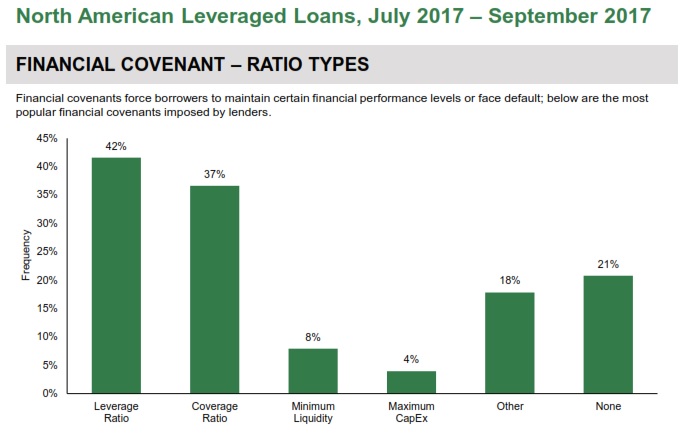

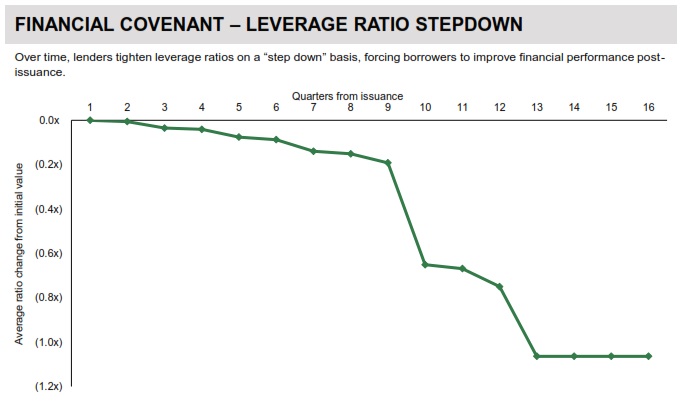

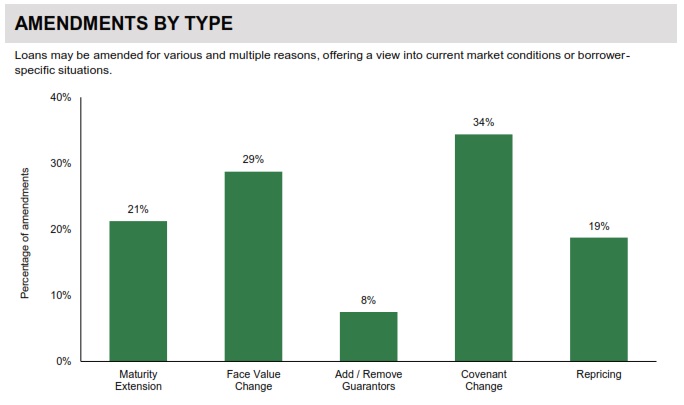

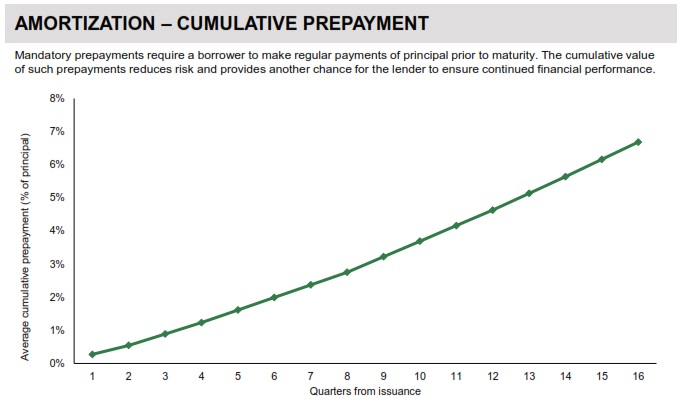

Street Diligence give the the recent trends in American leveraged loans including the requirement of lenders at issuance and how leverage ratios change over time for borrowers.

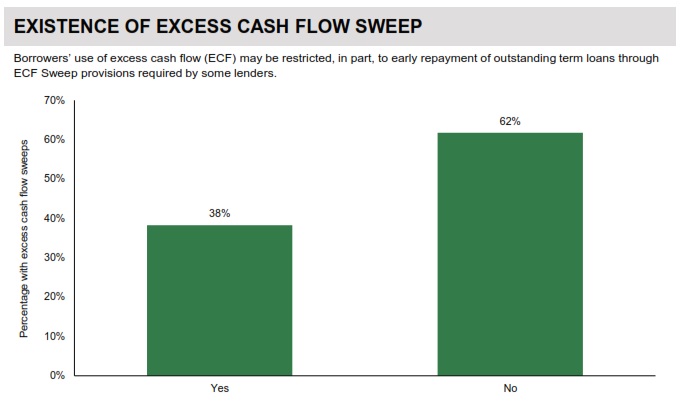

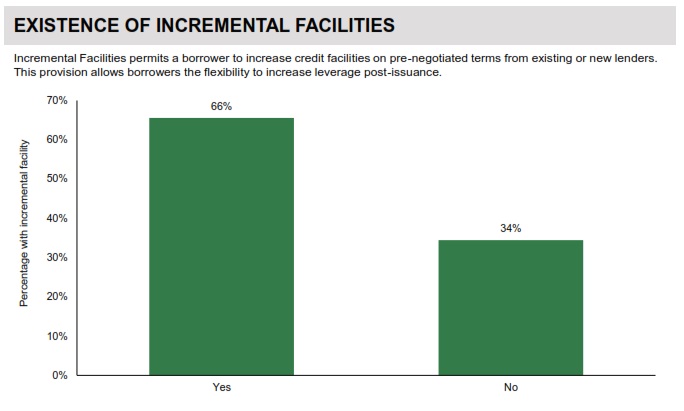

The charts reflect credit agreements and amendments filed on EDGAR by low-grade borrowers from July 1, 2017 to September 30, 2017.

About Street Diligence

Street Diligence’s analytics platform allows for the rapid evaluation and analysis of complex high yield bonds, bank loans and other related securities.

Street Diligence’s bank loan and high yield bond platform makes negotiating and analyzing credit agreements, indentures and their amendments much more effective. Coverage focuses on revolvers, term loans and corporate bonds in the U.S., and its system breaks down key covenant terms and conditions, allowing the investment professional to digest and negotiate them more effectively.

Street Diligence was founded in 2012 by former hedge fund portfolio managers and analysts to identify and negotiate away off-market terms, in addition to taking the frustration and tedium out of due diligence. The company is headquartered in New York, with offices in Boston. NY: 212.343.1934 MA: 617.721.9433 sales@streetdiligence.com