From Seward & Kissel

Driven by our ongoing commitment to understanding the dynamics of the hedge fund marketplace and bringing the latest industry color to our clients and friends, each year Seward & Kissel conducts various studies of the most important trends we are seeing that are impacting the hedge fund community. This year, for the third year in a row, we have conducted a Study covering side letters negotiated by our hedge fund manager clients during the period July 1, 2017 through June 30, 2018 (the “Study”).

In the current Study, 75% of the side letters were with managers in business for two or more years at the time of execution (“Mature Managers”), as compared to a higher 87% in the 2016/2017 Study, and 25% were with managers less than two years old (“Newer Managers”). This change may indicate more aggressiveness on the part of emerging managers to offer side letters in order to entice early investors. Nonetheless, we believe that the relative under-representation by Newer Managers in this statistic is attributable primarily to the increase in the use of founders’ classes over the past several years which generally decreases the need for side letters.

In The Seward & Kissel 2017/18 Hedge Fund Side Letter Study, released today, the percentage of side letters containing fee discounts significantly decreased, while those with preferred liquidity increased dramatically. In addition, overall average regulatory assets under management grew, as did the number of newer managers registered with the SEC (an increase of nearly 33%, compared to last year). These developments seem to point to efforts by managers to raise more capital in order to pay increasingly higher operational costs to serve investor and regulatory demands.

Specific highlights from the Study include:

- As fees may be reaching a floor level, fee discounts were included in just 24% of side letters, down from 49% last year, when they were the most common term used in side letters.

- Fee discounts have been surpassed by most favored nations clauses (appearing in 55% of side letters) and preferred liquidity clauses (27%), the use of which has skyrocketed over the last two years. In 2015-16, preferred liquidity clauses appeared in fewer than 7% of side letters.

- Continuing a two-year-long trend, government plans continued to shrink as an investor category. They accounted for just 7% of all side letter investors, down from more than 27% two years ago.

- As government plans have withdrawn, non-profit institutions have emerged. Non-profits, including large medical or religious institutions, represented the second-largest investor category (after funds-of-funds), accounting for 14.2% of side letters (up from 4% in the prior year’s Study).

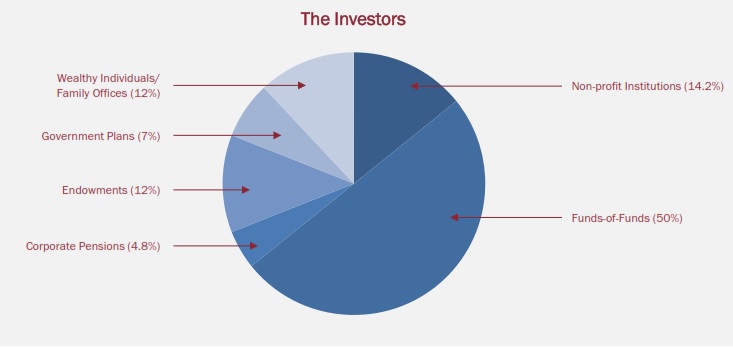

Which Investors Ask For Side Letters?

The six principal types of side letter investor categories that consistently appeared within the Study, in order of frequency, were: (1) funds-of-funds (2) non-profit institutions (3) wealthy individuals/family offices (4) endowments (5) government plans (6) corporate pensions.

The most frequent category of side letter investor seen in the Study was the fund-of-funds category, making up a significant 50% of all side letter investors (which is slightly down from the 56% figure in the 2016/2017 Study). Note that for purposes of the fund-of-funds category, we included side letters with fund platforms that various banks now offer, as well as side letters with allocator firms where the beneficial owners were not listed. Somewhat surprisingly, the second largest side letter investor category was non-profit institutions at 14.2%, which represented a significant increase from the 4% figure in the 2016/2017 Study. Tied for third place were wealthy individuals/family offices and endowments, each at 12% (as compared to 17% and 6%, respectively, in the 2016/2017 Study). Continuing a major negative shift, government plans represented the next largest investor category with 7% of all side letter investors (which was down significantly from 14% in 2016/2017 and from 27.1% in 2015/2016). Finally, once again, the smallest side letter investor category was corporate pensions at 4.8% (versus 3% in 2016/2017).

