By Deutsche Asset & Wealth Management’s Hedge Fund Advisory Team

Strategy and Drivers – Taking advantage of the rise in volatility

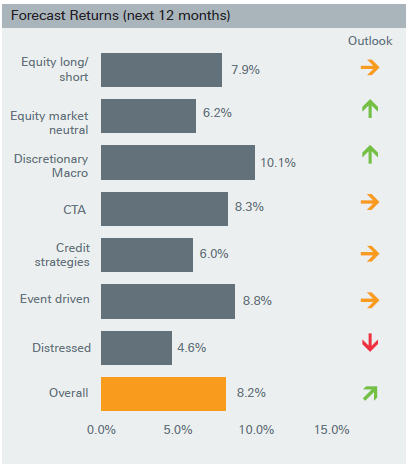

“Volatility and liquidity are persistent themes”. The theme of elevated volatility in markets – a key message of the June 2015 CIO view, suggests emphasising those strategies that thrive in this type of environment. In this vein discretionary macro, which tends to perform better during a change in market regime normally associated with increased uncertainty across asset markets, lends itself as a strategy to be emphasised. “Short term reversals in equity markets” another key CIO message that tends to be associated with mini spikes in volatility which lends weight to our forecast of higher market volatility which is one of the key drivers of our positive view for equity market neutral. We are positive on the outlook for the stock picking environment.

elevated volatility in markets – a key message of the June 2015 CIO view, suggests emphasising those strategies that thrive in this type of environment. In this vein discretionary macro, which tends to perform better during a change in market regime normally associated with increased uncertainty across asset markets, lends itself as a strategy to be emphasised. “Short term reversals in equity markets” another key CIO message that tends to be associated with mini spikes in volatility which lends weight to our forecast of higher market volatility which is one of the key drivers of our positive view for equity market neutral. We are positive on the outlook for the stock picking environment.

One proxy for this driver is an analysis of stock price dispersion which has been rising since 2013. A more supportive stock-picking environment drives returns for fundamentally driven equity market neutral approaches. This driver also represents a pivotal ingredient to directional equity strategies such as equity long/short and event driven. We have however reduced our outlook for these strategies because we have tempered our outlook for market direction in line with the CIO view.

Trending markets – CTAs source a sizeable proportion of their opportunity set from trends across asset classes. We have seen a consolidation of the three main trends in FX, bond and energy markets during 2015 to date. A re-emergence of one or more of these trends will be once again very supportive of returns for the strategy. It is however a market dynamic that is notoriously difficult to forecast so we will sit on the fence and maintain our neutral outlook for the driver and strategy.

Our neutral outlook for credit spreads is based on a possibly more difficult period for US high yield as capital market volatility increases. This is balanced against a more  constructive view on issues in Europe. Interest rates are forecast to rise in the US but not in the Eurozone over the next 12 months. In lieu of this we have a neutral outlook for credit strategies.

constructive view on issues in Europe. Interest rates are forecast to rise in the US but not in the Eurozone over the next 12 months. In lieu of this we have a neutral outlook for credit strategies.

Our Strategic Views on Selected Strategies

Equity Long/Short

Neutral: We have changed our view from Neutral/Overweight to Neutral. We believe that exposure to low net exposure equity strategies will allow investors to generate uncorrelated returns with less volatility and better downside protection. From a macro perspective we believe that expansionary ECB monetary policy coupled with continued weakness in the euro should provide support for profit growth within Europe. Japanese equity markets should continue to benefit from a weaker yen, lower oil prices and a pick-up of inflows from the Government Pension Fund’s commitment to allocate into equities. Within Japan we are more constructive on domestic stories as opposed

to exporters. Within the US we believe that the US equity market will be more volatile due to the likelihood of an interest rate hike by the Fed, combined with a strengthening US dollar and continued divergent central bank policies. Within the US specifically, we advocate a low net exposure strategies.

Equity Market Neutral

Positive: We maintain our overweight view for the strategy. It’s likely that we will see heightened equity market volatility in the US, as investors worry about the timing and magnitude of an interest rate increase, a potentially strong USD vs. EUR and its impact on corporate earnings. We expect this will lead to increased dispersion and lower correlation across equities and an increased focused on fundamentals of individual companies. This should bode well for stock pickers to earn alpha as they harvest volatility over transaction costs. In this environment we would

expect strong factor contribution across size, value, momentum and low beta to provide a tailwind for the strategy.

Event Driven

Neutral: We have downgraded our outlook on event driven to neutral. This is because we are wary of some of the more directional elements that form a component of the strategy as risk assets are tentatively exposed to a mini sell-off around the Greece issue. On the positive side strong corporate balance sheets in the US which are flush with cash suggest the possibility of more takeovers.We also believe that shareholder pressure will lead to higher levels of share buybacks and mergers, of which we have already seen in record volumes so far this year. In addition we are

of the opinion that activism will continue to play a large role as managers look to unlock value through operational, strategic and financial action plans.

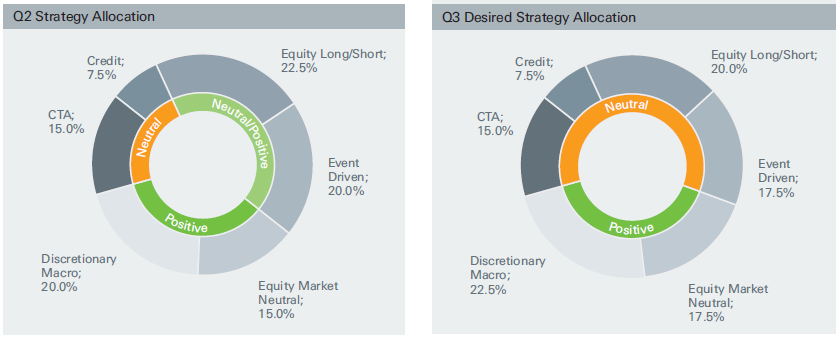

Strategy Allocation – Overweight Macro and Event Driven strategies, underweight Distressed

Our suggested strategy allocation for a balanced liquid alternatives investment solution is a pragmatic application of the opportunity set driven by our expected return and risk for each strategy. The highest suggested allocation is in discretionary macro at 22.5%. This is premised upon a higher expected volatility across equity, FX, and fixed income markets over the coming 12 months. In contrast we have tapered down the suggested allocations to the more beta centric equity long/short and event driven strategies as we head towards a new phase in the US interest rate cycle.

Equity market neutral’s 17.5% allocation is premised upon its significantly lower risk around its expected return. CTA strategies are ambivalent to market direction and have historically exhibited low correlation to other hedge fund strategies – we suggest a 15% allocation. Our smallest suggested positive allocation is to credit where the opportunity set is limited and manager selection is key. We see no reason to allocate to distressed as a strategy because returns are constrained by uninteresting valuations and a lack of bankruptcies.

The Hedge Fund Advisory team is part of the Alternatives & Fund Solutions division of Deutsche AWM. The Hedge Fund Advisory team provides hedge fund advisory and discretionary portfolio management services to a range of clients. The views presented in this Outlook are exclusively those of the Hedge Fund Advisory team and not any other division of Deutsche AWM. They are provided for information purposes only and do constitute investment advice. Investments in hedge funds may not be capital protected investments and investor capital is at risk up to a total loss. Hedge funds are complex investments that may not be appropriate for all investors. Past performance is not a reliable indicator of future performance. Projections are based on a number of assumptions as to market conditions. there can be no guarantee that the projected results will be achieved.

Related articles: