By Jason Hopper and Ken Johnson of A.M. Best

With interest rates remaining persistently low, NAIC Schedule BA assets, which include alternative investment securities, have generally provided insurers with the potential for higher risk-adjusted returns to help mitigate the decline in higher portfolio book yields. Without a meaningful increase in interest rates, insurers have limited choices for investing new dollars from maturing securities and new business premiums to maintain targeted risk-adjusted

returns. Therefore, the current industry trend toward modestly higher allocations to non-traditional asset classes (appearing in Schedule BA) is likely to continue. From an analytical standpoint, Schedule BA acts as a catch-all for non-traditional assets, including hedge fund holdings. In light of some unfavorable trends within the hedge fund industry, standard features such as the 2 and 20 fee structure, despite declining returns, has raised some unwanted attention on this asset class. A.M. Best has aggregated and analyzed hedge fund holdings that have been identified by insurance companies within their annual statutory NAIC statements, under the “type and strategy” column in Schedule BA, Part 1. A lack of compliance in the industry’s filings has skewed the numbers somewhat, however.

Investor concerns surrounding the performance of hedge funds have risen to unprecedented levels, as nearly 80% of investors that were interviewed in June 2016 by Preqin, an alternative asset data source company, expressed disappointment with hedge funds for failing to meet return expectations over the prior twelve months. This compares to the previous highest levels of investor dissatisfaction of 41% in December 2012. Fee levels remain a top concern for investors and a majority believe that fund manager interests are not aligned with their own, placing pressure on hedge fund managers to not only improve declining returns, but also ensure that their fees are competitive and in line with investor expectations. The fee arrangements are known well in advance of investing in these funds; however, the more recent underperformance by many funds has focused additional attention to this area. In many cases, fee structures have already been adjusted down or have become more performance-based.

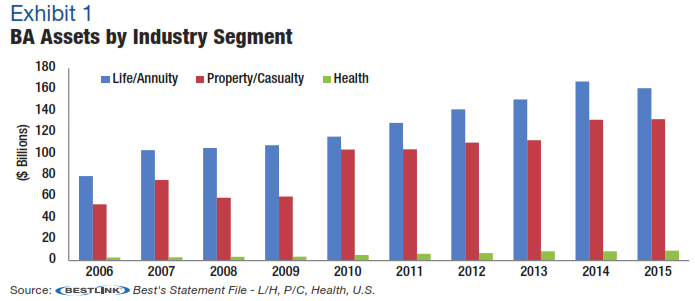

Overall, BA assets as a whole have been on a generally increasing trend over the last ten years for each of the insurance industry segments (Exhibit 1). Despite a decline in 2015, driven mainly by reductions from New York Life, Prudential Financial, and Metropolitan Life (MetLife), the life/annuity (L/A) segment still holds $161.3 billion, or 53.2%, of the total $302.9 billion U.S.-domiciled insurance industry BA Assets. This partially represents new investments into the asset class.

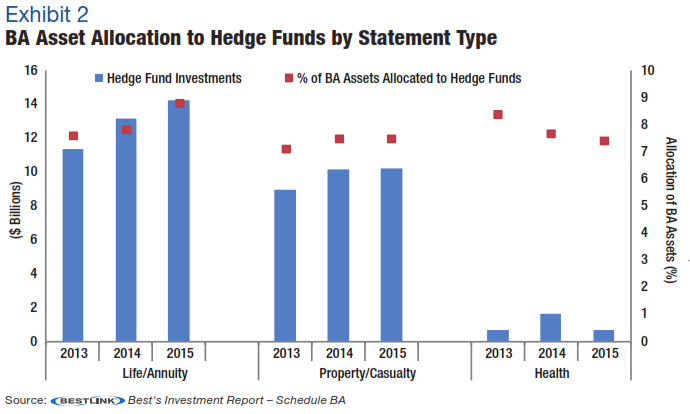

Similarly, total insurance industry investments in hedge funds have continued to increase over the last two years. Hedge fund holdings have grown within the L/A segment from $11.4 billion in 2013 to $14.2 billion in 2015 while the P/C segment has increased its holdings from $8.9 billion to $10.2 billion and the health segment has remained flat at $700 million for the same time period (Exhibit 2). In light of these trends, BA asset allocations to hedge funds have

increased from 7.6% to 8.5% within the L/A segment from 2013-2015 – the largest allocation of the three segments – while the P/C segment has increased its allocations from 7.1% to 7.5%. Meanwhile, the health segment has decreased its hedge fund allocations from 8.4% in 2013 to 7.4% in 2015 as other alternative asset growth as outpaced hedge fund investments.

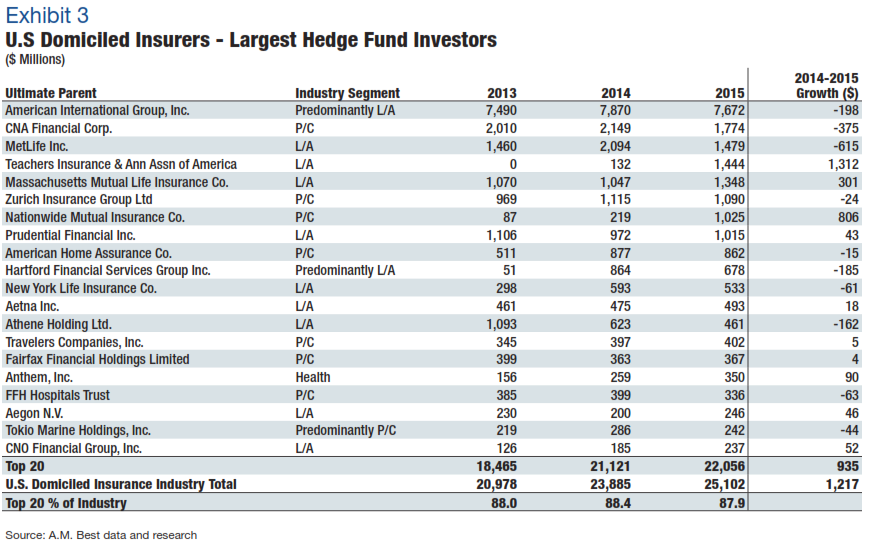

Overall, the top 20 insurance organizations, based on their ultimate parent investing in hedge funds, have accounted for about 88% of total industry holdings in each of the last three years. Additionally, they have accounted for more than three-quarters (76.8%) of the insurance industry’s growth from 2014 to 2015. Eleven of the top twenty organizations investing in hedge funds are comprised of L/A companies. There are eight P/C insurers in the top twenty, with Anthem representing the sole health company on the list (Exhibit 3). Worth noting is that just under half of these insurers reduced their hedge fund holdings from 2014 to 2015, led by reductions from Metlife, CNA Financial Corp, American International Group (AIG), Hartford Financial Services, and Athene Holding Ltd., each of which decreased its respective holdings by over $100 million. Conversely TIAA, Nationwide Mutual, and Massachusetts Mutual Life posted the largest increases in hedge fund holdings between 2014 and 2015.

One of the key areas of due diligence companies generally undertake before making an investment in a hedge fund is the general partner/investment manager. The proliferation of hedge funds, now 10,000+ strong, has made finding skilled managers a more difficult endeavor as it seems too much money and too many managers are chasing the same finite opportunities.

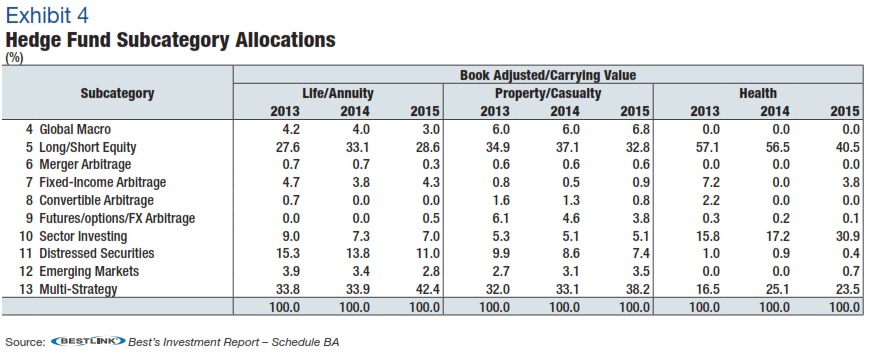

The next most significant due diligence area after manager capabilities and track record is the strategy pursued. A.M. Best recognizes that there are many conventions for attempting to classify hedge fund strategies, but we currently use the convention followed by the NAIC Schedule BA filings. As displayed in Exhibit 4, hedge funds are broken down into 10 distinct strategies. The two largest sub-classes across all industries are long/short equity and multi-strategy investments, although the health industry significantly increased its sector investing in 2015. Compared with market-neutral and statistical arbitrage managers, for example, long/short managers tend to have much longer holding periods (e.g., 3-5 years), and more concentrated portfolios consisting of 3-10 core positions, with perhaps an additional 20-40 smaller positions. Further diversification strategies can be implemented within long/short equity holdings through investments in value, growth, blend, or bottom-up funds.

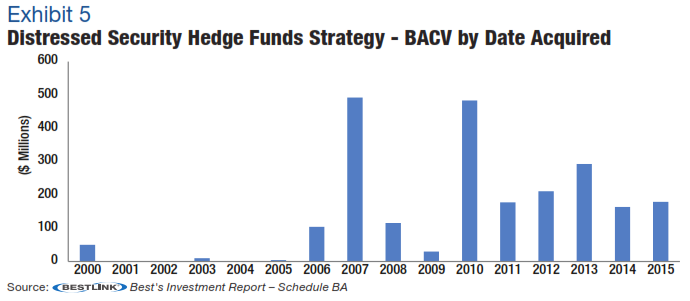

While the larger allocations to multi-strategy funds are not surprising for increased diversification benefits, the life/annuity segment’s allocation of 11.0% to distressed securities is seen as somewhat more risky; however it is noted that it has declined from 15.3% in 2013 and new purchases have declined dramatically from their peak in 2010 based on 2015 investment holdings (Exhibit 5). Following the 2008-2009 market crisis, there had been a flood of distressed assets into the market, which led to numerous new funds being launched to try to profit from the sector. These distressed funds were typically utilized as longer-term investments, with capital typically being entrenched for about 20 months on average, according to Preqin. As these funds are more illiquid, life/annuity insurers typically fit the longer time horizons associated with this hedge fund strategy, especially if they are utilized to back surplus as opposed to duration or cash flow matching specific liabilities. Despite the uptick at the turn of the decade, overall exposure to distressed securities through hedge funds remains a minimal percent of insurers’ overall capital and surplus.

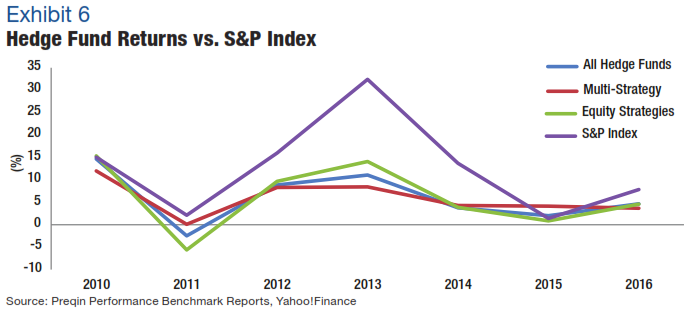

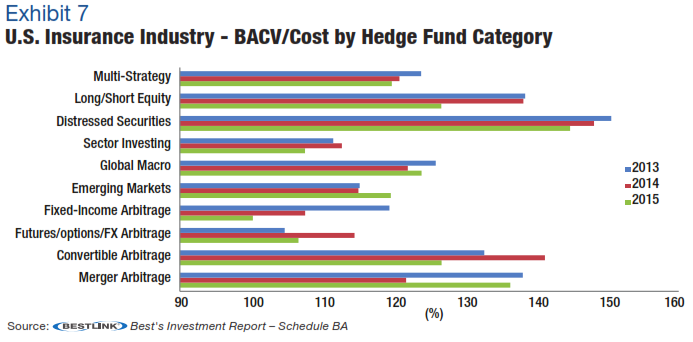

The top three hedge fund subcategories chosen by insurers, which account for 80.1% of the insurance industry’s hedge fund holdings, have all seen a decline in their returns over the last few years, but a slight uptick so far in 2016. Additionally, their returns have been consistently outperformed by the S&P Index (Exhibit 6). Further illustrating the point of recently declining performance, the book adjusted/carrying value (BACV) as a percent of cost in the

insurance industry has been declining since 2013 (Exhibit 7).

