Co-Opting External Expertise

Now with our economic view in place and a decent understanding of the elections it is time to talk to our political consultant, who works for Her Majesty’s civil service. One phone call to schedule an appropriate time and one call to gain all the political insight. Perhaps I am missing something. If only sleep was not required and I could call right now. But it is the middle of the night and I am getting a little tired – looking at the watch I realised I had been working for 16 hours straight! No wonder I feel tired and hungry. Best to hit the hay and get up refreshed and run all systems again. Make sure I have not missed anything, before talking with our political expert.

Scoring the Drivers of the Market

Finally, 8.30 again, I jump onto my seat and open “Inspector Gadget”. This time I am more concerned with the main drivers of FX especially pertinent for JPY vs the US$ – I investigate all correlations and the usual drivers I have selected over the last decade plus years of investigating foreign exchange movements (including interest rate differentials, current account, balance sheet differentials etc etc etc the list is long, I look at all of them and rate them. Then, finally, I focus on our proprietary top 5 driver score list. I do not want to miss anything.) I also look at traditional indicators like Purchasing Power Parity and overvalued/undervalued indicators (even though a currency can stubbornly go against such indicators for very long periods of time) as well as even the big mac index. All point to a similar story: the yen is overvalued by far, that is it is far away from fair value.

I have over the years analysed different country’s economic situations so often that I have developed my own way of looking at a country’s most important factors via my own indicators and in a certain order. That way I can obtain an understanding of a country’s current situation and its forward bias relatively quickly. Inspector Gadget gives this to me by downloading the raw macroeconomic data and presenting it to me in ‘story’ like fashion. I go over the Japan ‘story’ again and come up with the same conclusions I had not missed a thing. So overall the macroeconomic story is pointing to a Japan that without intervention will hit a wall and structurally the yen should start to weaken; but if a newly elected party wanted to kick-start economic growth in Japan they would have to weaken the yen quickly and aggressively, while holding debt service costs low; and perhaps engineering some inflationary expectations and get out of this deflationary rut. Although I have my doubts about being able to engineer sustainable inflation via these policies (since that would require continuous devaluations of 10-15% per annum, since a one-off yen level change would only achieve temporary inflation) it simply does not matter, perhaps ultimate success for Japan may not be possible, but the only way to try was to weaken the yen substantially and continuously.

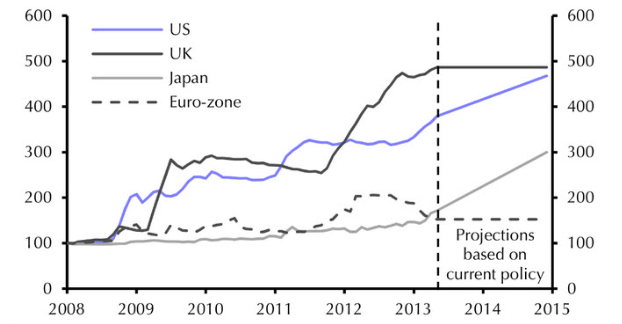

Monetary Base (Jan 2008=100)

sources: Thomson Datastream, Federal Reserve and Bank of Japan

sources: Thomson Datastream, Federal Reserve and Bank of Japan

A Potential Catalyst

The FX drivers and value analysis are all pointing to a weaker yen. There is a potential catalyst which would mean a much weaker yen, faster, and driven by immediate monetary action. And the yen is not moving. Still hanging around the 78-80 range. I cannot wait for the 15.00 telephone conversation to confirm the political side of the trade.

The conversation last for an hour and confirms all our assumptions: Abe will win and he will implement his plans. The firmest answers I have heard from our consultant to date. It is the real thing. My excitement is rising. But patience. Now it is time to get the market feel by talking to some large FX traders in the market.

Yep all traders are non-commital and nobody is hugely positioned. Great!

Back to inspector gadget who will give us the statistics on the yen futures positions IMM, CFTC – overall no bias confirming what the traders had told me. (This being FX the largest market in the world and mainly done over the counter it is worthwhile getting an idea of positioning from the actual traders, since published stats about positions are not conclusive enough). It is as if the market is still in shock that the yen is this strong at the moment and cannot get weaker. A phenomena called ‘anchoring’ – a price level is somehow perceived as a ‘normal’ level and people have difficulty in imagining it ever changing again. But we know better don’t we.

Timing the Markets

Now it is time to consult our systems for market timing. These systems consist of 5 different proprietary technical systems, some trend following, some pattern recognition and some swing systems, which make money in their own right over time. These tools for us are used for market timing. Once a conclusive analysis has been conducted, that looks into the macro, flow and drivers of the underlying, market tone, positioning, possible catalyst, volatility levels and option prices we would consult our timing systems, affectionately called ‘Tom and Jerry’ for just that: timing.

Tom & Jerry is not involved in the trade yet. There is still time. The market seems currently uninterested and we seem to be early in our conclusions. Other news and events, position management and trades overshadow the rest of the day.

At night, however, I read only reports about Japan and see differing view points. Smiling at various analysis – how much easier life is since we developed Inspector Gadget, who gives us all the information that we find in any of these reports but in a way that I can easily digest them. All at your fingertips. The upshot of all I read: confirming all our assumptions. We are definitely onto something!

Risk Management Begins with Instrument Selection

Now it is time to analyse which instruments to utilise for this trade once the time comes (and the time comes with Tom & Jerry as our guide, since we would only enter in a trade like this when it has already started moving in our favour, with a predetermined stop).

Choice of instrument: Volatility (vol) is low across markets on all FX instruments. If what we are thinking should occur then vol will be getting bid very quickly to higher levels from the current 5% or so. Options seem a good way to go. We look at options and the underlying for our trade and decide on a mix.

We analyse the mix as it would fit into our portfolio: correlations with our other positions, sensitivity analysis and positions sizing. We enter our confidence levels into our matrix and conduct our ‘when to reduce position size’ analysis.

This is a two step process, where we a) stack our arguments and discuss how we have to reduce our positions if each block falls away and b) how much we need to reduce if our risk blocks materialise. This is irrespective of price move, a high level risk analysis (though it must be said that if any of our fears materialise we would expect some price response).

Then we conduct a risk analysis based on price and volatility. We set our stops, we set our trailing stops if the trade should move in our favour and we set our ‘soft’ risk analysis matrix on top. We are set. Ready to put on the trade. But we wait.

Trade Execution and Maintenance

We wait. We wait, each day looking at Tom and Jerry for our entry point. Doing our daily analysis of the macroeconomic world, then the demand-supply analysis of commodities we analyse and relative value trades we follow. We evaluate new data and set our scenarios for what we think will happen next and search for discrepancies across the globe. All the while glancing at the yen.

Finally early november the time has arrived, we get signals from Tom and Jerry. The overall Macro story fully intact and even more likely for Abe’s party to win and implement change. It is now mid November 2012.

All else is already set, analysed, predetermined and mechanical, we know our risk before we enter and our overall portfolio performance with this additional trade; from now on it is really more mechanical. Our execution trader gets the go-ahead with all relevant parameters: we are now involved.

The seeds have been sown, now it is in fact a mechanical exercise: whenever a risk materialises we mark it in our matrix. If enough items are marked a certain predetermined action will be taken (like increase the position or reduce the position). We move our stops higher in line with the price move and volatility indicators. We continue to ride this position all the way to 103. Then one of our pre-determined risk factors occurs and we mechanically reduce the position by half and finally cut the position. Our entry point at 82. Our exit 102.25. It turns out to be a successful trade!

Being the Casino, Not the Gambler

But many do not turn out the same way. A lot of time and effort is wasted on analysis and more analysis only to wait for the ‘perfect’ timing to only watch your exit stop getting hit within the first weeks of the trade. But since we analyse trades where we risk 1% but make a minimum of 2% if we win the odds are clearly stacked in our favour, especially since we try to pick trades with a better than 50:50 hit rate, which is much harder than people think! Overall our research intensive process assists us in keeping a high ‘hit ratio’ and finding good risk:reward trades of 2:1 or 3:1. Combined with strong risk management and diversification across both asset classes and strategies of relative value and fat tail trades, we manage to achieve our strong statistics to date: a sharpe ratio above 2 and two digit returns with 17% year to date.

Questions are the start of any analysis and many end in further research which proves them wrong, but then there are some, which upon further research stand out as solid trading opportunities, worth investing in. The short Yen trade was one of them.

Archbridge Capital AG is based in Zug Switzerland.

To contact Archbridge Capital please email: info@archbridge-capital.com

Our widely read research notes are available on our website under ‘Research’ Website: www.archbridge-capital.com

trade balance is not sufficient to make a judgement,

there are lot of japanese companies all around the world, primarily in East Asia and North America.

How much money they transfer from these subsidiaries to Japan annually? this should be considered,

to assess the real picture of their account balance.

Best Regards