From Merrill Corporation/DataSite.com

Introduction

The oil and gas sector has been a significant contributor to global M&A activity in 2015, despite a more than 60 percent decline in crude oil prices. Both strategic and financial buyers have been active in pursuing mergers and acquisitions (M&A). Oil and gas was the third most active sector in M&A for 2015, behind health care and technology.1 By the end of Q3 2015, the M&A market had seen $323 billion in announced or proposed oil and gas mergers, the most on record for a similar period by nearly $100 billion, according to Dealogic.

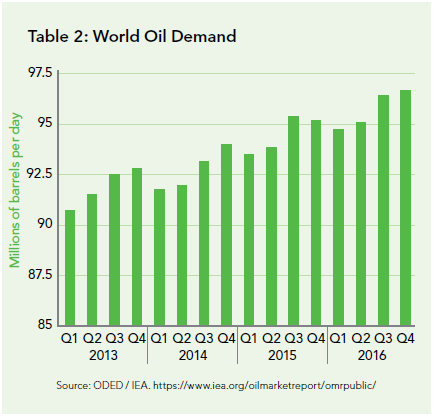

M&A activity is being driven by several factors. The sector is attractive to investors who view the oil and gas industry as a long-term investment based on a continuing increase in global oil consumption, which is growing at its fastest pace in five years. Demand is being bolstered in part by low oil prices and also by increasing consumption rates in Asia and other emerging economies.

The International Energy Agency (IEA) estimated in its 2015 World Energy Outlook report that global oil demand would grow by 1.6 million barrels a day in 2015, an upward revision of 200,000 barrels a day from its previous forecast, and would keep rising by 1.4 million barrels a day in the year ahead. While global attention to renewable energy resources is on the rise, it is still very likely that oil consumption will continue to increase for decades.

As the IEA also noted in its report, low oil prices stimulate oil use and diminish the case for efficiency investments and switching to alternative fuels, another factor impacting oil consumption rates in the near term and potentially long-term future.2

Another factor driving M&A activity is that lower oil prices translate into a buyer’s market and an opportunity for expansion at bargain prices as companies shed non-core assets to weather market conditions. As evidence of this, deal totals in the sector were buoyed by a handful of large transactions, including Royal Dutch Shell’s $70 billion acquisition of BG Group PLC, Schlumberger’s acquisition of Cameron International for $12.7 billion and Energy Transfer Equity’s acquisition of Williams Cos. for $32 billion.

“The big deals that we’ve seen have all had strategic merit, a consistent message from management, and synergies that justify paying a premium,” said Dan Ward, co-head of Deutsche Bank AG’s global natural resources group. “They’ve been done by large, best-in-class, well capitalized companies that can afford to be bold,” he added.3

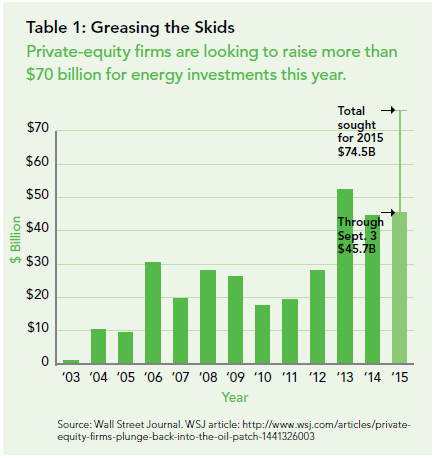

Private equity firms are also active in the  sector, both in terms of acquisitions and fundraising, despite the fact that the oil and gas sector has been a challenging investment for the past ten years. In the third quarter of 2015, financial investors inked 17 transactions in the sector, according to PwC, the highest number of deals in a third quarter in the past 10 years. According to Preqin, private equity firms have $115.6 billion available for energy deals. “Including the borrowed money they typically use to fund deals, their energy buying power stands at more than $300 billion, roughly equal to the stock market value of Exxon Mobile Corp,” said Ralph Eads, who heads energy banking at Jefferies Group, LLC.”4

sector, both in terms of acquisitions and fundraising, despite the fact that the oil and gas sector has been a challenging investment for the past ten years. In the third quarter of 2015, financial investors inked 17 transactions in the sector, according to PwC, the highest number of deals in a third quarter in the past 10 years. According to Preqin, private equity firms have $115.6 billion available for energy deals. “Including the borrowed money they typically use to fund deals, their energy buying power stands at more than $300 billion, roughly equal to the stock market value of Exxon Mobile Corp,” said Ralph Eads, who heads energy banking at Jefferies Group, LLC.”4

At the close of 2015, analysts predicted an increase in M&A activity as other sources of capital continue to shrink for oil and gas companies.

New Supply & Demand Model Changing Dynamics

This is neither the first nor likely to be the last time the companies in this sector have had to grapple with huge price swings. However, in many ways, oil and gas producers and financial supporters are in uncharted waters that are making it even more difficult to predict and plan for the future. New market conditions, such as emerging technologies, new oil field discoveries and new competition, will require companies to develop different strategies than those taken in the past.

Long-Term Rather Than Short-Term Pricing in Effect

All these factors are culminating in a new mindset for investors and financial markets – the premise that today’s low oil prices are a long-term rather than a short-term market condition. Taking this long-term view, financial lenders that may have been willing to “lend and extend” in response to a short-term price dip are now rethinking their commitments.

As the Financial Times noted in a 2015 Q3 article, “Banks use market information and teams of engineers to figure out how much an energy company’s reserves will be worth in six months’ time, and adjust the borrowing base accordingly. During the last round of determinations in March [2015], there was still some hope that oil prices might rebound quickly, therefore supporting reserve valuations. This time around there is far less optimism, so borrowing bases are expected to be cut more heavily.”5 Needless to say, faced with shrinking borrowing bases, oil and gas companies may have no choice but to sell off assets at lower valuations than desired.

Changing Supply Dynamics

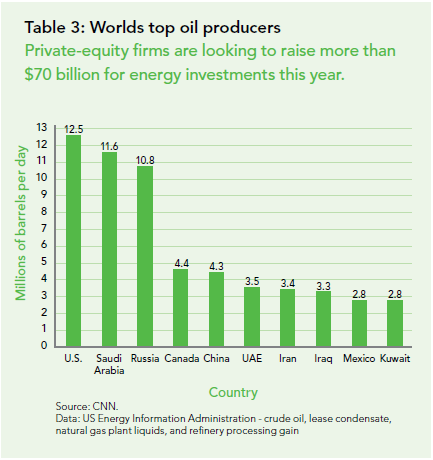

Advances in technology are also playing a huge role in transforming the oil and gas sector. New technologies for extraction have expanded existing reserves and uncovered vast reserves that were, a few short years ago, unheard of. As a result of this technology and recent geopolitical changes, countries including Russia, the United States, Iran and Iraq are all producing oil and gas products in addition to OPEC and changing the way supply, demand and prices are managed. “Traditional” production strategies, in which OPEC countries would agree to reduce output to balance supply and demand, are no longer being followed. At this point, there is no comprehensive agreement amongst all oil-producing countries to reduce production levels as a means to help oil prices rebound. As a result, the current production rates have resulted in a pile-up of supply.

Stockpiles of oil are at a record three billion barrels, according to the IEA. Demand growth has risen to a five-year high, but gains in demand have been outpaced by vigorous production from OPEC and resilient non-OPEC supply.6

With no unilateral agreement to reduce  production in sight, high reserves are likely to contribute to a long-term lower price for crude oil.

production in sight, high reserves are likely to contribute to a long-term lower price for crude oil.

Global Concern over Climate Change Solidifies

Environmental pressures are also playing a larger role in energy consumption policies than at any other point in history. A growing concern over global climate change may ultimately result in countries transitioning away from oil as a primary energy supply. At the Paris Climate Accord, nearly 200 countries committed to limiting climate change by reducing greenhouse gases, a move that will most likely have long-term impact on the demand for fossil fuels.

In the short term, at least, oil producers are not likely to see drastic changes brought about by the Climate Accord. According to Morgan Stanley analysts, most countries aren’t expected to take substantial actions until after 2020, which means that the short-term oil outlook is more likely to be driven by cyclical factors.7 In the long term, however, oil and gas companies may see the need to diversify and expand their renewable energy assets.

How is this “Brave New World” of Oil Production Affecting Overall Business?

All these factors taken together are resulting in new dynamics that are forcing oil and gas companies into new economic realities. With the steep decline of oil prices, many companies’ cash flows have slowed considerably and their asset values have been slashed, while their debt load remains the same. Faced with this financial imbalance, companies are exploring all their options. The focus for firms with weaker balance sheets is survival by whatever means possible, whether it involves selling off once-profitable operations that are no longer profitable, downsizing exploration initiatives, or finding other sources of capital.

As prices have continued to inch lower, these measures have not been sufficient, causing some firms to put themselves up for sale. For example, Petroceltic International, the London-listed oil and gas explorer whose shares dropped 77 per cent last year, has hoisted a for sale sign over the company as oil and gas prices remain weak.8 Bankruptcies are also expected to rise. Late in December 2015, the Federal Reserve Bank of Dallas reported that bankruptcies among oil and gas companies reached quarterly levels last seen in the Great Recession, and at least nine U.S. oil and gas companies that accounted for more than $2 billion in debt filed for bankruptcy in the fourth quarter.

Beyond mega deals, overall deal value has declined. As Deloitte noted in a recent report, “The data on the number and value of deals announced in the first eight months of this year (2015) show, somewhat surprisingly, a fairly modest level of new deal activity, particularly when the impact of one global-scale deal—the acquisition of BG by Shell—is excluded. In fact, if the two major oilfield services deals—the combination of Halliburton/Baker Hughes and Schlumberger/ Cameron—were also excluded, there would be a consistent downward trend in deal value since the second quarter of 2014, coincident with the decline in oil prices.”9

Deal volume has also declined. For example, at the end of the Q3 2015, there were 755 deals among gas and oil producers, compared to 1,200 at the end of Q3 2015.10 This is not surprising, as companies have tried to stave off selling in the belief that oil prices would rebound. The resulting disparity between buyers’ and sellers’ valuation expectations has prevented deals from taking place.

Looking forward into 2016, many experts predict an increase in M&A activity, driven by the increasingly tough financial positions many companies are now facing. As Doug Meier of PwC noted, “Depressed commodity prices, existing leverage constraints and deteriorating availability of debt and equity financing will encourage more companies to merge or sell off assets to strengthen their balance sheets.”11

Summary: Uncertainty and Opportunity

Despite the business challenges that oil producers face in reshaping their businesses, strategic and financial investors see opportunity ahead. The world, after all, will continue to rely on oil and gas for decades to come, and oil and gas producers will continue to invent ways to drive down exploration and production costs and adapt to dynamic market conditions.

For buyers with deep pockets and strong balance sheets, the current oil market represents an opportunity to acquire premium assets at attractive prices. For midsized companies seeking to grow, current market conditions may open up an opportunity to merge with another company as a means to capture cost synergies and increase market share. For others, current market conditions may represent a chance to more easily and cost-effectively expand into new geographies. Yet others may view the current market as an avenue to acquire new technologies at a lower price point.

The complexity and dynamic environment of today’s oil and gas market makes it even more critical for companies to fully understand all the implications inherent in a potential investment opportunity. Seizing the “right” opportunities and making smart investment decisions hinges on having the best information available.

Given the new dynamics in the market, all  of these opportunities require a new kind of strategic planning and due diligence on potential targets. Financial acquirers will need to be as “field savvy” about oil and gas targets as strategic acquirers in assessing the quality and location of a target’s assets, their management team and the cost and operational synergies they bring to the deal. In addition, companies need to anticipate factors, such as the emergence of new technologies that can force a fairly rapid change in market conditions and assumptions. For example, the volume of oil production in the U.S. has nearly doubled in the last ten years as a result of new extraction technology that has made its shale oil boom possible.

of these opportunities require a new kind of strategic planning and due diligence on potential targets. Financial acquirers will need to be as “field savvy” about oil and gas targets as strategic acquirers in assessing the quality and location of a target’s assets, their management team and the cost and operational synergies they bring to the deal. In addition, companies need to anticipate factors, such as the emergence of new technologies that can force a fairly rapid change in market conditions and assumptions. For example, the volume of oil production in the U.S. has nearly doubled in the last ten years as a result of new extraction technology that has made its shale oil boom possible.

Like the U.S., other countries may become top producers as technology continues to evolve and foreign buyers acquire U.S. companies and their technology.

Regulatory and political changes are also likely to impact the oil and gas market going forward. The U.S. government’s recent decision to lift its 40-year old ban on the export of crude oil is one example of a new dynamic that may very likely cause disruptions in the global market.

These are just a few of the new complexities facing today’s oil and gas companies and their investors. While success is never a guarantee, those who invest their time and resources to understand today’s market are best positioned to benefit in times of change.

1. Dana Mattioli and Dana Cimilluca, “Energy M&A Surges Despite Oil Slump,” Wall Street Journal, September 30, 2015.

2. “2015 World Energy Outlook,” International Energy Agency, 2015.

3. Mattioli and Cimilluca, “Energy M&A Surges Despite Oil Slump.”

4. Ryan Dezember, “Private Equity Firms Plunge Back into the Oil Patch,” Wall Street Journal, September 3, 2015.

5. Khadim Shubber, “U.S. Oil and Gas Battles Bank Lenders,” Financial Times, September 18, 2015.

6. “IEA: Oil Inventories Have Surged to Record Level,” Financial Times, November 13, 2015.

7. Sara Sjolin, “What the Paris Climate Deal Means for Oil Markets,” Marketwatch, December 14, 2015.

8. Richard Blackden, “Oil & Gas Explorer Petroceltic Puts Itself Up For Sale,” Financial Times, December 23, 2015.

9. “Deloitte Oil & Gas Mergers and Acquisitions Report – 2015 Update: Adjusting to the New Reality,” Deloitte Center for Energy Solutions, 2015.

10. Mattioli and Cimilluca, “Energy M&A Surges Despite Oil Slump.”

11. “Midstream Segment Boosts Third Quarter U.S. Oil & Gas Deal Activity, According to PwC US,” www.pwc.com, October 28, 2015.

About Merrill Corporation and DataSite

Merrill Corporation can support your due diligence projects and M&A transactions via the virtual data room DataSite. It can expedite due diligence for every type of private equity investment, joint venture partnership or conventional M&A deal.

A virtual data room (VDR) transforms the due diligence process by providing an exceptionally secure online repository, accessible via the Internet, for all data related to a specific venture. This provides a highly efficient method for sharing critical business information and examining the details involved in energy investments.

In addition, industry-leading VDRs offer yet another boon for due diligence participants in that they are able to easily accommodate the unusual documents that form part of the portfolio for oil and gas ventures, including out-size blueprints, 3D models and more. A VDR can also help potential partners more easily evaluate and structure areas of particular importance in oil and gas-related M&A activity, such as subsidiary formation, potential accounting and tax repercussions, regulatory issues, property and mineral rights. A VDR can help potential investors and sellers fully investigate and disclose all material facts that may impact a deal. Given that M&A and joint venture activity in the oil and gas sector typically includes large numbers of cross-border players, this centralised, online tool delivers information to interested parties 24/7/365, reducing the need for expensive travel and allowing a greater number of potential partners to evaluate the opportunity.

For more information about how Merrill Corporation can support your due diligence projects and M&A transactions, please email us at info@datasite.com or call us on +44 (0)20 3031 6300.

Related articles: