From Fitch Ratings, with additional content from Hedge Fund Insight staff

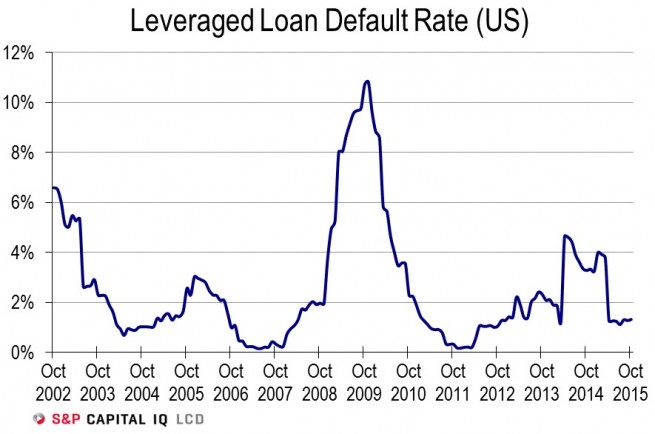

A total of $2 billion of loan defaults in November led by Millennium Health LLC pushes the trailing 12-month (TTM) default rate to 1.7% from 1.5% at the end of October, according to Fitch Ratings. Millennium’s $1.8 billion Chapter 11 filing on Nov. 10 represents the largest default in the institutional leveraged loan market since Caesars Entertainment Operating Co. in January.

NOTE THAT THE GRAPHIC SHOWS THE DEFAULT RATE OF THE S&P/LSTA LEVERAGED LOAN INDEX BY PRINCIPAL AMOUNT. THE ISSUES/ISSUERS TRACKED BY FITCH MAY NOT BE EXACTLY THE SAME.

NOTE THAT THE GRAPHIC SHOWS THE DEFAULT RATE OF THE S&P/LSTA LEVERAGED LOAN INDEX BY PRINCIPAL AMOUNT. THE ISSUES/ISSUERS TRACKED BY FITCH MAY NOT BE EXACTLY THE SAME.

Defaults in the energy and metals/mining sectors are also continuing to place pressure on the rate, underscored by the chapter 15 filing for Essar Steel Algoma Inc. In addition, Miller Energy Resources Inc. was the fifth energy loan default filing since March, driving the October energy TTM rate to 5.8%, compared to the 1% historical sector average. The metals/mining TTM rate will rise to roughly 13% from 10.9% due to Essar, the fifth default in the sector since May. Dex Media Inc. ($2.1 billion) is expected to file for bankruptcy in mid-December and will send the broadcasting/media TTM rate to roughly 6% from 0.4%.

Overall, the 2015 default rate should come in near the top of Fitch Ratings’ 1.5%-2% projection. Removing defaults for energy, metals/mining and Caesars would put the full-year rate at approximately 0.8%. US High Yield default rates are also rising – through 2% at the last reading. Commentators expect the US High Yield default rate to rise to the long term average of 4.5% during the course of 2016.

Energy and second-lien issuance has virtually halted. Since April, the energy sector has provided just 6% of second-lien issuance due to a lack of appetite for junior liens, and as oil prices in the mid 40’s pressure valuations. The energy sector has the largest share of second-lien loans, at 21%. From third-quarter 2014 through first-quarter 2015, energy accounted for 22% of total second-lien issuance. Third-quarter 2014 ushered in the bulk of this volume as crude oil prices peaked. Overall, second-lien loans comprise 8% of the institutional market.

Weak energy second-lien bids are also a focus. The average bid price for second-lien loans on a par-weighted basis was 89.9 cents last week, with 14% of the sample bid below 80 cents. Removing energy from the mix, the average price stands at 94.3 cents, with only 6% bid below 80 cents.

Apart from energy, the healthcare/pharmaceuticals sector is also struggling, with notable weakness in the secondary market since the end of September due to contagion from Valeant Pharmaceuticals International. The company drew Congressional attention for significant drug price hikes and then faced hedge fund allegations of accounting manipulation, heightening political and regulatory uncertainty for the sector. 38% of loans were bid above par just two months ago, but that figure is now 4%. In addition, 39% of healthcare/pharmaceuticals term loans are currently bid below 98 cents versus 10% in mid-September.

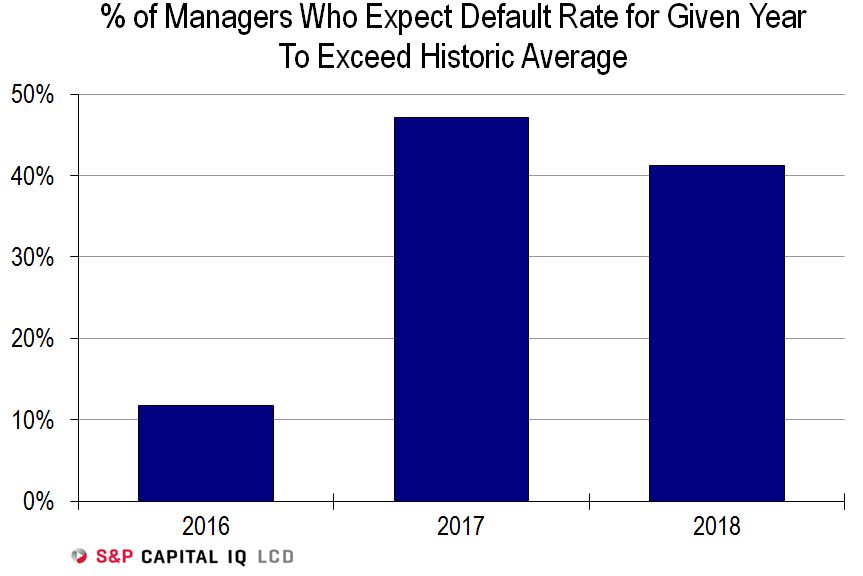

Market participants expect the default rate to rise next year with recent survey evidence (see graphic below) showing that the market is beginning to discount default rates at the long term average occurring in 2017.

Related articles: