By Hedge Fund Insight staff

Each year advisor to institutions NEPC surveys all hedge funds in place across all clients for whom NEPC advises on hedge funds. The 2017 survey went to 224 managers and 201 responded (Response rate: 90%). Information on 356 funds was provided.

– Highlights and trends are summarized here.

Firm-level data

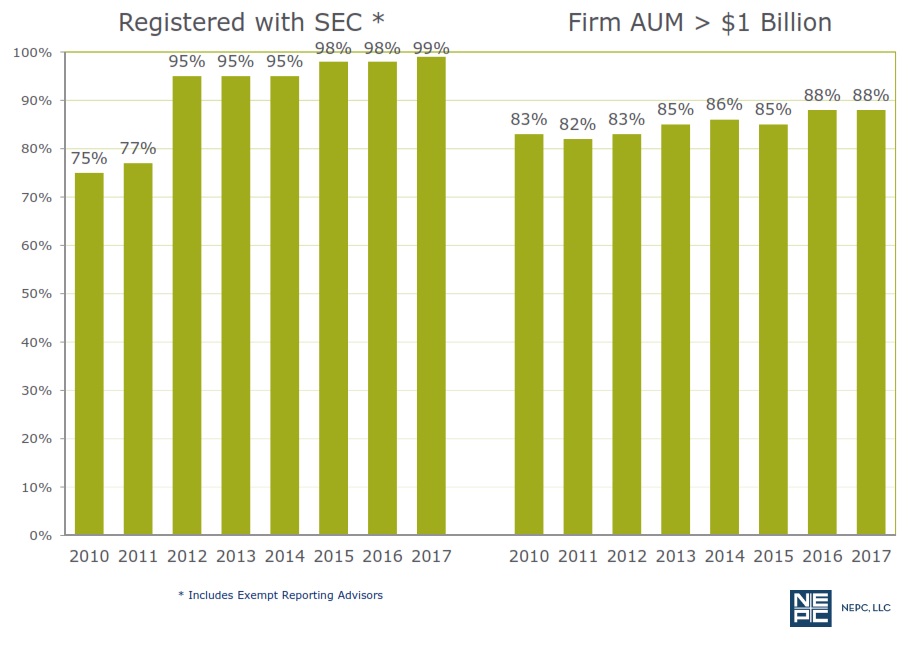

– 91% are fully registered with the SEC. An additional 8% are registered as “Exempt Reporting Advisors.”

– 27% reported receiving an inquiry from a regulator during 2016.

– 21% have had a change in ownership in the past year.

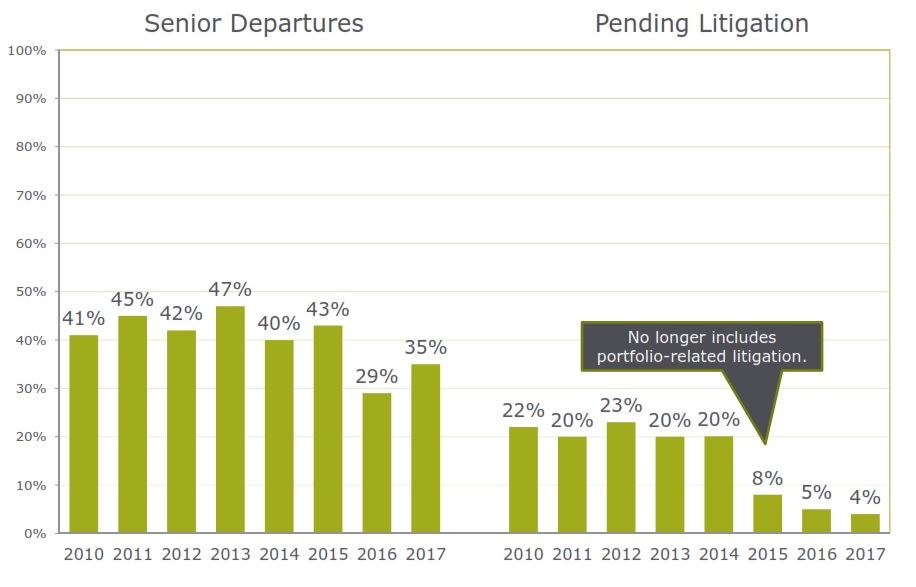

– 4% are involved in some form of litigation.

• This figure has fallen dramatically in the past three years because we changed the structure of the question in 2015 to exclude portfolio-related litigation.

• Litigation brought against the management company or fund could indicate greater operational risk.

– 35% have had senior personnel departures in the past year.

– 18% have an affiliated broker/dealer.

• Affiliated broker/dealers could present a conflict of interest; however, many broker/dealer

affiliates of hedge fund managers exist primarily for marketing purposes and do not have

trading capabilities.

Product-level data

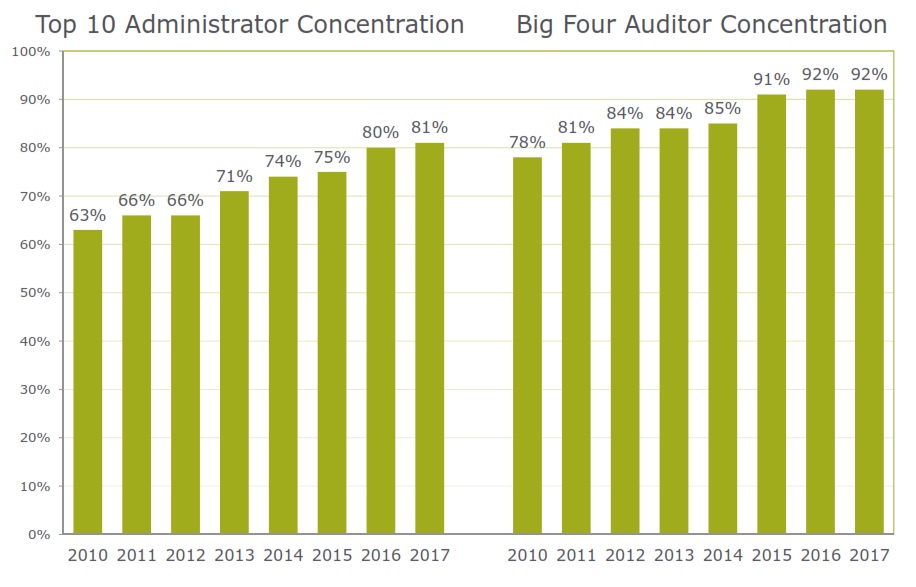

– 11 different audit firms are used, with the top two being PwC (30%) and Ernst & Young (29%). We are seeing increased concentration here.

– 35 different administrators are used, with the most-used being Citco (20%).

– 3% of the funds are self-administered.

– 9% have changed a service provider in the last year.

– 2% put up gates or restricted liquidity in the past year.