By Radi Khasawneh of TABB Group

Prime brokerage, the last bastion of resistance to wholesale transparency and efficiency in the equity markets, is being dragged into the light. New capital and leverage ratios to be introduced by the Basel Committee for Banking Standards will penalize prime brokers whose securities financing operations will now be incrementally included as risk exposure that requires a capital buffer.

Balance sheet pressures and compliance burdens are not only forcing regulatory standardization but also requiring the sell side and buy side to accelerate market structure evolution in order to survive and succeed in the new regulatory environment.

Just as regulatory change caused the fragmentation of order flow in the US seven years ago—necessitating the adoption of order and execution management systems—the treatment of collateral and the cost of financing in prime brokerage are forcing adoption of technology to resolve new challenges. For a long time, traders have looked at orders and collateral as two different things, but Basel III rules set to be fully implemented by 2018 mean they now must adapt the treatment of their financing and collateral in the same way as their orders.

The infrastructure to facilitate this increased vigilance is only just emerging, and there is still a significant degree of intransigence by participants on all sides in recognizing the necessities of the new world. The result of this is that prime brokers and their clients are still in the initial phase of recognizing a change that is not yet reflected in their behaviour but is increasingly important to the bottom line.

The PB Merry Go Round

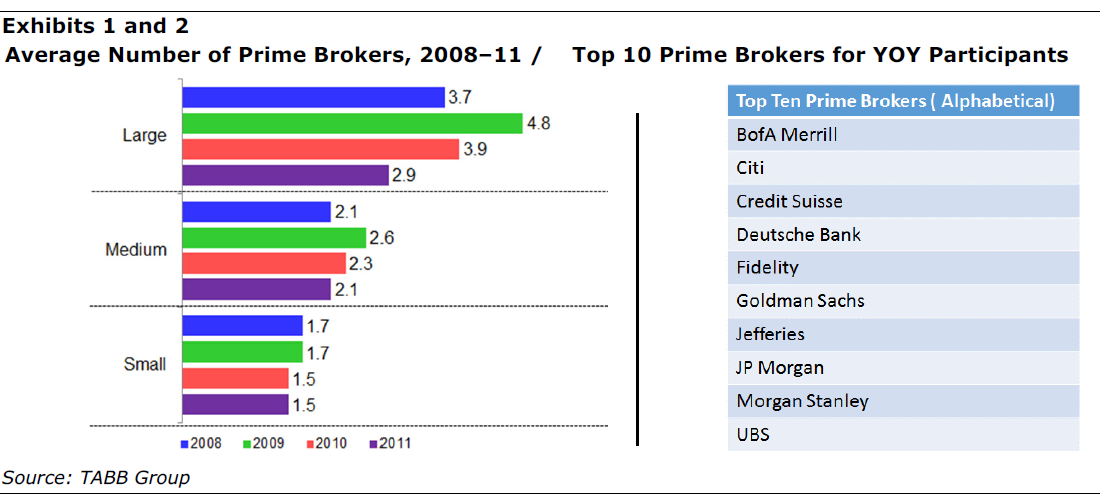

The story of the shift in the number of prime brokers used by the buy side has been a roller coaster that has been defined by shifts in sentiment toward counterparty risk. We have now come full circle, and there has been a retrenchment to the old paradigm. The near collapse of Bear Stearns and subsequent bankruptcy of Lehman Brothers in 2008 caused an unprecedented widening of the universe of prime brokers used by single hedge funds and institutional investors as they sought to mitigate their concentrated exposure to the prime brokers they relied on for securities financing. This was more pronounced among the largest firms. In 2009 funds with more than $3 billion in assets under management increased use of prime brokers to 4.8 firms on average according to a survey of fifty-one US funds conducted by TABB Group in early 2012 (see Exhibits 1 and 2).

That increase has since more than reversed for two key reasons: the scarcity of bank balance sheet is causing a sell side retrenchment to key relationships, and a buy side retreat has occurred as the implications of diversifying prime broker (PB) relationships became clear. Hedge funds have had to contend with parallel operational due diligence and compliance burdens. The question for them is determining whether or not dealing with more prime brokers and increasing the complexity of your workflow make you a riskier business from an investor standpoint. Large hedge funds had reduced their prime broking relationships to an average of 2.9 by 2011 (indications from conversations by Tabb Group are that this number may well have declined even further in the interim period).

The firms most affected by this—small and medium-sized funds—and asset managers have to be much smarter about targeting their business flow to preserve existing relationships. They have to maximize their impact in the context of an overall decline in performance and therefore the commissions and fees that are available to PBs. This evolution gives rise to a further complication—in a world where it is no longer an option to talk to and use everyone, how can a buy side client effectively track and benchmark financing with PBs versus the rest of the universe? Further, given the market dynamics, is it wise to make decisions on that basis and consider alternative options?

Either way, it is clear that a confluence of regulation and risk management will mean further increases in the cost of financing at the very time when the availability of collateral will come under severe pressure as new margin and clearing regimes kick in and drain available bank balance sheets. Those that ignore this will essentially be the equivalent of a buy side fixed-income trader that refuses to factor cost of mandatory clearing into new derivatives contracts. In both cases, regulatory change has moved the goalposts, but a lack of urgency on both sides could leave some behind the curve—affecting the very firms that could potentially benefit the most from a more proactive approach to surveillance of an emergent trend. In its most basic form, the problem can be summarized as equivalent to the reduction of efficient pricing models in fixed income as liquidity deteriorates. Without access to flow, the pricing inputs suffer, affecting competitive advantage. Similarly, the fewer prime brokers you use, the less scope there is for an informed and efficient collateral and financing policy. Brokers themselves will offer performance-tracking data to clients, but the fiduciary imperative requires an independent analysis in the long run. In the long term, everyone benefits from a reduction in the current opacity of the market.

Fragmented Divergence

As leverage, revenue, and collateral pressures increase, the financing function will likely become an important determining factor for the buy-side in their dealings with banks. The subject has been covered in recent research notes and white papers issued by dealers themselves1. A fuller assessment of the cost of financing and value of your business to a broker on a continuous basis has become a naturally useful data point as costs increase.

While many factors determine hedge fund and institutional choice of prime broker beyond simple cost of financing, there has been a traditional focus on credit risk and servicing needs. Changes in circumstances (a decrease in AuM) or a change in strategy can erode a fund’s standing with its dealer, making it more imperative to leverage existing value and make an informed decision on broker relationships. Meanwhile, the Basel III final capital rules for leverage capital ratio (LCR) and net stable funding requirements (NSFR) publishedin January this year are redefining the game.

Although both measures are not required to be fully implemented until 2018, the phase-in begins next year, and national regulators, such as the UK, Switzerland, and the US, have already begun the process of monitoring compliance, and punitive measures are in place for those behind the curve. In March this year, the US Federal Reserve Board conducted its fourth Comprehensive Capital Analysis and Review of thirty banks and rejected the capital plans of five banks and has also restricted shareholder payouts based on results. In total, the Tier 1 ratio (determining capital under the LCR) of all banks combined increased from 5.5 percent at the beginning of 2009 to 11.6 percent at the end of 2013. As systemically important institutions, the LCR and additional buffer imposed by the US regulator means all banks will have to have a minimum 10 percent core Tier 1 ratio (high-quality capital/risk weighted assets).

Eventually, these costs will have to be passed on to clients of capital consumptive businesses. Under the current framework, both securities financing (PB) and derivatives notional are subject to significant risk haircuts. In addition, money market funds that provided the crucial overnight and short-term funding are themselves having restrictions placed on their ability to lend to banks in the wake of the liquidity shortfalls that rocked French banks in 2010 and eventually caused them to reduce reliance on US wholesale funding while reducing long-term dollar liabilities (generated by trade finance arrangements). The new rules require matched funding for liabilities of at least thirty days in duration, limiting the amount of short-term financing that a prime broker can rely on. The rollover financing and leverage that were common components of the business model become prohibitively expensive with a yield curve-like funding structure.

Eventually, these costs will have to be passed on to clients of capital consumptive businesses. Under the current framework, both securities financing (PB) and derivatives notional are subject to significant risk haircuts. In addition, money market funds that provided the crucial overnight and short-term funding are themselves having restrictions placed on their ability to lend to banks in the wake of the liquidity shortfalls that rocked French banks in 2010 and eventually caused them to reduce reliance on US wholesale funding while reducing long-term dollar liabilities (generated by trade finance arrangements). The new rules require matched funding for liabilities of at least thirty days in duration, limiting the amount of short-term financing that a prime broker can rely on. The rollover financing and leverage that were common components of the business model become prohibitively expensive with a yield curve-like funding structure.

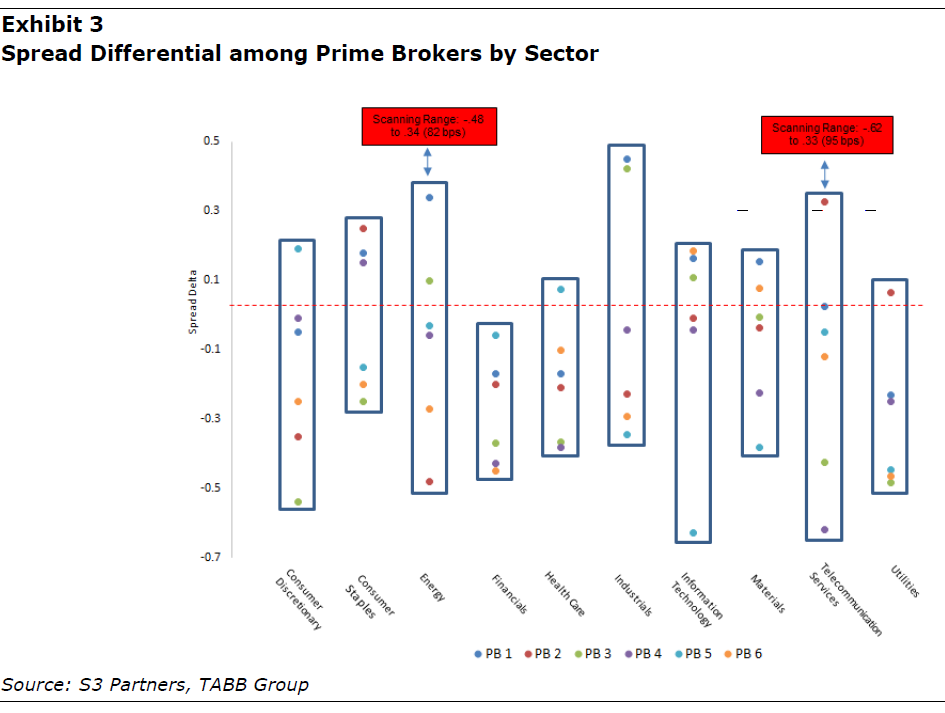

Even before these changes occur, independent data suggests there is already a significant divergence in the cost of financing for equities trades across prime brokers. Exhibit 3 shows the spread differential in the cost of long and short equity financing with the six most frequently used prime brokers. The largest differential was ninety-five basis points in the telecommunications sector (essentially the different cost applied to the same universe of securities according to aggregated data, with 0 being the benchmark rate across the whole universe of prime brokers).

Although there are variations in the scale of differential, one can see that the choice of broker across sectors can have a significant impact on funding today (and this would be even wider if it included a wider universe of brokers of varying perceived credit quality). A further point to make is that this shows the negative impact restrictions on internalization (where brokers had been allowed to net the risk of long and short secured financing positions on their balance sheet) could potentially have on their available capital.

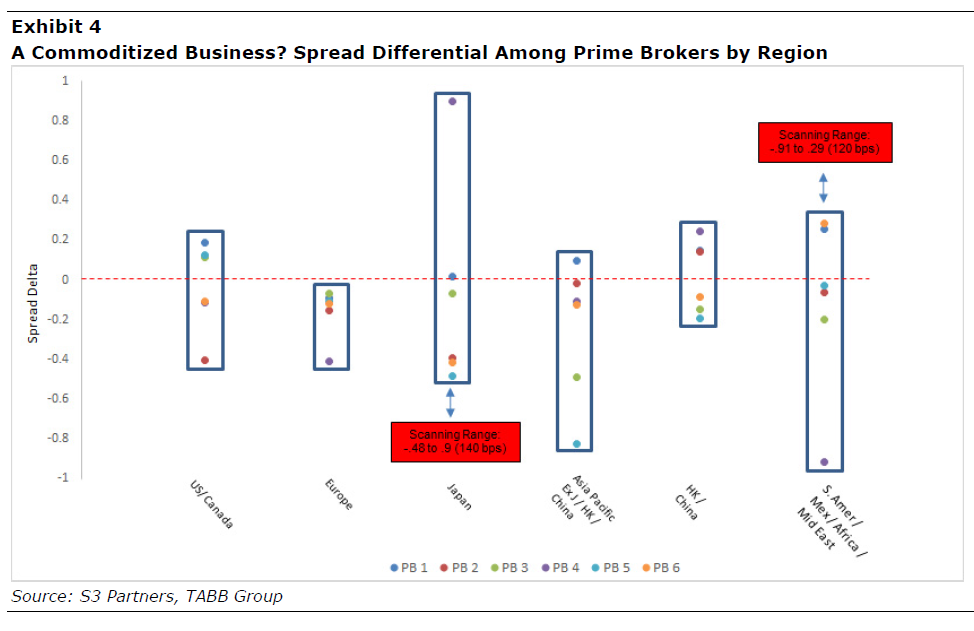

When cut by the region in which securities are traded (the way most PBs themselves look at their business), the data shows that this variation does split according to local strategies and culture (see Exhibit 4). In Hong Kong and China, for example, the preponderance of stock picking, long/short strategies mean a much tighter range than comparable emerging markets. At the more illiquid end of the range, where access to inventory is still a key factor, other options are being pursued to reduce the balance sheet drag on the broker but maintain the relationship (see below). This has opened the door for niche players to emerge that otherwise would have been shut out of conversations, but the general perception is that the old relationship paradigm (and broker name recognition) are still the primary considerations. In TABB Group’s view, this will start to make less sense as the disparity between perceived value persists but requires a cultural change in some regions.

When cut by the region in which securities are traded (the way most PBs themselves look at their business), the data shows that this variation does split according to local strategies and culture (see Exhibit 4). In Hong Kong and China, for example, the preponderance of stock picking, long/short strategies mean a much tighter range than comparable emerging markets. At the more illiquid end of the range, where access to inventory is still a key factor, other options are being pursued to reduce the balance sheet drag on the broker but maintain the relationship (see below). This has opened the door for niche players to emerge that otherwise would have been shut out of conversations, but the general perception is that the old relationship paradigm (and broker name recognition) are still the primary considerations. In TABB Group’s view, this will start to make less sense as the disparity between perceived value persists but requires a cultural change in some regions.

Just as it is often said that liquidity begets liquidity in the trading world, so the experience of collateral and financing efficiency in prime services will encourage analytical application across products and regions. Fixed-income strategies, for example, will increasingly be capital constrained, but the obvious efficiencies available in equities through regular monitoring of financing costs must indicate that funds and asset managers can themselves take responsibility for permanent running costs rather than relying on their relationship brokers to be a one-stop shop and data provider. In many cases, and for the least valued clients, this will create a win-win situation where the business naturally gravitates toward the most beneficial – and welcoming – prime services offering.

This simple point has yet to be fully understood and internalized by many participants, yet there is still a clear perception that prime broking relationships are sticky and dependent on a myriad of add-on services, that there is a clear link between execution and financing, and that the research piece is critically important. The buy side, although acknowledging the status quo, is increasingly seeing these services as separate and distinct.

Just as in other markets, the on-boarding costs both in terms of time and functionality preclude people from picking and choosing their PBs in the same way as they trade on exchanges or differentiate among clearinghouses. So rather than informing decisions on a trade-by-trade basis, these tools can rather feed into an overall picture of the financing performance of a portfolio, the value of client flow, and the most efficient partner for strategic goals. While every fund will emphasize the need to create alpha as the main strategic imperative, we see efficiency in all areas as key to delivering this and therefore a more important role for surveillance data.

With independent benchmarking, even the smallest funds and asset managers can now have the ability to make a much more informed decision about the true cost of trading and adjust accordingly. Part of that process will be factoring in alternative services now available beyond the basic model. The transition from surveillance to effective action remains the largest challenge they face.

Conclusion

Equity, FX, and fixed-income markets have all been through an overhaul in terms of client behaviour on the execution side. Increased automation, trade, and price transparency have brought benefits and challenges to market structure. It is high time people applied this thinking to the more opaque parts of the financing and post-trade infrastructure that have so far largely escaped examination.

These hidden costs can be as basic as financing rates but can extend to the use of collateral, clearing choices, and analytics to more effectively benchmark the performance of portfolios. As in the over the counter (OTC) world, this change is being driven by regulatory constraints and reforms, but the buy side has been slow to adopt and leverage the wealth of data and information now available to them. On one side, this is understandable. Regulatory timelines, on-boarding costs, and compliance burdens are making all but the most critical decisions extraneous in the short term.

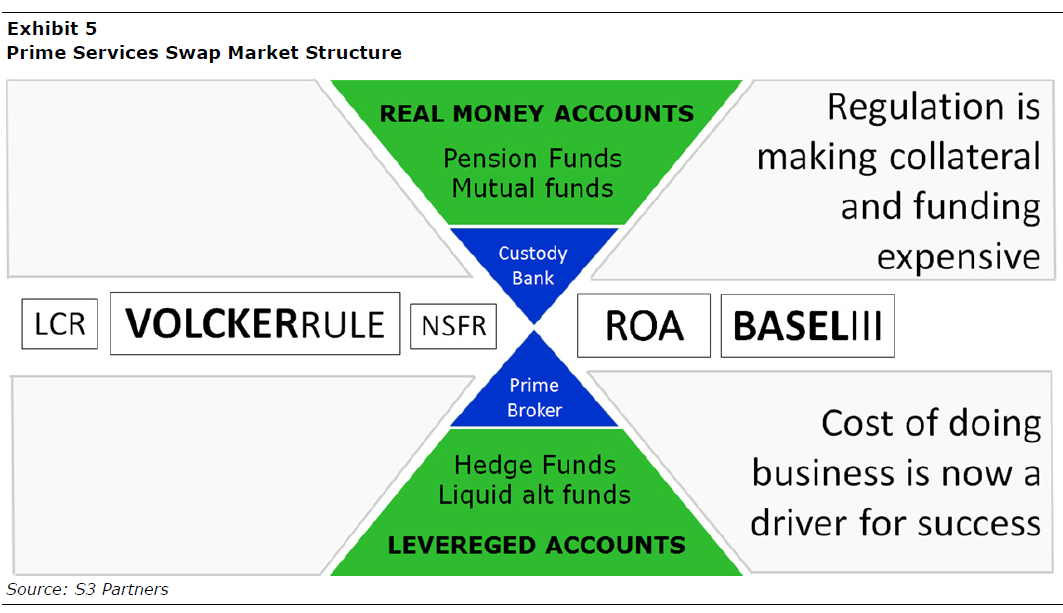

Complacency, however, would be a mistake. The onus of managing your own financing and risks is more important than ever given the extreme restrictions on bank resources and overhaul of existing business models. Efficiency in prime services decision-making is quickly becoming a key fiduciary benchmark for the industry, whichever end of the buy-side spectrum a firm is on (Exhibit 5). People on all sides characterize the environment as requiring a do-it-yourself approach from clients. When relying on the dealers is no longer an option, effective benchmarking becomes a critical part of the conversation.

Benchmarking on its own, however, cannot be the full solution. Both leveraged and real money accounts have to understand how best to use and apply this data to their own financing and collateral decisions. This disconnect may yet prove that prime services remains an exception to the general rule that transparency increases nimbleness and efficiency in behavior. Not grasping this opportunity would be a mistake for the buy side, and the sell side should recognize that enabling choice will help them focus on key strategic goals whatever they may be.

The striking differences that already exist in the cost of financing the same securities at major PBs should make it clear that this remains a non-standardized and qualitative market. Further increases in the cost of financing are inevitable as regulatory implementation accelerates globally, something the PBs themselves have made clear to clients. A head-in-the-sand approach will not make the problem go away, so coming to an acceptable solution that satisfies fiduciary obligations should be critical for most funds out there. This importance will only increase in line with costs. The fewer data points available in the normal workflow, the more important this is, so paradoxically the smallest funds have the most to gain from implementing this today. The clock is ticking.

This is an extract from the TABB Group Report “Equity Prime Brokerage: Exploring Unchartered Territory”. TABB Group is a financial markets research and strategic advisory firm focused exclusively on capital markets. For more information about TABB Group, visit www.tabbgroup.com.

©2014 The TABB Group, LLC. All Rights Reserved. May not be reproduced by any means without express permission.

1 “Leveraging the Leverage Ratio”, JPMorgan Prime Brokerage, 2014. “As Regulation Shifts to Leverage and Liquidity, Short-Term Financing Markets May Get Squeezed”, Goldman Sachs Equity Research, 2014.