By Hedge Fund Insight staff

One of the public services Hedge Fund Insight provides is mastication: HFI will chew over a major piece of work to give you the highlights. Each year Ernst & Young publish a Global Hedge Fund & Investor Survey*. As usual there were some interesting and surprising results in the sixty-odd pages. Here is what took the eye of HFI on reading the 2015 Survey.

*Survey methodology

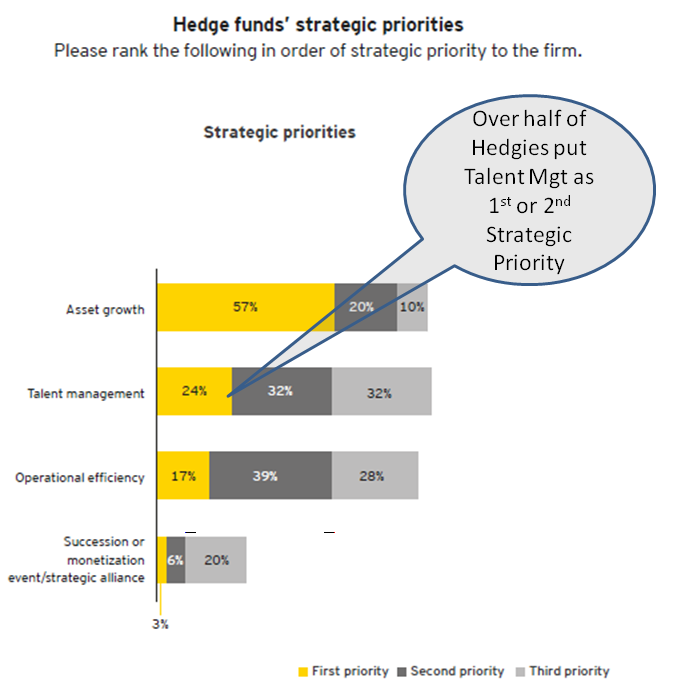

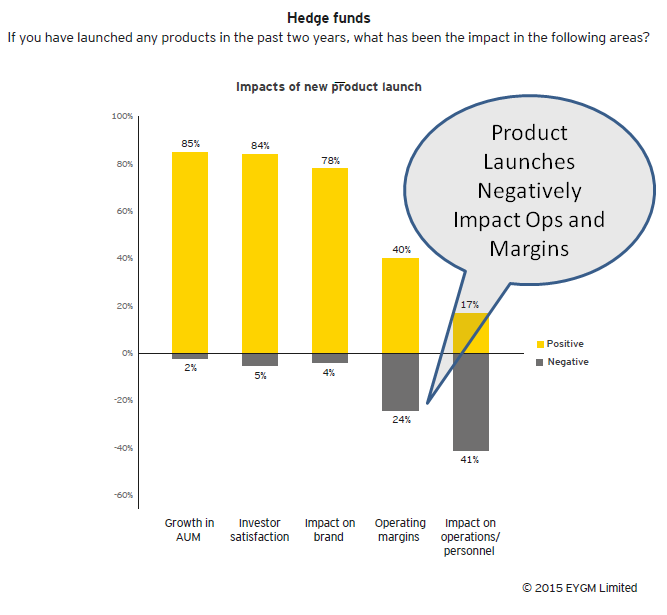

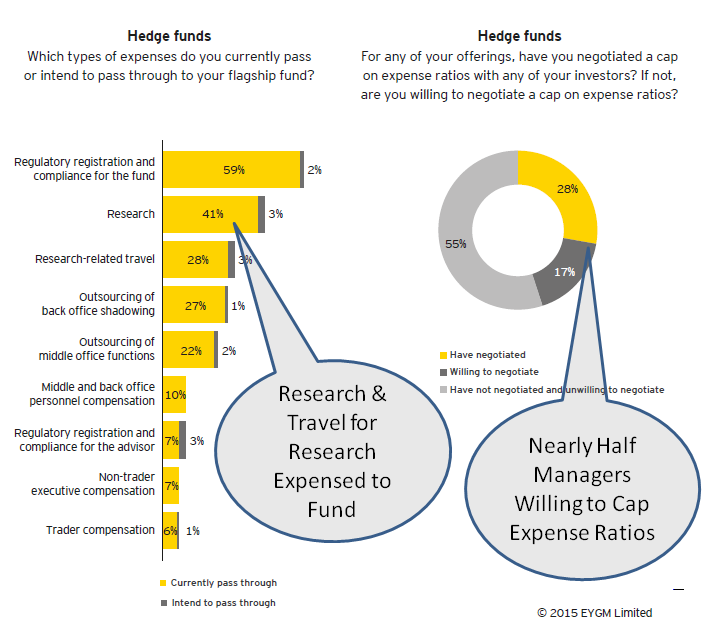

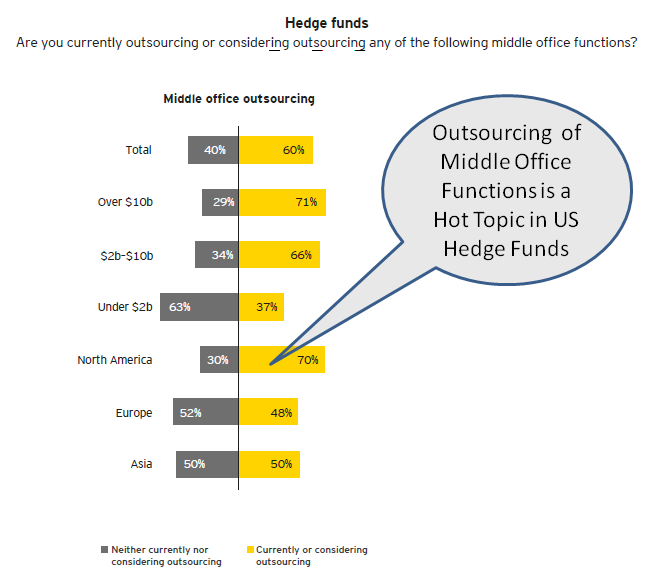

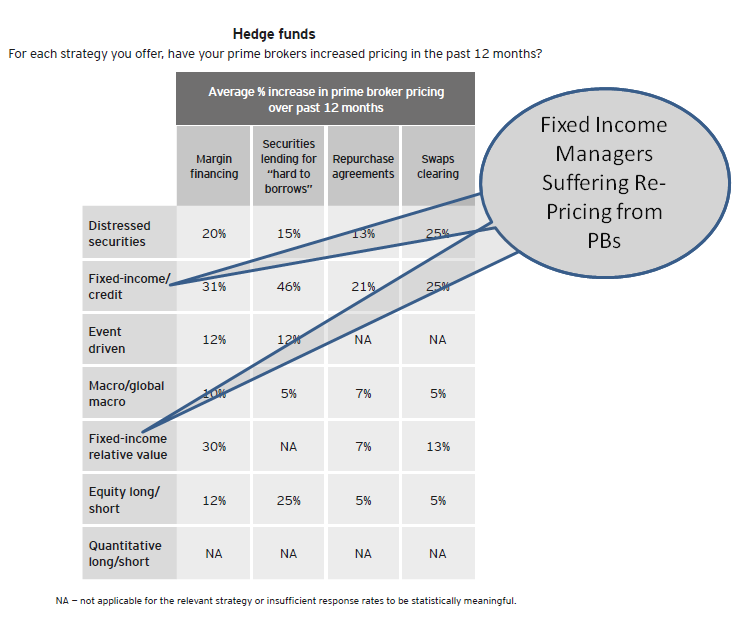

The purpose of this study is to record the views and opinions of hedge fund managers and investors globally. Topics include managers’ strategies to achieve growth, investor demand, changes in the prime brokerage relationship, middle office outsourcing, technology investments and the future landscape of the hedge fund industry.

From June to September 2015, Greenwich Associates conducted:

• 109 telephone interviews with hedge funds representing just over $1.4 trillion in assets under management

• 57 telephone interviews with institutional investors (fund of funds, pension funds, endowments and foundations) representing nearly $1.83 trillion in assets, with roughly $413 billion allocated to alternative investments

One Response to “Talent, PB Fees, and Middle Office Outsourcing Highlighted in E&Y HF Survey”

Read below or add a comment...