A Q&A With Frank Gallagher and Peter Drippé, Portfolio Managers at Visium Funds

A Q&A With Frank Gallagher and Peter Drippé, Portfolio Managers at Visium Funds

Q1: How important is shareholder activism as a key driver of merger and acquisition (M&A) activity in 2015?

We believe that shareholder activism activity will continue to grow in 2015. Recently we have seen more and significantly larger companies targeted by shareholder activists. Also, what is interesting to note, is that the perception of shareholder activists by both main stream long-only investors as well as corporate management

has improved in recent years. Activists are now garnering more respect as management teams have constructively engaged with shareholder activists rather than aggressively fending them off. In addition, institutional investors are

also now quietly partnering with shareholder activists whom they view as positive catalysts for corporate change.

Q2: In which industries do you expect to see activism-driven activity?

From our perspective, the common denominator is not a specific industry but a common situation wherein an enterprise’s balance sheet is under-managed or there are hidden assets that could be better utilized. As a result, we are seeing company by company activism-driven activity across all industries, triggered by bottom-up analysis.

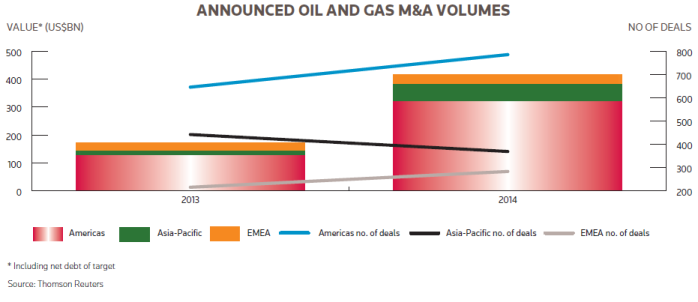

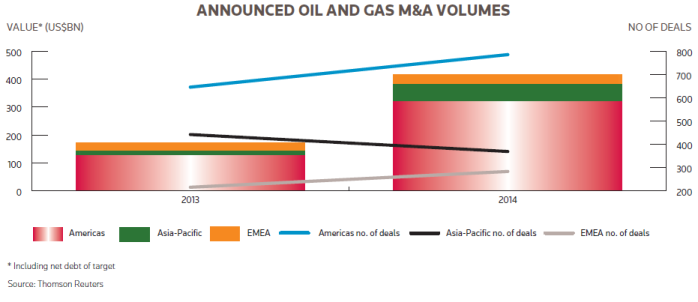

Currently, the Healthcare sector is generating the highest percentage of industry volume in terms of M&A activity. Consumer Non-Cyclical companies have been actively engaged. Conversely, shareholder activists generally tend to stay away from companies that are heavily regulated such as those in the Financial Services sector. With the Energy sector capturing attention as of late, it is still too early in this cycle of declining energy prices to expect M&A activity to increase. Although we have seen some degree of consolidation, there is a disconnect between what a buyer is willing to pay for an Energy company and what a seller perceives the company to be worth.

Increasingly there has been a greater focus on companies converting to Real Estate Investment Trust structures (REITs). REITs have historically traded at higher valuations. As a result, we have seen REITs introduced in a variety of industries – from casino gaming companies, retailers and hotel companies. Although they represent different sectors, each has the common characteristic of owning real estate assets whereby the value could be better realized through yield vehicles.

Increasingly there has been a greater focus on companies converting to Real Estate Investment Trust structures (REITs). REITs have historically traded at higher valuations. As a result, we have seen REITs introduced in a variety of industries – from casino gaming companies, retailers and hotel companies. Although they represent different sectors, each has the common characteristic of owning real estate assets whereby the value could be better realized through yield vehicles.

Q3: How has the increased corporate inversion regulation that was enacted last year slowed the trend of relocating corporate headquarters abroad?

Increased government regulation has certainly put a damper on U.S. corporate inversion activity. The trend of U.S. companies moving their headquarters abroad for tax advantages has been quelled. The unintended consequence is that now U.S. companies, rather than being the acquirers, are increasingly becoming the acquisition targets of foreign companies.

Q4: How has the strengthening dollar impacted event-driven activity?

Both restructuring and activist activity has been to some extent negatively impacted by the strengthening dollar

over the last several months. Senior management of U.S. based companies, many of which have currency exposure by virtue of overseas revenue, were slow to recognize the potential impact of the stronger U.S. dollar versus other reserve currencies.

Consequently, corporate management teams are now evaluating currency risk and its potential impact on company earnings. We believe that the distraction provided by the unanticipated consequences of the strengthening dollar should run its course over the next few months. Corporate management should then resume its regular process of evaluating and pursuing M&A opportunities that complement their business strategy.

Note: as at the end of March 2015 9% of the portfolio of the Visium Event Driven Fund was in activist positions. The largest strategy allocation in the Fund (42%) was to special situations investments.![]()

![]()

![]()

Useless blather. I expected better from this venerable site.