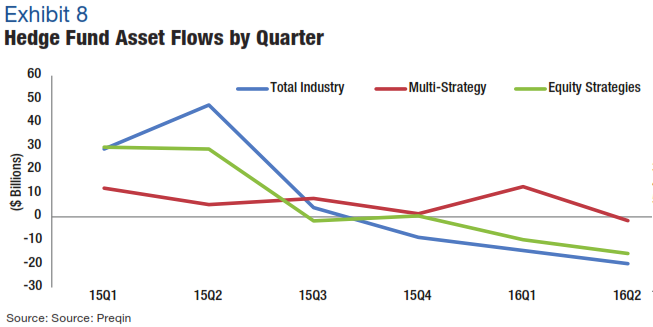

In the face of declining returns and potentially misaligned fee structures, investor capital has been decreasing dramatically over the last few quarters for the hedge fund industry. The industry as a whole saw net outflows of $14.3 billion and $19.9 billion in the first and second quarters of 2016, respectively. Outflows have varied by fund strategy, however, as multi-strategy funds saw net inflows of $11.2 billion for the first half of 2016 (Exhibit 8). According

to a June 2016 survey issued by Preqin, 39% of respondents plan to reduce the amount of capital they have invested in hedge funds over the next year. Comparatively, only 18% plan to increase their exposure, potentially accelerating this outflow trend in the second half of 2016. Given the disappointment in both returns and fees, the pessimism and outflows by investors and insurers is not surprising. A few large public pension funds, which generally allocate close to 9% of their portfolios to alternatives, have already backed away from this market over the last few years. Similarly, as already mentioned, the top three investors within the insurance industry have already decreased their holdings by $1.2 billion from 2014-2015, with more reductions likely. It appears some of the outflow has remained in alternatives, whether through increased allocations to private equity or infrastructure exposures.

Are There Rating Concerns?

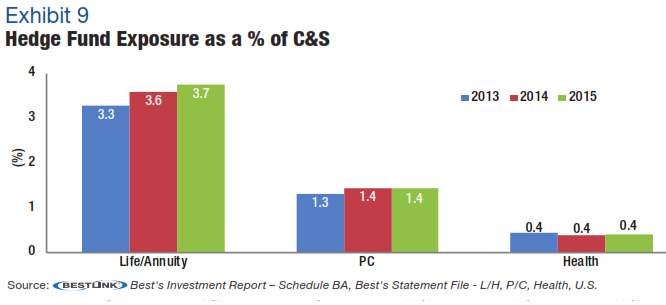

On an aggregated total industry segment basis, hedge fund exposure remains modest to minimal as a percent of capital & surplus, with L/A insurers having the largest exposure at 3.7% as of year-end 2015 (Exhibit 9). While exposure remains negligible, it has been slowly ticking up from the 3.3% reported in 2013 for the segment. The P/C segment’s exposure of around 1.4% for each of the last three years is about half that of the L/A segment, while hedge

fund exposure in the health segment remains around 0.4% of capital & surplus.

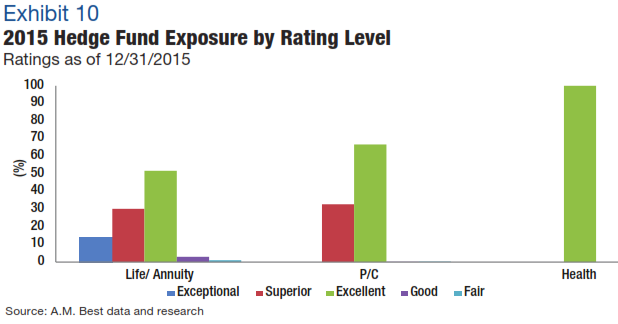

From an A.M. Best Rating Unit perspective, hedge fund investments are largely concentrated among insurers with an Excellent rating or higher (Exhibit 10). Additionally, only 4.6% of hedge fund holdings are held by rating units rated lower than Excellent, illustrating that lower rated insurers prefer to not take on some additional investment risk related to more complex investments. AIG and TIAA account for nearly half of the L/A segment’s hedge fund holdings, while the top five investors account for about three-quarters. Similarly, AIG accounts for about one-third of the P/C segment holdings, with the top five accounting for 76.3%, while Anthem is the only rating unit in the health

segment with hedge fund investments. Note: AIG announced in 1Q16 that it planned to reduce its hedge fund exposure by half.

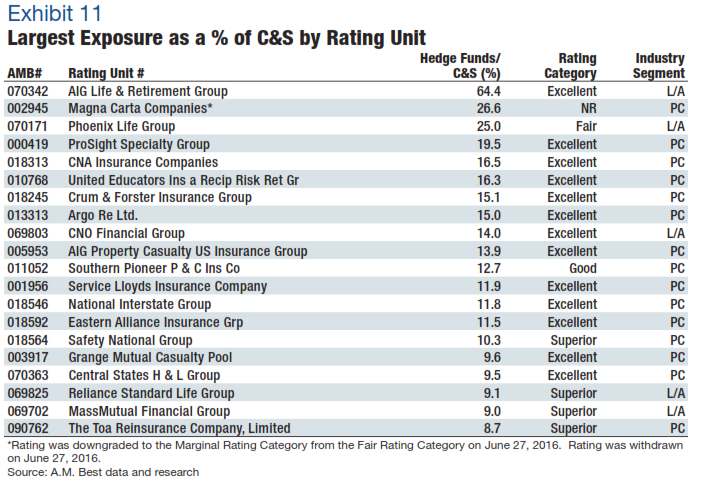

Only three rating units hold hedge funds at or greater than one-quarter of their capital & surplus position, two of which are rated in the Fair category (Exhibit 11). Additionally, only fifteen rating units are leveraged more than ten percent of the C&S. Interestingly, fifteen of the top twenty most-leveraged companies are within the P/C segment; however A.M. Best feels that the relatively modest exposure for these rating units are within manageable levels.

For most traditional classes, A.M. Best believes the industry has demonstrated the appropriate expertise, based on reported asset impairments. However, for many insurers, the track record of their experience investing in hedge funds is not that long. With the level of exposure to hedge fund investments growing and the deteriorating performance and sentiment toward the industry, there is less certainty in determining valuations, liquidity, and credit quality. A.M. Best believes at some point this could lead to insurers underestimating their investment risks. Hampered by the limited transparency of Schedule BA, A.M. Best continues to spend additional time with companies’ management as part of the enterprise risk management (ERM) review to ensure they understand the additional investment risk being assumed. The persistent low interest rate environment has continually challenged companies to find solutions to improve earnings and maintain favorable investment spreads and returns, and shifting investment appetite and strategies will likely continue as many companies have already gone through the exercise of tightening expenses where applicable since the financial crisis of 2008-2009. Finally, many insurers, particularly on the life/annuity side, recognize that hedge funds are not an efficient tool for those companies with an increased focus on duration and/or cash flow matching strategies.

Conclusion

A.M. Best views modest allocations to hedge funds as it would many other traditional asset classes. Our analysts expect companies to be able to discuss these investments in detail, including strategic use, performance, liquidity, and how fair value is measured. This is true whether or not an outside manager is utilized. Similar to any other asset class, there should not be significant concentrations, whether by manager or investment strategy. Most of the alternative asset risk is being borne by the higher-rated insurers that have the capital and expertise to better absorb the risk. A.M. Best remains committed to closely monitoring the rising trend in alternative investments and regularly reviews capital charges to ensure appropriate treatment of this asset class. We recognize that there is a place in the investment portfolio for hedge funds, but insurers in this asset class need to understand the volatility this

investment may bring to quarterly performance.

The asset/liability aspect of these securities is also important. Historically, these assets were primarily used as “surplus” investments whereas more recently they have had increased usage in liability portfolios. This use is less attractive from our viewpoint as the potential higher risk-adjusted return is offset by the often unpredictable cash flows of the hedge fund investment to be used as a duration or cash flow matched tool by the insurer.

As for the use of proceeds from this “run” on insurers’ hedge fund portfolios, although some of it may find a home in other alternatives such as private equity, infrastructure, or other real estate-type exposure, we would expect most to go back to more traditional investments such as investment grade corporate bonds and/or commercial mortgage loans and common stock. Obviously, this only makes more dollars chasing a crowded investment set, potentially further squeezing already tight insurer returns. After a few years of sub-par returns, particularly against a broader S&P indexed return, A. M. Best would not be surprised if we see a pullback from direct investments in hedge funds over the short- to medium-term as companies try to ride out the volatility on the sidelines. So while most hedge fund investors in the insurance space are disappointed, and justifiably so, there just aren’t many other attractive alternatives for them to invest in this current low-return environment. As always, companies should be able to explain risks they choose to keep, avoid, or hedge, including those taken in the investment portfolio.

Smaller Insurers Represent Sales Opportunity For Hedge Funds (Sep 2016)

Top 10 Trends in Insurance for 2016 (Mar 2016)

A.M. Best on Insurance Industry Hedge Fund Exposures (May 2015)