By Stephen Pope, Managing Partner Spotlight Ideas

Crude oil futures (Nov 12) have fallen sharply in US trading this Monday (24th). The global economic prospects are mixed and as focus fell on poor German business confidence figures and Spanish inertia re a bailout. Markets sold off. It would appear that the impact of QE3, OMT and BOJ stimulus is fading fast…

Trading on the New York Mercantile Exchange saw Nov 12 light sweet crude futures trade at USD91.24 a barrel during the afternoon trade so falling 7.07% from the September peak of 98.14. The intraday low was posted at USD91.26 a barrel.

The need to focus on growth is certainly centred on the Euro Zone where trading sentiment remains vulnerable amid uncertainty over whether Spain will request a full scale sovereign bailout. There is also new fears over the path Greece will take as “Der Spiegel” reported over the weekend that the country faces a EUR20Bn budget shortfall…until now the markets had believed Greece was trying to save EUR11.5Bn.

Technical View of Crude Oil

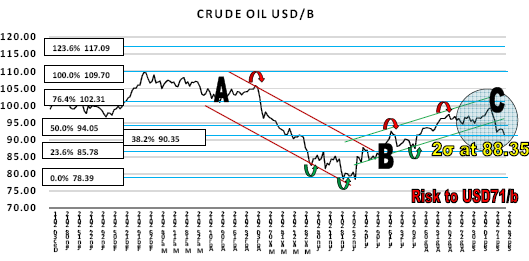

The corrective channel [A] saw spot collapse from 105.00 to 78.39 in the space of 3 months. However, the decline was arrested as the new impulsive [B] gathered momentum as more energy was required to keep pace with global demand following the extreme heat that prevailed across North America. Similarly, China was

boosting oil imports to meet renewed stockpile demands.

We now have to focus on the technical of wave [B] and how they influence the recent decline to determine if a new corrective [C] is forming. The average spot in [B] is 94.17 and the standard deviation or σ was 2.912.

We now have to focus on the technical of wave [B] and how they influence the recent decline to determine if a new corrective [C] is forming. The average spot in [B] is 94.17 and the standard deviation or σ was 2.912.

We see a new corrective forming if spot trades below 2σ under the mean spot price in [B], i.e. at 88.35.

At the moment the last spot of 91.24 had nearby support at the 38.2% Fibonacci Level of the 2012 range, but we do not think it is very strong. It appears to be a situation that the longer Sapin prevaricates and global economic data continues to underwhelm the markets we expect the 2σ level to break so opening risk to theold year low of 78.39 with risk extending as far as USD71.00/barrel.

One Response to “Oil Faces Risk Of New 2012 Low Says Spotlight’s Pope”

Read below or add a comment...