Analyzing trends separately for Mature Managers and Newer Managers, some interesting takeaways were that: (1) 100% of the side letters with government plans, endowments and corporate pensions were with Mature Managers; and (2) 75% of the Newer Manager side letters were with funds-of-funds, which represented 28.5% of all the funds-of-funds side letters analyzed.

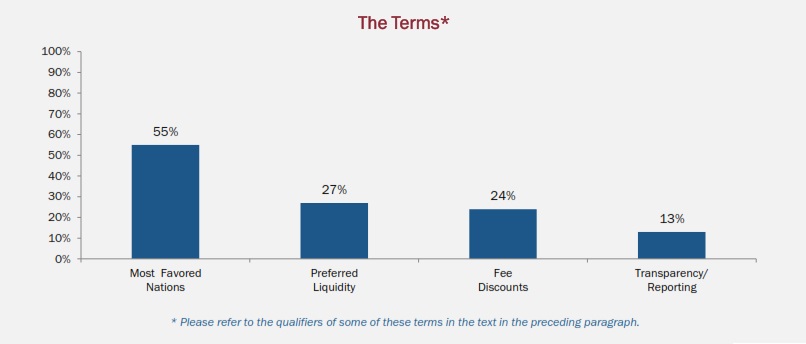

The Terms

The Study focused on four principal business terms: (1) some form of most favored nations protection (“MFN clause”); (2) preferred liquidity; (3) fee discounts; and (4) transparency/reporting obligations (of portfolio positions and/or portfolio exposures). With respect to liquidity, the Study focused solely on an investor’s ability to redeem from a fund earlier than other investors (i.e., preferred liquidity), and not on other commonly seen liquidity-related side letter terms such as clarifications relating to gating, in-kind distributions and/or suspension clauses. The Study also did not cover other terms often seen in side letters that are of a regulatory or similar nature.

The most frequently observed business term within the Study was an MFN clause, which appeared in 55% (up from 47% in 2016/2017 Study) of the side letters (including in 52% of the Mature Manager side letters and 67% of the Newer Manager side letters). All of the MFN clauses contained a bundling or package concept providing that if a preferential term (e.g., a lower fee) was given to another investor contingent upon a less favorable term (e.g., a longer lock-up), the MFN holder would have to accept the bundle or package of rights, and could not select just the favorable term. The next most popular business term was a preferred liquidity clause, which moved up to second place from last place in the 2016/2017 Study. Preferred liquidity clauses were seen in 27% of all side letters (as compared to just 11.4% in the 2016/2017 Study and 6.8% in the 2015/2016 Study), with an approximately equal percentage representation across the two Manager categories. Moving down to third place from first place overall were fee discount clauses, which made up 24% of all side letters (down significantly from 49% in the 2016/2017 Study), with a similar percentage representation across the two Manager categories. 82% of the fee discount clauses covered both management fees and incentive allocations, while 18% applied only to management fees. This decrease in the frequency of fee discounts may indicate that fee levels are bottoming out across the industry. The least common side letter term was some form of lagged portfolio transparency/reporting obligation, which was seen in only 13% of the side letters (down substantially from 26% in the 2016/2017 Study), comprised of 10% of the Mature Manager side letters, but 33% of the Newer Manager side letters.

Comparison to Separately Managed Accounts

Certain institutional investors prefer investing with hedge fund managers via a separately managed account (“SMA”) as opposed to investing directly through a hedge fund for a variety of reasons, including due to customized investment strategy needs, portfolio transparency requirements, tax reasons, and asset segregation preferences, among other things. Therefore, as part of the Study, we decided to look at SMAs entered into by our clients during the same period. The pertinent results were that: (1) 71% of the SMAs were with Mature Managers (down from 77% in the prior Study); (2) similar to the 2016/2017 Study, 64% of the SMAs were with funds-of-funds and 27% were with wealthy individuals/family offices; and (3) over 75% of the SMAs had fee structures typically not offered in the standard classes of hedge funds, including for example lower rates, sliding scale rates and/or hurdles on incentive fees.

If you have any questions, please contact Steve Nadel, partner at Seward & Kissel’s Investment Management Group and lead author of the Study – New York office 212-574-1200 | Washington,DC office 202-737-8833.

related articles: