By Allan Martin, Partner NEPC, LLC

Historically, there is a high correlation between the Yield-to-Maturity (YTM) of the Barclays Aggregate Index and the benchmark’s 6-year forward return. The current 12/14 Barcap Aggregate 6 yr YTM is 2.3%. With regular corporate bonds with such a low yield, American pension plans with target returns of 7 1/2% have to diversify beyond regular stocks and bonds. For example, European middle market senior secured loans may offer an attractive risk-adjusted return, particularly in the context of a low-growth economic environment.

Middle Market Loans are Senior Secured Floating Rate Debt. The typical cash yield is between 5 3/4% – 9%, giving a total return of 10-12%. They are issued with 5-7 year term, but have an average life of less than 4 years because of active re-financing. Borrowers are typically seasoned, healthy, growing companies, but they have limited access to capital (and capital markets), those in Europe might be middle market companies with EBITDA of €10m – €500m.

Obviously there are exiting markets for primary issuance and trading in syndicated loans, but the Middle market loans generally compare favourably to broadly syndicated loans through wider spreads, lower leverage and tighter covenants.

The Opportunity

There are a number of factors which make the opportunity set rich for European private debt:

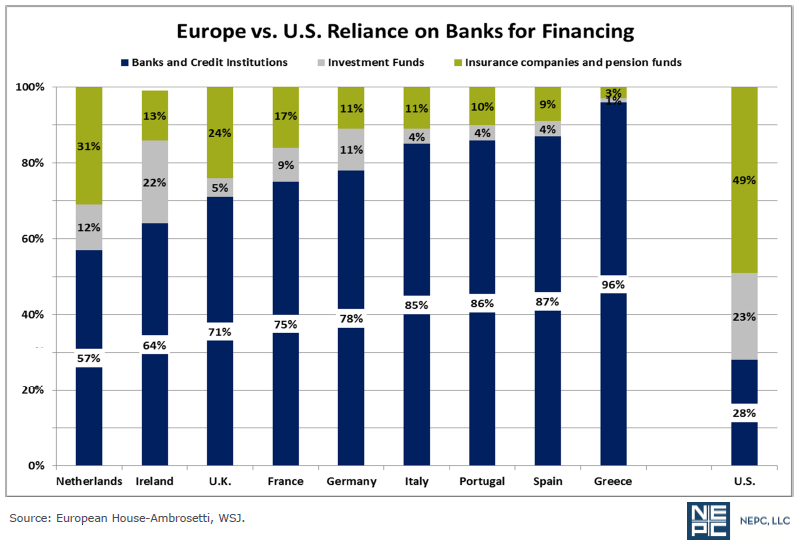

− There is a fundamental supply/demand imbalance in the European leveraged loan market which may continue, supporting premium pricing relative to North America.

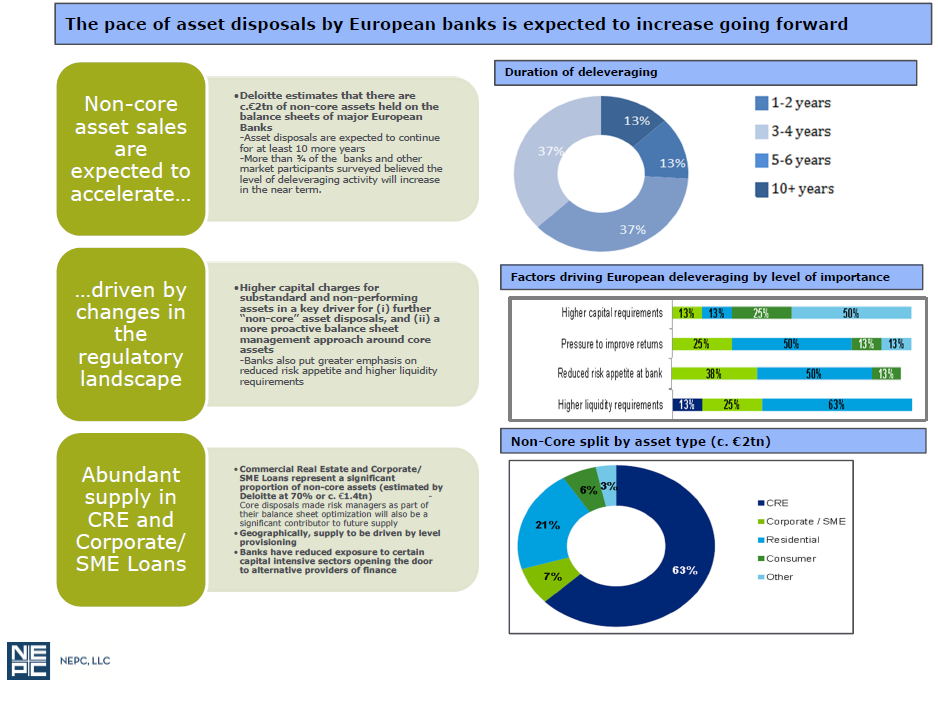

− Banks remain Europe’s largest credit investors, but they are under increasing regulatory pressure to shrink their balance sheets, and the supply of secondary loans looks set to increase.

− CLOs, Europe’s largest institutional source of credit, are in run-off with limited new formation.

− Non-bank arrangers are of growing importance in Europe and anchor investors who can commit in large size can help set terms.

(click on the graphic to enlarge)

European banks have begun to dispose of unwanted loan portfolios at a record rate. This year €150bn of bank loans are forecast to be sold on – an increase of 60% over 2014. Whilst the UK market is set to top the transaction table this year, there is growth elsewhere in Europe too. For example the Italian market has taken off with NPL transactions this year expected to be greater than last five years combined. On the other side, there are favourable debt markets in Europe, and there is a continued strong appetite from buyers and a greater willingness by banks to sell post-AQR have prompted more sales.

In general Europe has a less developed shadow banking system than the U.S., and this is the opportunity.

This article is based on a presentation given to the SACRS Fall Conference 2015.

KKR agree with NEPC’s broad assessment – they released a press release today with the following headline: “KKR’s Direct Lending Activity To European Companies Further Expands”

“As part of its effort to build a direct lending platform for mid-sized European corporates, KKR today announced the further closing of two transactions, Casual Dining Group, a leading multi-brand casual dining operator in the United Kingdom (U.K.), and Sarquavitae, an elderly care operator based in Spain.

“KKR’s European direct lending platform, part of KKR Credit, provides funding for medium sized enterprises across Europe in need of customized funding solutions beyond traditional bank lending. In 2015 alone, KKR completed eight direct lending transactions in Europe, deploying more than $500 million in long-term capital for companies across a number of countries, including the U.K., Ireland, France, Germany, Spain and Benelux, and across a variety of sectors such as industrials, consumer, retail and care services.

“Marc Ciancimino, Member and Head of European Private Credit at KKR, said: “We believe that the direct lending landscape in Europe is undergoing a structural change. Non-bank lending is becoming a more important feature of the €9.5 trillion market backing European corporates. We are seeing an increase in the number of companies looking for alternative customized lending solutions to support their needs.””