From Activist Insight

An Interview With Kai Liekefett and Stephen Gill of Vinson & Elkins

Have you noticed an upsurge in activism in the energy industry recently?

Kai Liekefett: Up until 2012, activists weren’t really focused on this sector. But in the last three years, there were more than 30 reported activism campaigns in the U.S. and numerous activist situations that were resolved outside the public eye.

What’s behind this rising activity in the sector?

Stephen Gill: There have been three drivers that we’ve seen. First, the shale boom has changed the industry. The U.S. is now a leading producer of oil and gas in the world. The problem is that energy companies incurred record capital expenditures in the midst of the shale boom, while at the same time oil and gas prices have fallen and near-term profitability has been reduced.

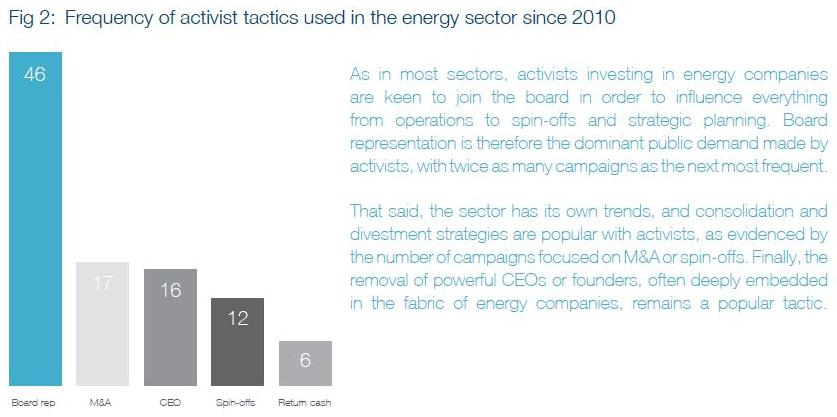

Second, in this industry, a lot of companies are susceptible to financial engineering. Many energy companies have upstream and midstream assets; some also have downstream assets. The market currently rewards pure play companies, which drives activist demands for spin-offs and other divestitures, in particular drop-downs into master limited partnerships, or MLPs.

And third, the energy industry has, for better or for worse, an entrepreneurial or wildcatter culture, which has led to activists calling for better corporate governance at energy companies. Now, I think that focus is a bit overblown, but institutional investors and proxy advisory firms care about governance, and activists are playing to the audience.

Are companies of all sizes being affected?

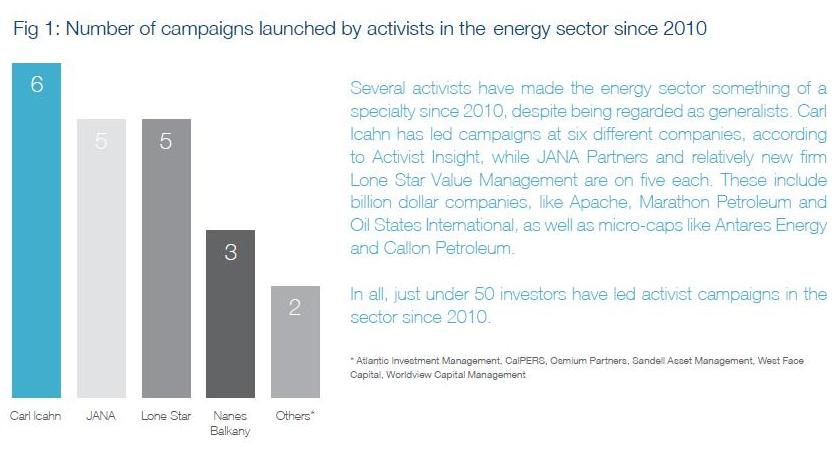

KL: It’s really happening all over the energy industry. Size is no longer a deterrent to activism. Last year, Elliot waged a proxy fight against Hess, which was then a $25 billion company. This year Apache, a $30 billion company, has become the target of Jana Partners. The bread and butter of activism in the energy space, however, are small- and mid-cap companies. Some activists such as Loan Star Value specialize in targeting those companies. Indeed, smaller oil and gas companies sometimes have more room for improvement than mid- or large-cap companies.

Do activists need expertise in this industry to be successful?

SG: The industry has unique characteristics that need to be understood, but that doesn’t

preclude the same plans being replicated. Understanding how oil and gas companies and their assets are valued, and how they perform is important. Also, the accounting requirements for oil and gas reserves can be a trap for the unwary. That said, we’ve seen most of the well-known activists investing in the sector, and we expect those that haven’t, like Pershing Square or Trian, to target the energy industry before long.

What are some of the arguments that do or don’t resonate in the industry?

KL: Let’s start with what most often doesn’t work: The long-term vs. short-term debate. Institutional shareholders care primarily about the situation at hand, and therefore we advise clients to focus on near-term or mid-term results in a campaign. This may be regrettable because whether activism is beneficial or detrimental to our economy in the long term remains an important question.

SG: What does resonate is a coherent strategy, which is easily understood by analysts, the market and investors generally. Proactive engagement with your shareholders is critical – you need to be able to explain your strategy to a non-activist. Other than that, we advise our clients to sit down and have a productive private meeting with the

activist. Campaigns won’t see the light of day if you can convince an activist that their plan won’t work.

Has this increased activist activity had an impact in the boardroom?

SG: Beyond the usual industry trends, this is now the number one topic in the boardrooms of our clients. As a result, boards are more sensitive to it. It can get personal, but on the whole directors are willing to listen to activists’ ideas. There’s a lot more openness in terms of change, these directors are not zealots to their own ideas. Also, activists have become more sophisticated and the quality of their nominees has become a lot better. Some boards might have financial expertise, but an activist may come along and say, “I’ve got one of the best COOs in the industry among my nominees.”

Does Vinson & Elkins represent activists as well as issuers?

SG: As a leading law firm in the energy sector, we represent only issuers in this space. We have held discussions with some of the well-known activists about other sectors and have represented “occasional activists” in other industries, however. For example last year we represented an investment fund in its proxy fight to stop the $6 billion merger of Clearwire and Sprint. After four adjournments and an intense campaign, the merger consideration was eventually increased by around 70%.

What do you expect to see from activists in this sector in the near future?

KL: We think we’ve only seen the tip of the iceberg. Many activists have discovered this sector and we think that more will invest in the coming years, especially as valuations in equity markets may not reflect the intrinsic value of energy companies. There’s also a relationship between activism and M&A activity in the sector. Activism facilitates deals, but it can also have a chilling effect, as there have been concerns about how transformational deals might be attacked by activists. Therefore, our clients have become careful about deals that are not immediately accretive or where synergies are not immediately apparent to the market.

Vinson & Elkins LLP is an international law firm with approximately 700 lawyers across 15 offices worldwide. More than 400 V&E attorneys regularly advise clients on energy-related matters. Kai and Stephen are based in the firm’s offices in Houston, Texas. www.velaw.com

Reproduced with permission from Activist Insight.

“Activist Insight” provides the most comprehensive global information source on activist investors. This includes live alerts on activist investments, over 200 detailed activist manager profiles, unique stats on activist campaigns and proxy battles, and much more. See www.activistinsight.com