By Salvatore Ruscitti, of MRB – The Macro Research Board

We recently upgraded energy stocks to neutral from underweight. Downside risks to oil prices and rising costs for oil producers were key reasons behind our downgrade of the sector in May 2013. Our cautious stance worked out well as a supply-induced bear market in oil prices crunched the earnings of energy companies, and significantly pressured the relative performance of energy stocks in recent years.

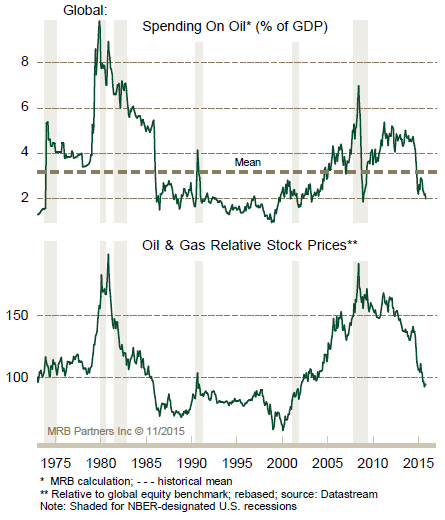

However, with oil prices now at the low end of what we regard as a choppy trading range and forward earnings expectations at historic lows, the risk/reward in the sector has become more balanced. Furthermore, energy stocks are deeply oversold relative to the global equity benchmark and sentiment on oil is extremely negative, implying that the risk of a near-term relative bounce is rising.

Moreover, oil prices are now cheap by historical standards, with global expenditures on crude equivalent to approximately 2% of world GDP. The rate is towards the lower end of its post-1970 range and points to support for oil prices (and, thus, the earnings of the energy sector) if global economic growth firms, as we expect. After oil prices fell by roughly 60% in 1985-1986, global oil stocks performed broadly in line with the equity market from the mid-1980s until the early-2000s. The same is likely to hold true over the next few years. This is consistent with a neutral stance on the sector.

Stabilizing oil prices should lead to a trough in the relative earnings momentum of energy companies, although upside will remain constrained given our forecast of range-bound oil prices for the coming year and the considerable lags involved in realigning cost structures in the industry. Consensus estimates for 2016 and 2017 have been materially lowered in recent months as the futures curve for oil collapsed this past summer, and removed hopes for higher prices. As a result, a subdued outlook for oil prices is now more adequately reflected in forward profit expectations, further reinforcing the notion that downside risks to earnings is limited, provided that oil prices find a floor.

Valuations present an unclear picture. Energy stocks look expensive on our measure of relative value and on a forward P/E ratio basis. However, these elevated readings reflect tumbling earnings estimates. More stable measures of valuation are more favorable: the price/book ratio is at an all-time low, although book value impairment remains a risk in a low oil price environment. This mixed picture underscores that valuation is only compelling with the prospect of a sustained rise in oil prices, which we do not anticipate in the year ahead. Thus, a neutral stance is warranted.

MRB – The Macro Research Board (www.mrbpartners.com) is a partner-owned independent research firm, and is widely recognized as one of the world’s leading providers of well-researched and actionable theme-based macro strategy and investment ideas. MRB provides its services to a select number of firms across the buy-side community.

Reproduced with permission of MRB