By Simon Kerr, Publisher of Hedge Fund Insight and Principal of Enhance Consulting

One of the major decisions taken by the investing institutions that came back to hedge funds after the Credit Crunch was to stick with CTAs. In the period after the Credit Crunch that was not difficult – the Barclay CTA index was up 14% in 2008, and some brand name CTAs up a lot more. The long term role of CTAs in a portfolio context was proven in adversity. So CTAs got a disproportionate share of fresh allocations to hedge funds in 2009-10.

As other hedge fund strategies and markets have recovered a lot more than CTAs in 2009-12, it is unsurprising that the flows to the big managed futures funds have slowed and then stopped in aggregate. Analysis of institutional mandates won by hedge fund groups shows that Winton was a major beneficiary of such flows in 2011, and similarly for BlueCrest in 2012. Hedge fund databases reflected positive net flows to CTA’s right up to the 3Q 2012.

The Barclay CTA Index was down 3.09% in 2011 and down 1.59% last year. For diversified funds of hedge funds there can be a decision about the size of allocation to CTAs, just as an alternatives program at an endowment can vary managed futures exposure.

There is a different sort of challenge for a fund of funds with a dedicated mandate. A funds of fund focused on credit strategies cannot get out of credit. The lead questions become about the sub-strategies within the broad label – European credit over US credit, corporate credit over sovereign risk, and high yield over distressed. What are the mainstream components of the strategy’s return and what are the diversifying elements? Sub-style allocations are a key decision for managers of funds of hedge funds with a narrow mandate.

Altegris is one such provider – the California based alternatives advisor has a particular focus on macro managers and CTAs. The information access point is that Altegris has an actively managed mutual fund that aims to deliver absolute returns by accessing returns of trend-following and specialized managed futures investment managers. The $960m Altegris Managed Futures Strategy Fund invests in a limited number of CTAs, and through the quarterly factsheets and monthly letters it is possible to see the portfolio breakdown, and how it has changed.

Altegris Advisors are investment advisors to the Fund, and JP Morgan Investment Management is the sub-advisor. The Altegris/JPM take on the CTA world, as expressed through portfolio construction, is divided into trend-followers and specialists. Trend following is the most common CTA strategy, contributing three-quarters of historic strategy level returns, and needs no explanation here.

In this context specialized managers may employ a wide variety of trading approaches, including discretionary macro, short-term systematic, counter-trend and other strategies. The permitted bands of the Altegris Managed Futures Strategy Fund allow for 60-100% of the Fund to be in trend-following managers and up to 40% of exposure to be in specialist managers. Soon after launch in August of 2010 the Altegris Fund of Funds (structured as a mutual fund) had a sub-strategy split of 85% trend-followers/15% specialist managers.

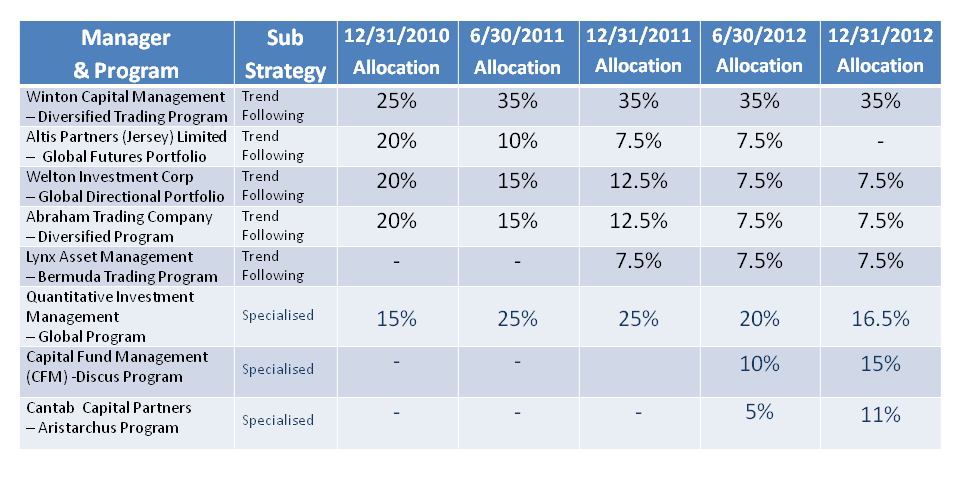

The active allocation decisions taken since the start of 2011 have been biased towards adding to the specialist managers, as shown in the table below:

Table 1: Changing Sub-strategy and Manager Allocations of Altegris Managed Futures Strategy Fund

Source: Altegris Advisors LLC/Hedge Fund Insight

The top down portfolio shape was changed in March 2011 to 75% trend-following and 25% specialist managers in an effort “to further diversify the Fund’s portfolio and lower Fund performance volatility.” Over the last couple of years managers of CTAs have mentioned that quantitative easing and the risk on/risk off market environment have impacted their ability to ride sustained trends from which they benefit most. The advisors to the Altegris Managed Futures Strategy Fund have responded to this challenge to the style of trend-following CTAs by allocating away from them. They have commented that “the increased exposure to specialized managers over the second half of 2012 should help capitalize on the mean reverting environment, should it continue.” At the end of 2012 the trend-followers made up 55% of the Fund, and the specialist managers the rest.

The experience of the advisors to the Altegris Managed Futures Strategy Fund is typical of a specialist fund of hedge funds mandate, and to a degree diversified funds of hedge funds. In the early stages the advisors were concerned with capturing enough of the index level or strategy level return of CTAs in general. The lack of positive absolute returns from trend following CTAs has led to making the representativeness of the portfolio less an issue so much as a point from which to deviate in pursuit of real returns.

The core of funds of hedge funds portfolios is mostly about representativeness – capturing the asset class return, if you will. The challenge for the selectors is to find funds that do the mainstream hedge fund investment strategies well on an on-going basis. Hence the bias away from top-down and macro-driven equity long/short managers, which produce return streams of a different shape from bottom-up focused equity long/short managers. The non-core holdings of funds of hedge fund portfolios are the juice. They are there to give non-representative attributes to the whole portfolio – tail-risk hedging, downside protection, unusual sources of alpha (uncorrelated even with mainstream hedge fund strategy returns), and some to give potential for outsize returns.

This concept – core and non-core in funds of hedge funds – goes a long way. It can be used to differentiate between providers of funds of hedge fund services. It can be applied by investing institutions that invest directly in hedge funds to create more targeted alternatives programs. For example the core exposure could be taken through hedge fund ETFs or hedge fund index notes, or hedge fund replication methods – the cheaper way to get the exposure. The non-core component will delineate the scope of the active hedge fund investing program – find the diversifying, tail risk hedging, high leverage, hedge funds with unusual sources of alpha generation.

photographic credit: the trading room photo (top row lhs) is rights reserved by Norges Bank

Istar capital, run by Rudolf Shally and Thomas Artrarit, made more than 3% in 2012. It is one of the funds seeded by IMQubator.

Interesting analysis, thanks for sharing. Your analysis, coupled with an analysis of the underlying manager track records, shows that Altegris is paring back exposure to their non-compelling, losing mangers (i.e. Welton, Abraham and Altis) over time and changing their original investment thesis with new manager substitutions.

I’m just not impressed with the performance of Altegris’s MFTAX product, not to mention that the fees are very high and there are numerous challenges to accessing CTAs in a mutual fund structure. Their fund is more of a gimmick for the retail market and definitely not the best way to allocate to the space.