By Financial Risk Management (FRM is part of Man Group)

MARKETS

In the US, we remain cautious of equity valuations. Earnings growth is weakening and some data shows it becoming negative. Data also shows institutions have been net sellers of stock for the past four quarters and only non-financials have been net buyers over the previous five years. This may be a headwind to US equities progressing much in the second half of 2015, though low interest rates should continue to facilitate buybacks and (if premiums are not too great) debt financed acquisitions. Everyone knows US rates are soon to rise, but this is well in the price. Moreover, the gradual nature of the tightening is well telegraphed. Paradoxically, it could be that institutional flows out of US stocks may well find their way to Japan and Europe, helping to push up equity prices in thin summer trading.

To our mind, the problem area for investors is Emerging Markets. Evidence suggests that Emerging Market leverage has significantly risen as growth has plunged. The leverage is high on any historic comparison. Owing to this, the vulnerability to Fed rates hikes is higher than during the last round of Fed tightening during 2004-06. The potential downside in this could occur in front of the expected September hike.

Significantly, the leverage problem extends well beyond China. But it is there where the sell-off in Emerging Markets has taken hold. Mainland stocks are down about 25% from their mid-June highs and the Chinese government has taken a plethora of measures to prop up the market. Over the summer we can expect more moves from the Chinese authorities to safeguard financial stability (and political calm). A sell-off could yet become a rout. In this environment, relative value plays on the A/H spread appeals as volatility in the premium helps RV players take advantage of mispricing.

Looking to the second half, we remain mindful about the thin liquidity in markets. Events surrounding Greece, the transition in the US interest rate cycle and leverage in Emerging Markets could each test the capacity of markets to clear. In this environment, we will continue favouring mangers with balanced exposure levels, long and short alpha generation skills, and a proven ability to trade in challenging liquidity conditions.

HEDGE FUNDS

The HFRX Global Hedge Fund Index gave up its winning run in June, losing -1.24% and leaving the index up +1.27% for the first half of 2015. The loss for June built on a fall in the first half of the month when hedge funds declined -0.40% (June 19). Performance in June across most strategies was negative as the fallout from Greece failing to agree terms with its creditors wore increasingly heavily on markets as the month went on.

The biggest swing saw Equity Long-Short managers move from fractional gains at mid-month to modest losses by the end of June. But Equity Market Neutral managers performed well throughout the month, putting up positive performance on gains posted by fundamental managers and mean reverting, factor based strategies. Despite healthy levels of M&A event driven managers showed mainly negative performance, while Managed Futures endured a tough month with losses across all asset classes, particularly in Commodities and Rates.

Discretionary Macro managers suffered negative performance in the first half of June and compounded this with additional losses going into the month end as the credit issues dogging Greece (and to a lesser extent Puerto Rico) ushered in the return of risk on, risk off market behaviour. Indeed, Macro/CTA funds had their largest daily drawdown since August 2007 on June 29 after Greece’s withdrawal from talks with creditors. The QE trade of long European equities, short the euro failed to work and when market volatility increased equities fell and the euro rose. Managers who played rates trades being short US treasuries also lost ground, although at least one manager had a winning trade by shorting core Eurozone government bonds and going long treasuries. There is a view among some managers that it is too early to oppose existing QE themes (such as being long equities and long the dollar). However there is realisation that in anticipation of more volatility, trade structuring in the form of buying options is needed to provide a bit more optionality in some macro books. For Emerging Markets, particularly regarding credit, the positive news is that Greece, so far, hasn’t triggered contagion. In China, MSCI’s decision not to begin offering ‘A shares’ in index products ushered in profit taking on the eight month rally of the Shanghai Composite Index, leaving it down about 25% over June. Managers with large net exposures suffered heavily.

Managed futures lost ground throughout the month leaving many managers down for the first half of 2015. Long positions in rates across UK, Eurozone and US instruments drove negative returns. Equity futures, which by some accounts was the biggest area of risk and was being scaled back by the end of June, also hurt performance after the biggest losses in two years for European equities offset mixed performances in the US and Asia. A number of managers lost performance on the Euro rising against the dollar, although being short yen/dollar generated gains for some. The general view is that Greece may dampen sentiment in the short-term, but lacks the factor of surprise or scale to affect markets for long, though a continued impasse could make credit more expensive, thus damping investment and growth.

Commodities markets endured largely range bound trade for most of June typified by energy futures. However, an exception to this occurred with the significant amount of short risk in grains which hurt managers when those markets rallied and then spiked higher on June 30 amid a stronger-than-expected stocks report from the US Department of Agriculture. Managers with short positioning booked losses after wheat and corn reversed mid-month declines and rallied strongly into the month end. Managers also made decent returns from being short nickel.

EQUITY STRATEGIES

European Equity Long-Short managers were broadly flat as the exploitation of alpha opportunities helped to offset the sell-off in risk assets at the end of the month. Most managers feel at the macro level that EU growth is accelerating, a view that June PMI data supported. Small and mid-cap stocks are providing more alpha opportunities for managers which may be due to their having better fundamentals than large caps. Managers are exploiting the volatility driven by index related trading in response to macro themes and this opportunity is expected to carry on for some time. So far, events in Greece are not detracting from what is perceived to be a long-term positive case for European equities. But with thin summer trading conditions enveloping markets managers are being careful to structure exposure to avoid gap risk and maintain liquidity.

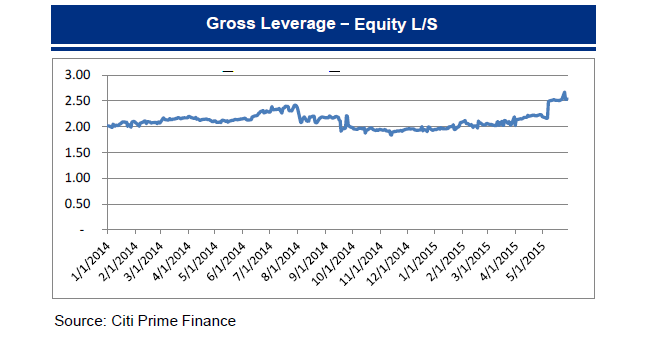

US Equity-Long Short managers displayed (data from JP Morgan shows) wider dispersion and a modest decline in correlation. Managers are outperforming in most cases with their marginal losses coming in at around half the pull-back in the S&P. Manager outperformance was helped by the Russell making a small gain compared with the S&P losing over 2% following the end of month sell off related to concerns around contagion from Greece. Across the managers net exposure has been reined in after hitting the top of its recent range earlier in the month. It is important to realise, however, that even among managers in the lowest quartile (in terms of market beta in their portfolio) net exposure is below the levels seen in 2014. The addition of short exposure is shown in the heightened gross exposures. It seems to have been done mainly through the addition of index puts. This marks a change from the first four months of the year when the use of hedges was quite low.

Statistical Arbitrage and quantitative market neutral managers delivered variable performance with most managers producing flat to slightly negative returns. Quant managers trading non-directional futures did better than their directional peers in the CTA sector. Equity factor strategies presented few interesting opportunities in June with the best results coming from managers that happened to have the right exposure in Asia ex. Japan.

Credit Long-Short was generally weak in a month characterised by risk aversion. Managers with exposure to credit value and distressed were negatively impacted by the sentiment surrounding Greece and Puerto Rico. Leveraged loans, with floating rate terms, outperformed high yield particularly in the first half of the month, while more liquid and investment grade names were hit as yields rose. Being less impacted by Greece and Puerto Rico, structured credit managers outperformed corporate credit mangers. Mining, metals and energy names were also weaker with several of the latter issuing second lien, collateralised deals that served to push the value of unsecured debt lower.

Event driven mangers turned in mainly negative performance (generally -50 to -150 bps) as deal spreads widened even though M&A hit a new monthly record in June of $620 bn (with first half M&A up 30% to $2.72 trillion from the year ago period). On many deals, managers were lightly hedged on the acquirer and not as short as they should have been. This hurt performance when big price declines materialised for Avago, which is buying Broadcom for $37 billion, and Shell, which is paying $73 billion for BG.