investment portfolio.

- Active management is important to portfolio performance: 78% of Millennials believe that active management provides incremental value – that it is possible to outperform market indices through expert stock selection. In addition, more than half (56%) of Millennials currently own actively-managed mutual funds, and almost all of these individuals (94%) plan to maintain or increase their current allocations to active funds.

- The investment outlook is positive; however, their confidence is easily shaken by market volatility: 86% of Millennials surveyed claim to have a long-term outlook regarding their investments, 73% feel well-positioned for a market downturn and nearly half describe their risk tolerance as “aggressive.” Contrary to their portrayed confidence, nearly 30% of Millennials –significantly more than any other age cohort – state that they would either reduce their equity exposure or exit the market entirely in the event of a 20% drawdown.

When it comes to awareness and education, alternative investing seems to be particularly fertile ground. Consider that most investors need to grasp what they’re investing in before they’ll fully embrace any recommendation. The AMG Funds survey backs this up; 62% of investors surveyed admitted they will avoid investments they do not completely understand. Yet, when it comes to alternatives, many investors seem to lack this requisite knowledge. Nearly two-thirds (60%) of respondents said they felt not very/not at all knowledgeable about alternative investing—and only 10% said they feel highly confident in selecting alternatives on their own.

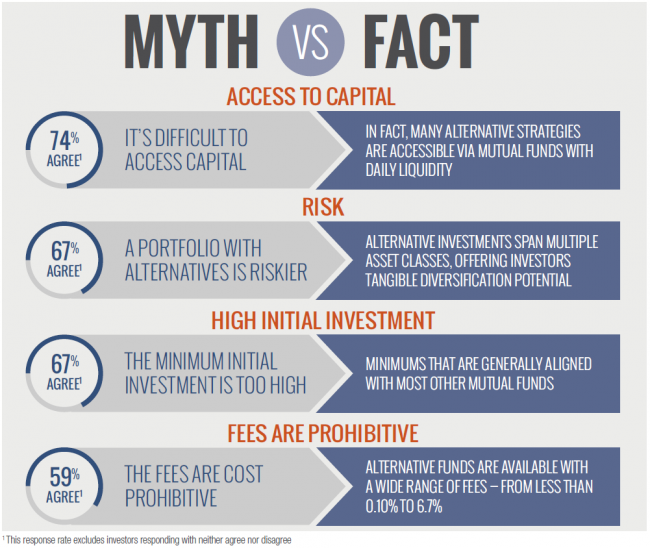

Even more troubling, many investors couldn’t offer an opinion and much of what they thought they knew may be misunderstood. Here are several of the myths and misperceptions we uncovered: