By Simon Kerr, Principal of Enhance Consulting

This week I heard a presentation by a senior trader at one of the large global macro hedge funds which has been in business for nearly 20 years. He put across several insights into the way of working of those who engage in the strategy. The particular trades under discussion were in foreign exchange, in the Euro/U.S. Dollar, during last year.

Fundamental Set-Up

In FX there are three elements to the fundamentals that should be aligned for putting on a position, according to the trader. The first is valuation. In FX there are several valuation models which are commonly used though each has limitations. Purchasing power parity (PPP) for a currency pair is a value which is unobservable in markets, and is a conceptual level that actual FX rates pass through without pausing. Extreme deviation from PPP is taken as an under or over-valuation. The Economist uses the price of the ubiquitous McDonald’s meal to calculate the “Big Mac Index”, a guide showing how far from fair value different world currencies are. The Big Mac theory, which is based on an observable purchasing-power parity, says that exchange rates should even out the prices of Big Macs sold across the world.

The second element of the fundamentals to consider is the interest rate differential between the two countries on each side of the currency pair. This is not a static element, as the FX markets (spot rate) move with forward forward rates. So expectations of future interest rate differentials are what count. The relative growth outlooks of the two economies is what the senior trader emphasised in getting a handle on interest rate differentials. For my part I would say that the perceived prospects for medium term inflation are now taking a much bigger role in the mind of the market than hithertofor in looking at interest rate differentials.

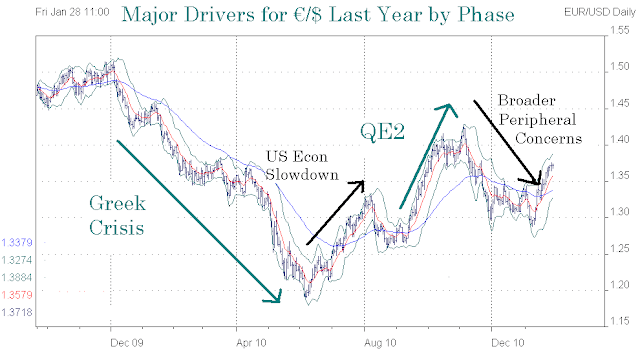

The third fundamental element to a good FX set up for a macro trader is the policy environment. Last year presented a classic opportunity (in looking at Euro related trades) in that European politicians/central bankers commented on levels and movements in traded rates (CDSs as well as bond auctions and FX parities). Some of the great macro trades have been set up by governments attempting to talk down markets when their policy objectives clash with what the markets discount as sustainable. So last year was a classic of its type in this regard, though interest rate policy specifically was a stale issue according to the bulge-bracket macro trader. That is, changes to interest rate policy were not expected to be a driver of the market condition for the trade under consideration in the time-frame envisaged. For trades at the market level like those illustrated here, and particularly in FX it is very important to understand the market drivers at the time. The graphic below indicates what the macro trader stated were the major drivers for the €/$ level last year through the different phases.

Technical Set-Up

The technical set up for a macro trade can be about flows and positioning by the various categories of market participants (say hedgers, speculators and governments). For example, the Commitments of Traders report for listed US futures showed there were very high levels of Dollar bear positions just before the monthly employment report for July 2010 released on the 6th August last year. So the positioning in the market shifted the odds of the labour market data being bad enough to move the Euro up further versus the Dollar. That date marked an interim top for the Euro versus the Dollar.

The other form of commonly used technical set up is pattern recognition, which in its crudest form is chartism. Along with the rest of the market, the senior trader from the well-known global macro firm was onto the break in the multi-quarter uptrend for the Euro (versus the Dollar) that occurred in December 2009. The Greek debt crisis powered the multi-month fall in the Euro which lasted into the middle of 2010. The break in trend of itself is often a good entry point for a trade, but as FX markets have lots of minor reversals against the major trend traders have to have tools to identify the second and third high quality entry points as the new major trend unfolds. In the middle of January 2010 there was a good secondary entry point on such a short term reversal – as is typical the secondary entry point corresponds to a support/reversal level on the previous major trend – in this case around 1.45 on the €/$ in the period 13-15th January.

