By Hedge Fund Insight staff

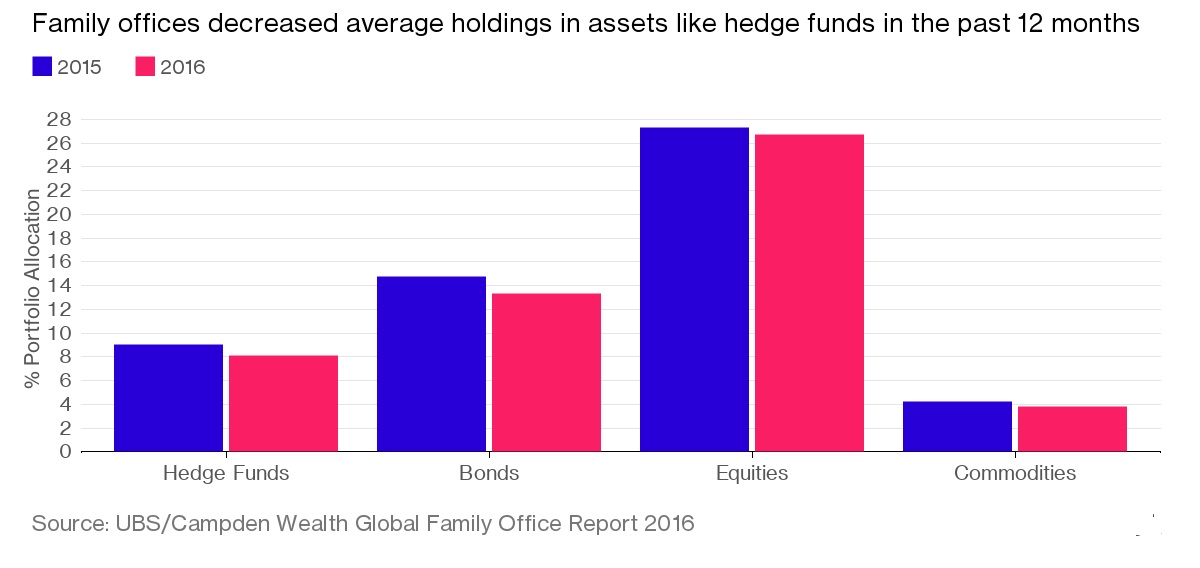

Family Offices reduced their exposure to hedge funds by 10 percent in the 12 months ending in May, according to a report by UBS Group AG and London-based research firm Campden Wealth.

Over one third (34 percent) of family offices intend to decrease their allocations to hedge funds, according to the Global Family Office Report 2016. In contrast, 20 percent plan to increase their allocations and 46 percent expect to leave them unchanged. Multi-year survey participants reduced their holdings in hedge funds from 9 percent to 8.1 percent on average last year.

More than half of family offices surveyed said they want to increase their co-investments. This has been an area that hedge fund management companies have been giving increasing attention to themselves. So larger hedge funds, from $500m upwards in AUM, will have opportunities to cross sell private equity and debt deals, where they already have a dialogue with the heads of investments at family offices.