By Warren C. Smith, MRB – The Macro Research Board

The rebound in risk assets since mid-February should persist as investors slowly unwind their fears of a recession. Sentiment is still fragile and economic activity will be slow to improve (and choppy), but it is becoming clear that the markets significantly overreacted to weak manufacturing data and the “economic message” from sliding oil prices at the start of the year. Oil price trends have not reflected global economic growth, rather prices were crushed by excess supply. In the long run, cheap oil is profoundly pro-growth.

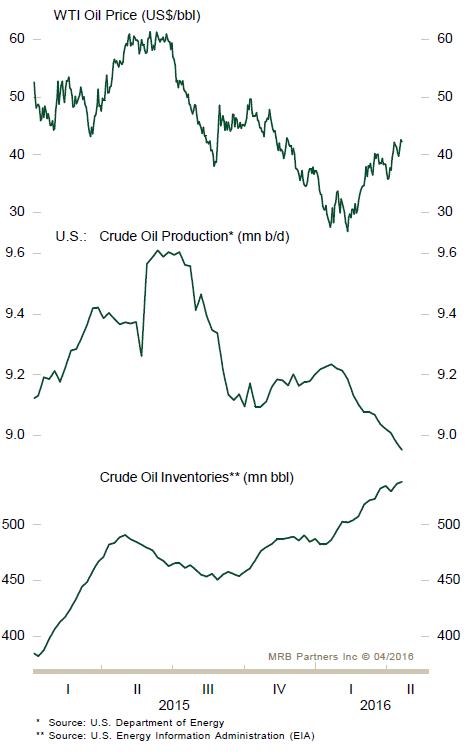

The plunge in oil prices since 2014 was not demand-driven, as global demand has steadily improved since oil prices peaked. Rather, the oil market remains fundamentally oversupplied. To this end, one hopeful sign for stability in oil prices is that U.S. crude oil production is now in a clear downtrend (and U.S. output has recently been inversely correlated with oil prices). U.S. shale output will continue to retreat during the course of the year as old wells dry up and are not replaced by new drilling activity. U.S. crude oil inventories have remained stubbornly strong, however, less output increases the odds that the inventory overbuild will soon diminish. A downshift in oil inventories is critical to ensure that the recent low in oil prices proves durable.

In terms of the investment outlook, falling crude oil output is supportive of oil prices which, in turn, are positive for risk asset markets. It is positive that resource plays have rebounded, as it reduces the odds of a financial and economic meltdown in the commodity-producing economies and the threat of contagion to the rest of the world. Moreover, stable to firm oil prices reduce the perceived risk of deflation, and will buoy overall global growth expectations.

It is probable that the tight relationship between oil and risk asset prices will soon start to fade. As global trade picks up, we expect that oil prices will settle into a volatile trading range, while non-resource equity and corporate bond prices will keep grinding higher. Oil’s upside is capped by the likelihood that supply will revive in response to higher prices. A trading range in oil prices near current prices, however, would be a positive outcome for the world, as it does not present a roadblock to better economic growth, and also reduces fears that erupted when oil prices were in a freefall.

MRB – The Macro Research Board (www.mrbpartners.com) is a partner-owned independent research firm, and is widely recognized as one of the world’s leading providers of well-researched and actionable theme-based macro strategy and investment ideas. MRB provides its services to a select number of firms across the buy-side community. To learn more about their service offering, please contact Mr Chris Sandfield, Partner and Head of Client Relations at MRB on +44 207-073-2792, or via email at: chris.sandfield@mrbpartners.com

related articles: