By Stephen Bowles, Head of UK Institutional Defined Contribution, Schroders

![]() This analysis of the defined contribution (DC) pension landscape among the top listed companies in the UK comes from the fifth edition of the Schroders’ FTSE Default DC schemes report. The aim of this six monthly report is to shine a light on default DC schemes during the accumulation phase in order to examine their different asset allocation strategies.

This analysis of the defined contribution (DC) pension landscape among the top listed companies in the UK comes from the fifth edition of the Schroders’ FTSE Default DC schemes report. The aim of this six monthly report is to shine a light on default DC schemes during the accumulation phase in order to examine their different asset allocation strategies.

Since the first report in March 2013, a wider pool of employees than ever before now has access to company pension

schemes through auto-enrolment – now totalling over 5.2 million people. Of these members, 4.5 million sit within DC

schemes, with 300 such schemes available for auto-enrolment.

This report analyses the asset class mix of the default funds of FTSE companies’ pension schemes, examining different

strategies, and identifying short-term and long-term trends from over the last two years. The DC default funds of 30 FTSE 100 and 35 FTSE 250 companies have been researched for this project. Unless otherwise stated the source of the charts and tables were from research undertaken by Instinctif Partners on behalf of Schroders.

Asset allocation splits and typical portfolios

Despite moves to diversify asset allocation over the last two years, the typical default DC scheme of a FTSE pension

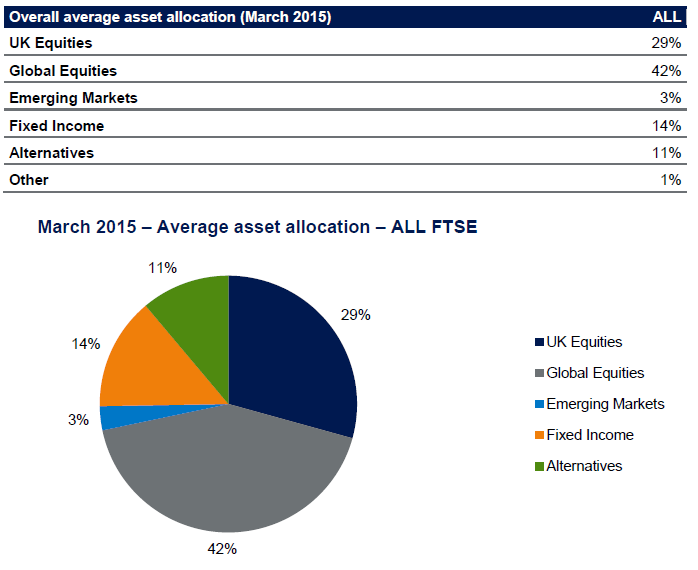

scheme is still overwhelmingly invested in developed equities. The average default DC fund of a FTSE 350 firm currently has 71% of its total allocation invested in this asset class – by far the largest exposure of all asset classes – with this allocation consisting of 29% of assets invested in UK equities and 42% in global equities.

The next most exposed asset class is fixed income, which now accounts for 14% of the typical asset allocation of a default DC fund, followed by alternatives at 11%.

All FTSE (100 & 250) portfolio composition: medium-term trends

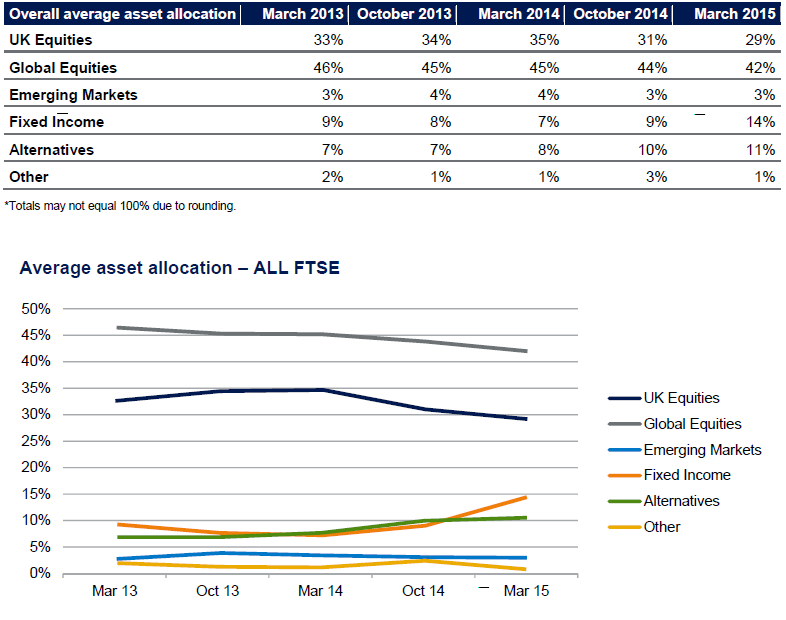

Two years on from our first analysis in March 2013, FTSE firms have made clear progress in diversifying the asset allocations of their default DC pension funds, with a particular focus on increasing allocation to fixed income investments.

Over that period, the average allocation to developed equities has fallen from 79% to 71%, as allocation to UK and global equities has fallen from 33% to 29% and 46% to 42% respectively. This may in part be due to recent stagnant economic forecasts for the European and wider economies.

In a particular sign of diversification, the overall average asset allocation to fixed income has risen from 9% to 14% over the last six months. Inflation expectations have fallen internationally across the board and interest rates have fallen in a variety of currencies, which has boosted prices and capital returns for fixed income investments.

In a particular sign of diversification, the overall average asset allocation to fixed income has risen from 9% to 14% over the last six months. Inflation expectations have fallen internationally across the board and interest rates have fallen in a variety of currencies, which has boosted prices and capital returns for fixed income investments.

Over that time period, we have also increased the sample size of our analysis from 40 to 65 FTSE default DC pension funds.

The alternatives asset class, which includes allocations to investments including commodities and property, has increased by 1 percentage point over the last six months to 11%, a slightly slower increase than in the six months to October, but this is now 4 percentage points higher than in March 2013.

Individual scheme observations

Almost two-thirds of the default schemes analysed invest in fixed income (40 out of 65) with the average allocation to this asset increasing to 14% in March 2015 from 7% in March 2014.

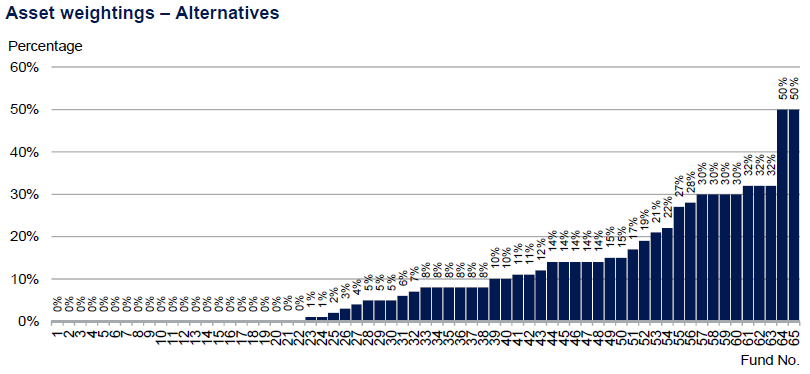

Over two-thirds of default schemes have an allocation to alternative investments (45 of the 65 schemes analysed) with a maximum allocation of 50%.

Of these schemes, 20% have an allocation of at least 20%, compared to 16% a year ago.

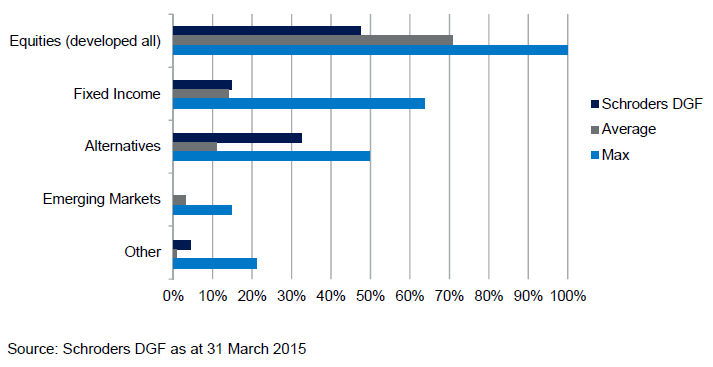

The Schroders Diversified Growth Fund (DGF) provides an example of how a scheme’s asset allocation can take a more balanced and diversified approach, seeking to maximise return and mitigate risk. Over the past six months the Schroders DGF has decreased allocation to developed equities from 53% to 48%, and has increased allocation to fixed income from 13% to 15%.

Methodology

In order to gather a snapshot of the UK DC default funds during the accumulation phase the FTSE 100 and FTSE 250 firms were asked to supply data. This was supplemented by publically available information for their employees taken from corporate websites. The DC default funds of 30 FTSE 100 and 35 FTSE 250 companies were analysed.

The subsequent data was then broken down into broad asset classes for analysis purposes. Information correct as at 22nd April 2015. Research undertaken by Instinctif Partners on behalf of Schroders.

For further information, please contact:

Estelle Bibby, Senior PR Manager, Schroders:

Tel: +44 (0)20 7658 3431

estelle.bibby@schroders.com

One Response to “Alternatives In UK DC Pension Schemes – Schroders’ Report”

Read below or add a comment...