This secondary, high-quality entry point can be illustrated in another trade mentioned on this website – in Gilt futures (see here and here).

Technical Set Up for Trade in Gilt Futures Showing High-Quality Entry Point

The significance from a money management perspective is that the second entry point – as the security price accelerates away from a key support or resistance level – can be a higher conviction entry point than the first. This is because the investment hypothesis (“the market is going to go down”, say) has been tested by market action and passed the test. So depending on style, the macro trader can trade in several risk units at the second entry point. In no way is the second entry point a secondary entry point!

The global macro trader also disclosed the use of a particular tool to assess sentiment – the world wide web. The fund monitored the occurrence of the phrase “quantitative easing” on the web in August, September and October to ascertain the degree of dominance in the minds of investors.

Trigger

Global macro trading is often about assessing the persistence of action by the various actors in the market drama. It was interesting that the senior macro trader said that the trigger for putting on the position was often the behaviour of the markets themselves. Note that the crucial observations are across markets, not necessarily from market action within the market under consideration. So for the €/$ last year the maturity of the Euro rally that began in June was under consideration in August by the trader because the co-movements of the S&P500 (as a proxy for global equities) and the fx rate diverged. The €/$ and the SPX had synchronised price changes for a period of some months, but over the first few trading days of August days the S&P was flat whilst the € was still appreciating against the $. For the macro trader this signalled a change of behaviour was imminent for the Euro/Dollar relationship because the S&P action signalled at least a pause in the driver for the FX rate (the slowing US economy). To quote the trader directly, “divergences between markets are the best clue for market behaviour. A correlation break that lasts for one-to-two days and can indicate a movement to follow that lasts for 2-3 months.” He also stated that more than 50% of a macro trader’s insight comes from understanding the message of the markets, that is the behavioural inference is key. Like many traders, including those with a macro framework, the presenting macro trader only puts capital to work if the market has already started to move in the direction he wants to play.

Sizing

Sizing of positions in macro is usually a function of risk/reward and correlation. The senior trader didn’t mention correlation himself in this regard, so we’ll concentrate on the potential profit and loss as the key input to position sizing. The target price and stop loss levels for positions in markets are typically placed at or near significant support and resistance levels – the difference between current price levels and these two levels gives the upside/downside ratio for the potential trade. The potential loss between current levels and the stop is used to scale the maximum position size. A loss of say 5% on a position that is 20% of the gross equity of the fund would give a portfolio level loss of 1%. If two percent loss at the fund level for a single position is the outer bound then a 3% loss to the stop would equate to a 24% of equity maximum position size. The principle is determine how much you are prepared to lose – “anything else is bad discipline, or has ego in it,” admonishes the trader.

This particular macro fund also uses drawdown from peak as an additional risk limiter at the level of the individual trader. So the risk capital of the trader will be reduced if his P&L is down 5% from his own peak, and he will be out of the market for a period if he loses 10% from his peak P&L, even if he is still positive on the year.

Closing the Position

The macro trader acknowledged his belief in the concept of reflexivity – Soros’ concept that positive price changes themselves impact how positively investors think about the market – such that prices can waterfall down or continue upwards way beyond most expectations. Conceptualising potential price changes and unusual market impacts helps macro traders mentally prepare for a range of market outcomes. But still and all, positions have to be closed even after exceptional profits – so what feeds into the decision making at the closing of a trade? “A position should be reviewed when a price target is hit, and should be closed for sure when a lot of the market has joined you in that position.”

The macro trader concluded that the way to make money in macro trading was “to take risk aggressively, but you need to take it (execute) well.”

This article originally appeared on Simon Kerr on Hedge Funds

For the work of Enhance Consulting see here.