Last week the “Financial Times ” ran a story that the UK tax authorities (HM Revenue & Customs) were looking to tackle the disguising of employment relationships through limited liability partnership structures and the manipulation of profit and loss allocations to achieve tax advantages.

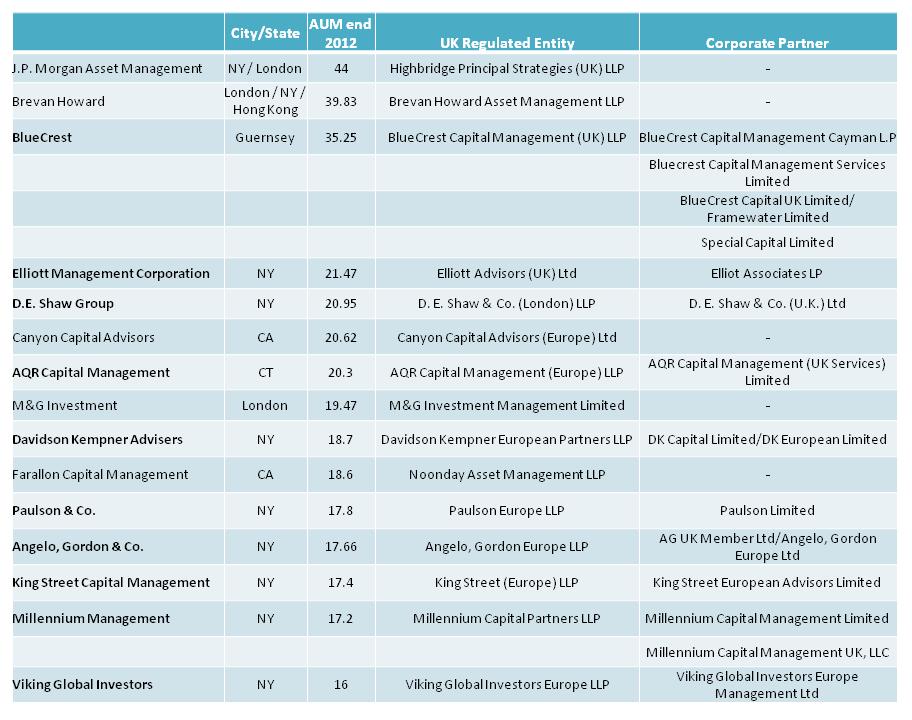

The Table Below Shows 15 of the largest 25 hedge fund groups in the world. It includes all those hedge fund groups in the top 25 that have an entity registered with the UK’s financial regulator the FCA. 10 of the 15 hedge fund groups have a “corporate partner” listed amongst the owners of the businesses on the Financial Services Register.

Not to say that each of the hedge fund firms in the table with a corporate partner has been either disguising employment relationships or manipulating their UK P&L, but these are the largest global firms of the type HMRC will look at. Note that there are American firms with larger UK businesses than some of those listed – for example Moore Capital is much bigger in London staff terms than Paulson & Co, but the ranking is by total group AUM.

Source: The Financial Services Register

Source: The Financial Services Register

Footnotes: The top 25 hedge fund firms with no entity registered with the FCA are Bridgewater Associates, Baupost Group, and Adage Capital Management. For clarity a number of the largest hedge fund firms with London offices have been excluded from the table as they do not appear to have a corporate partner. Those excluded firms are: Standard Life Investments, Och-Ziff Capital Management Group, MAN Group/GLG Partners, BlackRock, Winton, and Renaissance Technologies. Farallon Capital Management and Canyon Capital Advisors are included in the Table specifically to illustrate that not all American firms optimise their corporate structure in Europe to minimise tax. To a degree M&G (and JPM/Highbridge) are included in the Table for the same reason. E&OE.

From “The Guardian” 2 June 2013

Gibraltar is launching a campaign to persuade hedge funds to ditch their plush Mayfair offices for the low taxes of “the Rock”.

Fabian Picardo, chief minister of the British overseas territory, said multimillionaire hedge fund managers should quit London for Gibraltar because it’s “much cheaper”, while promotional material promises they are “unlikely to be liable for corporation tax”.

Picardo, who has made attracting hedge funds a key aim of his administration, last week invited hedge fund managers to the peninsula where they were told income tax could be limited to £30,000 a year no matter how many millions they earned.

Gibraltar also boasts no VAT and social security payments of just £120 per family a month. In the UK the top rate of income tax is 45%, VAT is 20% and national insurance is levied at 14% of weekly earnings above £797.

Gibraltar’s campaign to attract hedge funds by means of low taxes comes just weeks after David Cameron wrote to Britain’s crown dependencies and overseas territories ordering them to “get our own houses in order” as he pushes for international action to tackle “staggering” losses from tax avoidance.

Picardo denied Gibraltar was a tax haven and said the territory complied with all European Union tax and transparency regulations. He said he was delighted the UK was “finally going to crack down on tax evasion”, which he said was good for Gibraltar which already has “the toughest regulation”.

However, promotional material given to hedge fund managers said: “Gibraltar’s tax laws are central to its position as a thriving fund domicile.

“The profits of any branch or permanent establishment of the investment manager are not subject to tax in Gibraltar, to the extent that those activities are undertaken outside Gibraltar.” Corporation tax on activities undertaken on the rock is levied at 10%, compared with 24% in the UK.

Hedge fund managers were told their income tax bill could be reduced still further if they were granted “special tax status” as a “high executive possessing special skills”. Such a status caps an individual’s tax bill at £30,000 no matter how much they earn. The territory was unable to say how many hedge fund managers have the status.

Whole article:http://www.guardian.co.uk/world/2013/jun/02/gibraltar-lure-hedge-funds-london

There are many reasons why a corporate partner might exist within a partnership, indeed the recent HMRC consultation document recognised this fact and recognised the commercial role that such “mixed” partnerships play.

As examples, where the investment management business was previously carried on by a corporate member but is now carried on within an LLP structure the corporate will continue as a member of the LLP. Often a corporate member is used to hold the lease of the managers office space as some landlords are not yet used to seeing an LLP as the lessee. In addition, for US managers who want to set up a new office in London a corproate member may be used to act as the parent holding entity in the UK for corporate governance purposes and as the conduit for the injection of regulatory and working capital.

There is therefore not necessarily any linkage between the existence of a corporate member and the existence of any “manipulation” of profits.