From Eurekahedge

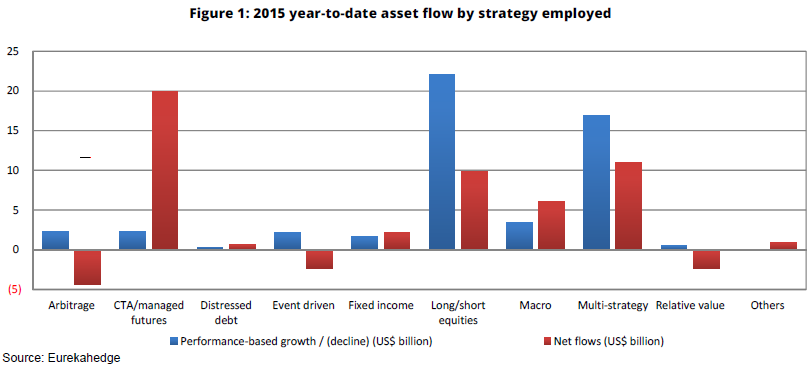

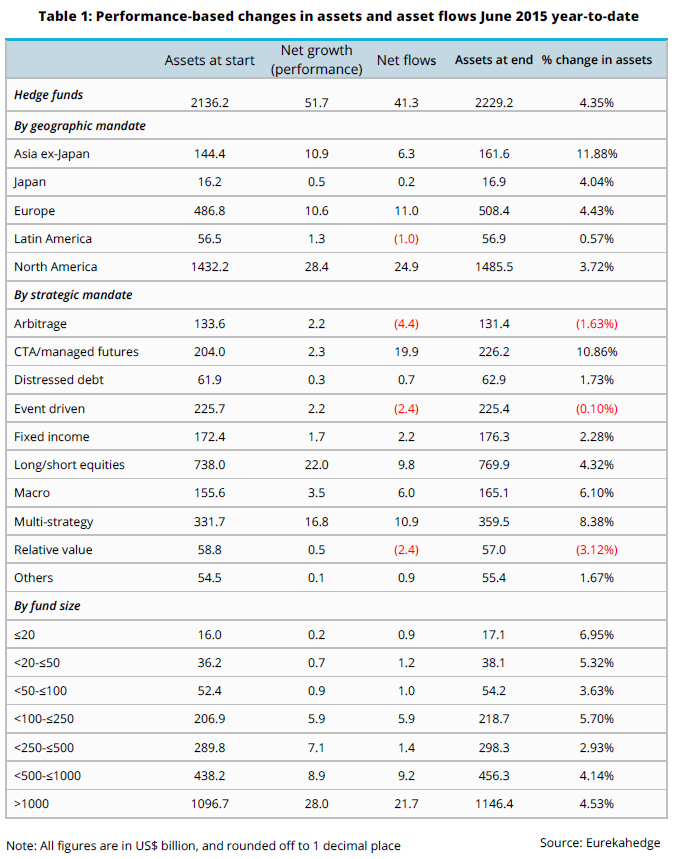

- Hedge fund assets under management have increased by US$93 billion in the first six months of 2015, with roughly US$52 billion coming from performance driven gains and US$41 billion from new investor allocations.

- Despite losses of 1.13% in June, European mandates continue to see resurgence in investor allocations. European hedge funds have recorded US$12.5 billion in new investor allocations for Q2 2015 following net outflows of US$17.1 billion over the three preceding quarters.

- CTA/managed futures funds have grown their asset base by 10.86% in 2015 largely on the back of strong capital inflows totalling US$20 billion – its highest 1H investor allocation since 2008.

- Asia ex-Japan mandated hedge funds lost 1.58% in June and recorded US$1 billion worth of performance-based losses in the worst month for regional managers since the taper tantrum of 2013.

- North American managers lead in terms of year-to-date net investor inflows recording US$24.9 billion in new allocations, about two-thirds the level seen for the same period in 1H 2014.

In June CTA/managed futures funds saw a further recovery from the wave of redemptions that have plagued the strategy since 2H 2013, reporting US$1.4 billion in asset inflows during the month; their sixth consecutive month of positive asset flows. Net capital allocations as of June 2015 year-to-date sum up to a solid US$19.9 billion; a far cry from 2014 when investors withdrew US$16.1 billion from managed futures funds. Year-to-date performance gains were rather positive, coming in at US$2.3 billion although performance-based losses for the month of June were the highest monthly performance-based loss since October 2012.

STOP PRESS: Additional 29th July:

Today Credit Suisse released their mid-year Hedge Fund Investor Sentiment Survey, covering over 200 global institutional investors. In the Survey CTAs saw one of the largest declines at this mid-year point, moving down from the 3rd most sought after strategy in the year-end annual survey to 9th place at mid-year. It seems the 6-month rule is working again – whatever has been doing well/badly in the previous 6 months is what surveyed investors say they want to allocate to/ignore.

Related articles:

The Environment Is Good For Systematic FX As Well As CTAs (Apr 2015)

Asia Ex-Japan and CTAs Outperform in 2014 (Jan 2015)

CTAs Dominate Rank Of Top Performing Hedge Funds Of UK Managers (Dec 2014)

Graphic of the Day – Investors in CTAs (Nov 2013)

One Response to “CTA Capital Flows Positive For Six Months Straight”

Read below or add a comment...