By Simon Kerr, Publisher of Hedge Fund Insight

Though it may seem a thought from a long time ago, this year had been stacking up as a relatively good one for Asian hedge funds. This was true as recently as just over a month ago.

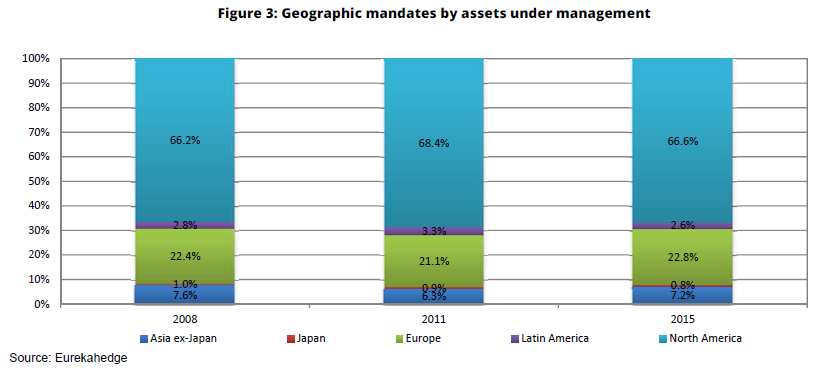

Comparisons for performance in the YTD to the end of July are shown in Fig 1. This shows Asia Pacific hedge funds performed better than hedge funds in general, better than large hedge funds, and better than (all geographies of ) equity hedge funds.

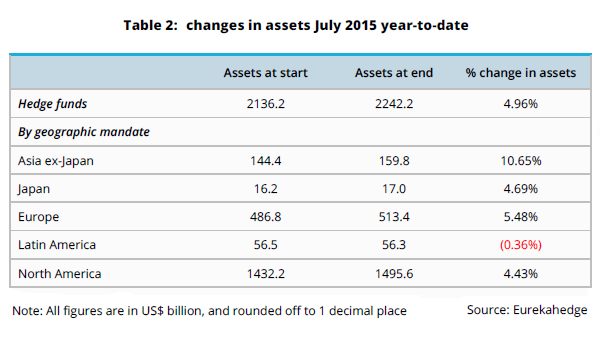

Looking at the Eurekahedge regional indices, the YTD story (through July) is similar for both fixed income hedge funds and equity hedge funds (Figure 2). Asia ex-Japan hedge funds had leading performance versus other regional aggregates for hedge funds investing in these asset classes.

The Eurekahedge Asian Hedge Fund Index was up for 13 months straight from May 2014 to May 2015, and this year through July the Index was still up 6.76% after two losing months.

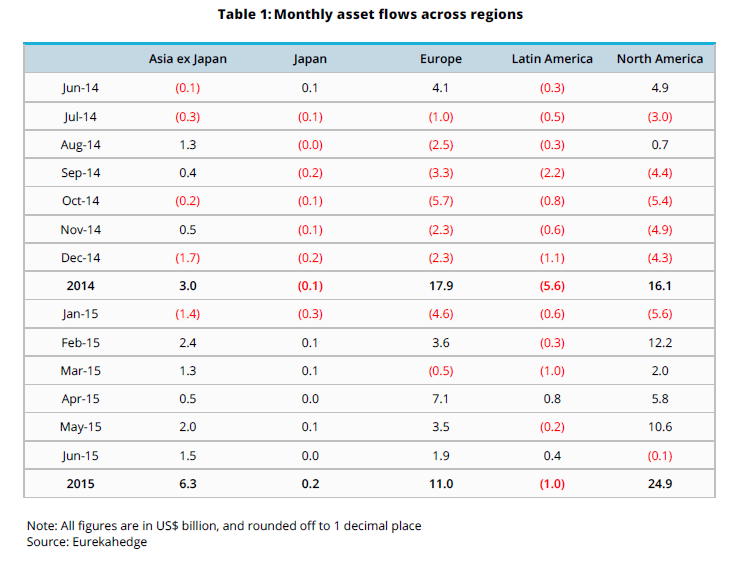

The long string of positive monthly returns for Asian hedge funds had the usual effect*  on capital flows to those funds. Table 1 shows that from the middle of last year net subscriptions to Asian hedge funds became more consistently positive. Net inflows were as consistent for Asian hedge funds as they were for North American funds, according to Eurekahedge data. The comparison with North American is particularly tough as that region is the main source of new capital to the whole industry, and there is a natural bias to invest with near managers (whatever the mandate).

on capital flows to those funds. Table 1 shows that from the middle of last year net subscriptions to Asian hedge funds became more consistently positive. Net inflows were as consistent for Asian hedge funds as they were for North American funds, according to Eurekahedge data. The comparison with North American is particularly tough as that region is the main source of new capital to the whole industry, and there is a natural bias to invest with near managers (whatever the mandate).

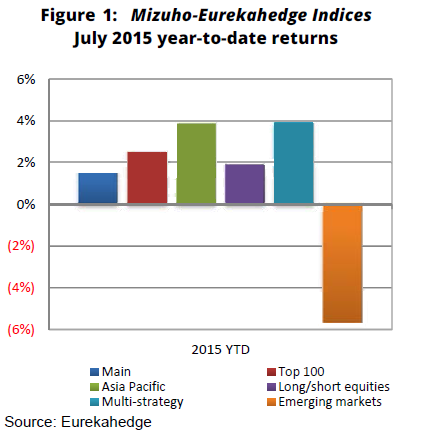

On a year-to-date basis, Asia ex-Japan hedge funds have recorded US$8.5 billion in net capital allocations, nearly all in long/short equity funds. The total assets in Asia ex-Japan funds were up 10.65% from the start of the year at the end of July. Assets in Japanese funds were up 4.69% over the same period (Table 2).

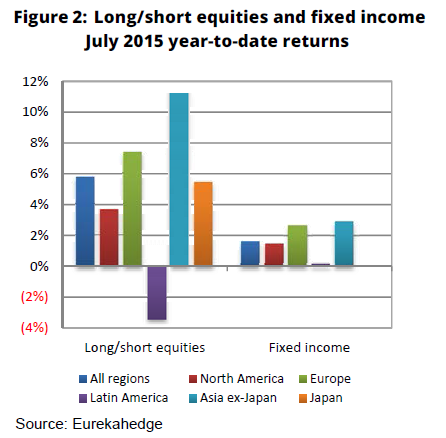

Around 7% of geographically designated hedge funds are invested in Asian markets. Figure 3 shows that in the last few years the proportion of the industry invested in Asian hedge funds has grown faster than the industry in general. Longer term performance data makes a logical case for such growth.

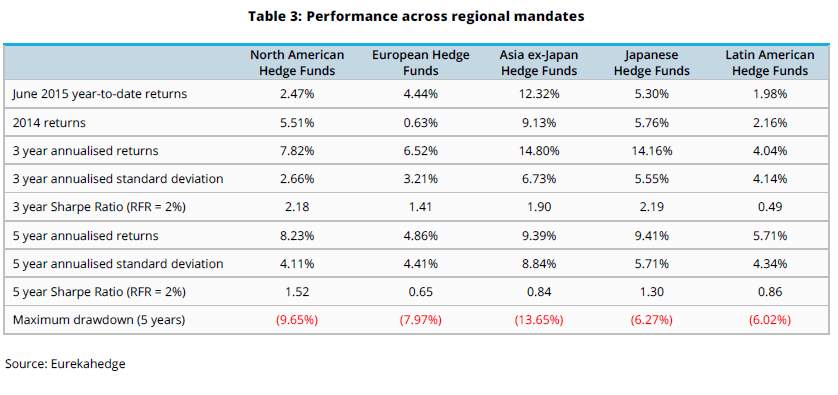

Table 3. shows 3- and 5-year performance data across regional mandates. In aggregate Asia-Ex Japan funds and funds with a Japanese investment mandate have the highest absolute returns over both the last 3 and 5 years. The two also also show the highest volatility of return when compared to other regional investment mandates, and Asian hedge funds have much the largest 5-year worst drawdown. So as ever with performance, there are other measures to be taken into account is addition to absolute return, most notably correlation and variance in return but also alpha compared to beta and risk of loss. But still and all a case could be made for Asian hedge funds in general based on 5-year, 3-year and 1-year performance histories through the middle of this year.

However July and August have been rough for markets in Asia, particularly the markets of Greater China. For example Asia ex-Japan hedge funds lost 2.60% in July, Asia ex- Japan mandated long/short equity funds were down 3.14%, but funds with Greater China exposure were down 8.49% in July, according to Eurekahedge. The downdraft continued into August – equity markets in China were down by around 12% in the month.

However July and August have been rough for markets in Asia, particularly the markets of Greater China. For example Asia ex-Japan hedge funds lost 2.60% in July, Asia ex- Japan mandated long/short equity funds were down 3.14%, but funds with Greater China exposure were down 8.49% in July, according to Eurekahedge. The downdraft continued into August – equity markets in China were down by around 12% in the month.

Early stage feedback suggests that hedge funds dedicated to investing in China have done better than the market returns for August, which is as it should be given structural shorting. The better managers have kept at least a proportion of their out-sized gains from the first half of the year to be up high single digits in the YTD, for them August returns were close to breakeven. The Market Vectors Asia (Developed) Long/Short Equity Index was down 3.52% for August, putting that ETF down 3.32% for 2015 so far.

In aggregate hedge funds across all strategies lost between 2 and 3 % in August, with equity hedge funds being down around 3 1/2% for the month and event driven down 1 1/2% on average, going by HFR data. Macro fund losses of more than 2% in August took the typical fund in that strategy into negative returns for the year to date.

It has taken investors in hedge funds some time after the Credit Crunch to come back to Asian hedge funds, but for most of the period since last Summer capital flows have been positive, indeed dis-proportionately positive. The market volatility of the last two months will have put purchase programs on hold. It will be indicative of long-term institutional commitment to Asian hedge funds if we see small flows ((in or) out) between now and year end. Look on Hedge Fund Insight for an update in the New Year.

* “the usual effect” is the 6-month rule, which was referred to last month here.