Seward & Kissel LLP’s Seed Transactions Deal Points Study draws from over 150 data points amassed over a five-year observation period. The Study identifies market trends and provides both quantitative data and qualitative explanations of the state of the seeding industry.

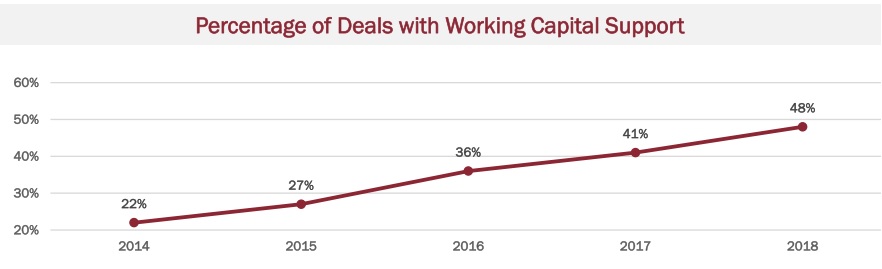

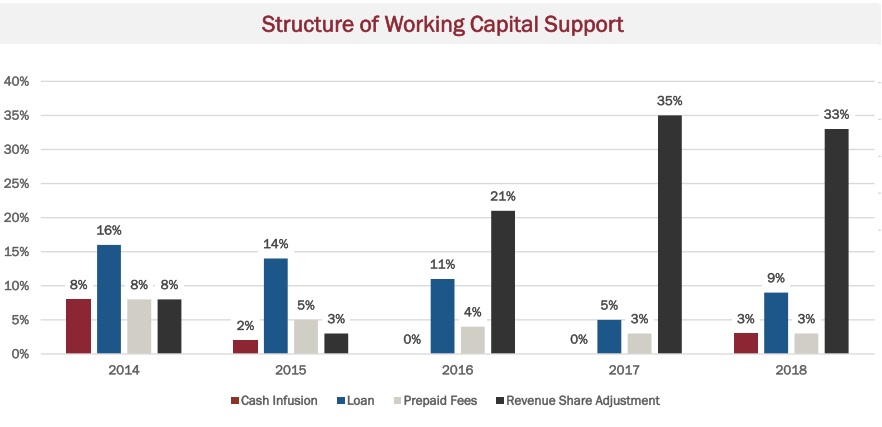

The data illustrates the rise of seed deals year over year, with institutional seeders reasserting themselves as the key drivers behind the increase. It also points to a trend toward more “manager-friendly” structures, particularly when it comes to sharing the expense burden of the business. 2018 proved to be one of the hottest years for seeding activity in the last decade, following 2016’s volatility and 2017’s perceived overheated marketplace.

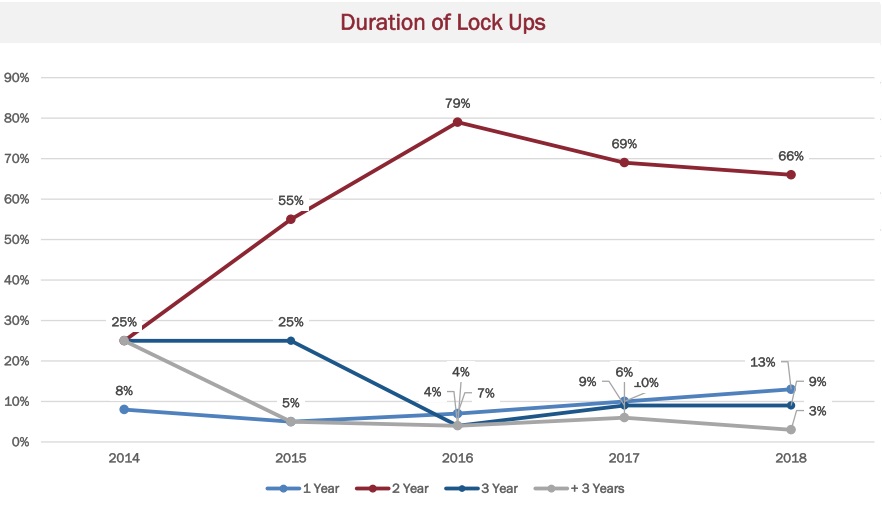

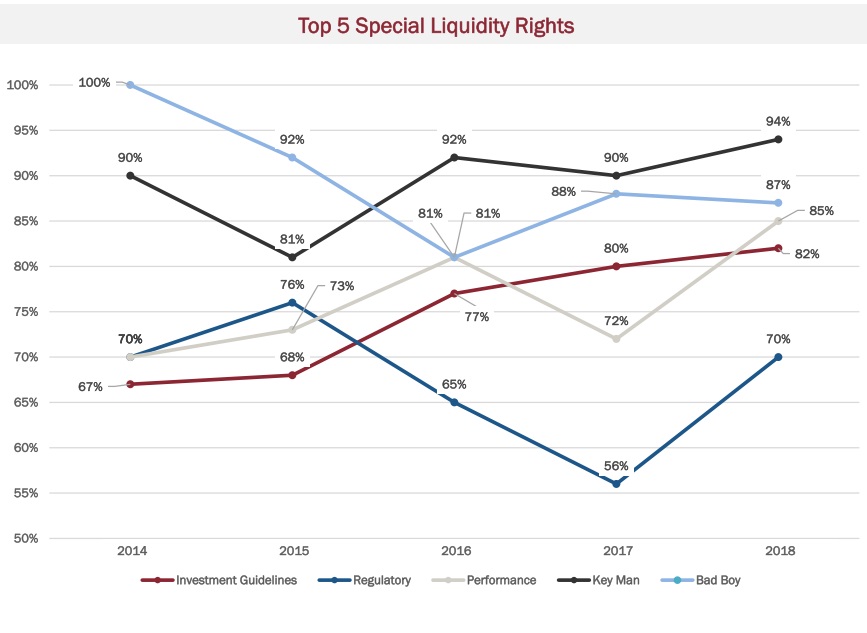

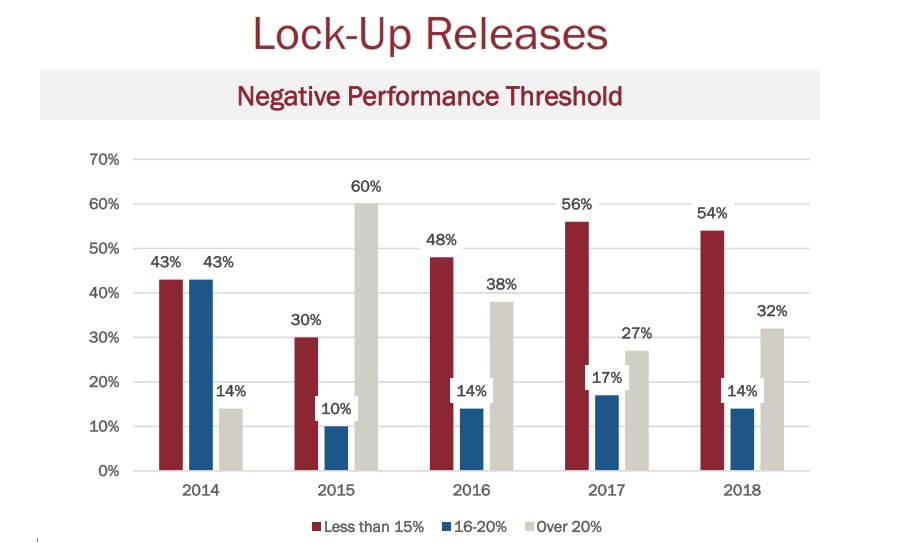

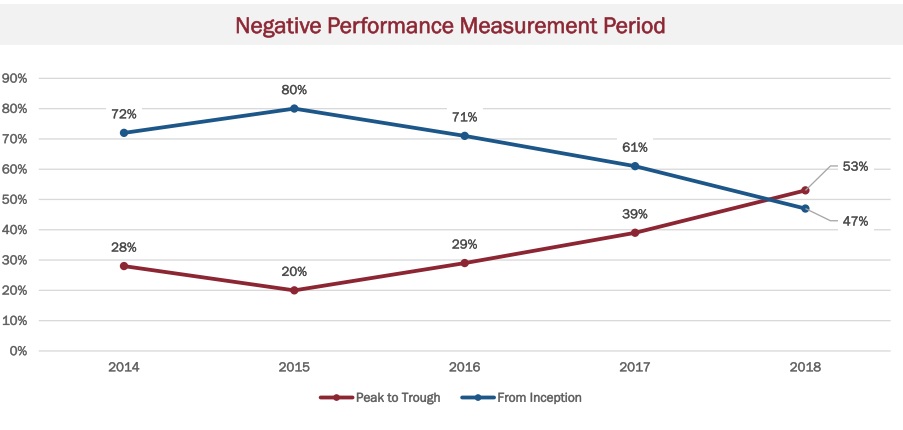

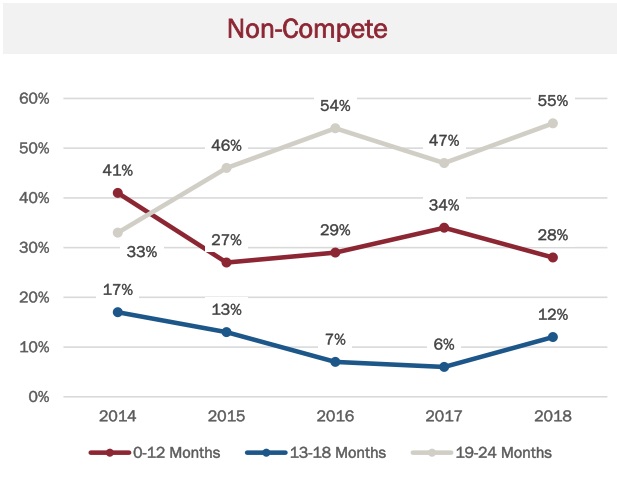

Special Liquidity Rights – Seeders require the ability to withdraw their capital in the event that the fund or manager experiences a variety of specific harmful events – whether these events represent damage to the seed investment itself or compromise the manager’s ability to successfully manage assets in the future (thus eroding or eliminating the value proposition of the revenue share). These events include certain levels of losses or if the manager and/or its key personnel engage in certain types of “bad boy” behavior or are otherwise subject to legal or regulatory censure.

If any such events occur, the lock-up terminates and the seeder’s investments become redeemable, often on an accelerated basis, regardless of whether the redemption notice window for the fund is open or closed, and often before the date of the next scheduled liquidity (e.g., quarterly).

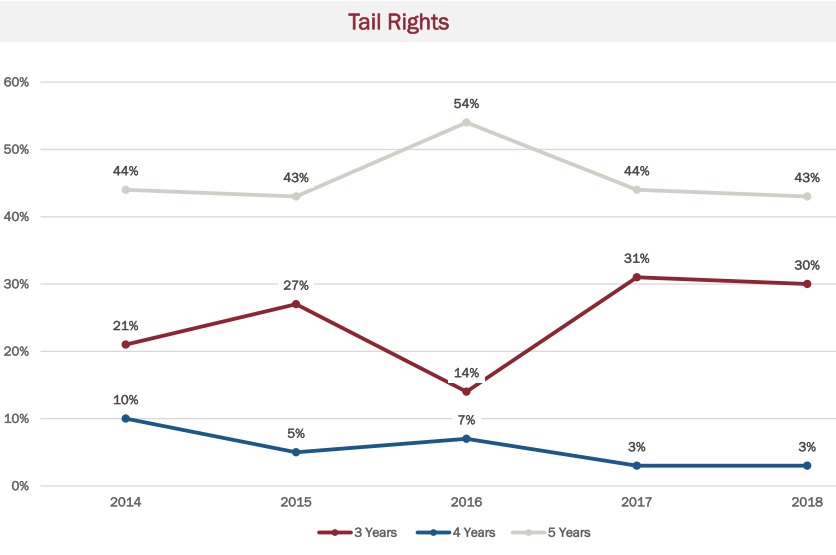

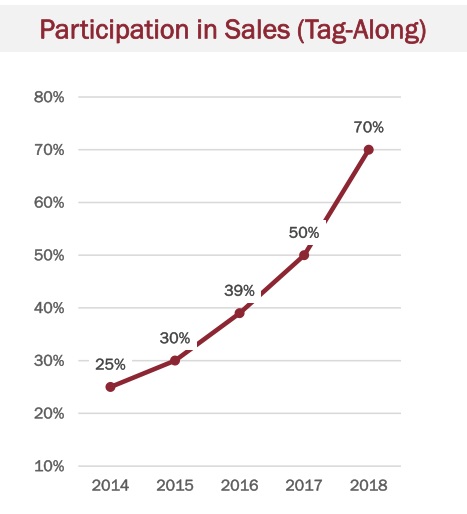

As a partner in the manager’s business seeders expect that they will be permitted to participate in sales and other liquidity events of the manager. While in some instances a seeder simply requires an outright consent right to any sale or issuance of equity (and

presumes that it will condition its consent on being permitted to participate in the transaction), it is also common for a seeder to pre-negotiate a “tag-along” right to participate in any sales. In the case of seed transactions where the

seeder’s economics are calculated by reference to revenue (the overwhelming

majority of seed transactions), the tag-along right often will also include a conversion mechanic to account for the fact that the seeder’s top-line interest in the business is considerably more valuable than a traditional bottom-line equity interest. As the number of buyers for stakes in asset managers has increased over the last several years – thus making an exit or partial exit through a sale more likely – seeders have been increasingly likely to require this right, with the frequency of this feature nearly tripling over the observation period.

To follow up with the authors of the study please contact Gary Anderson, the lead author of the study and partner at Seward & Kissel at 212.574.1637 or anderson@sewkis.com

Related content:

Tages – Europe’s Largest HF Seeder – Gets A Capital Infusion from Trapani (Dec 2016)

Seeders Becoming Much More Important To New Hedge Funds According To Study (Feb 2015)

The Shrinkage of Hedge Fund Seeding Capital (Mar 2010)