From Hedge Fund Insight staff

A bumper year for hedge funds in 2020, the on-going Coronavirus crisis, and the impact this is having on commercial aviation, is likely to result in a huge increase in interest from hedge funds looking to buy or lease their own jets.

Hedge Funds and their managers have been traditionally very active owners and users of private aircraft. It is believed that the global pandemic will increase this trend, as hedge funds will want to protect their star managers from catching COVID-19, and there are as many as 680 fewer person-to-person interactions when flying by private jet compared to commercial travel (source: GlobeAir analysis March 2020).

Oliver Stone, Managing Director, Colibri Aircraft, the private jet broker said: “Hedge funds had a really strong year in 2020. The world’s 20 best performing hedge funds earned $63.5 billion for clients last year, which was a record for the last decade(1). This, coupled with changes in the commercial aviation sector and the fear of catching COVID-19 whilst flying with such airlines, will increase demand for private jets when restrictions around international travel are lifted.”

He continued, “Airlines have also cancelled thousands of routes as a result of the Coronavirus, making it harder or impossible for hedge fund managers to reach certain destinations, and the time spent to board a commercial flight could increase dramatically as new health measures are introduced at airports and by airlines – a costly experience for business travellers.”

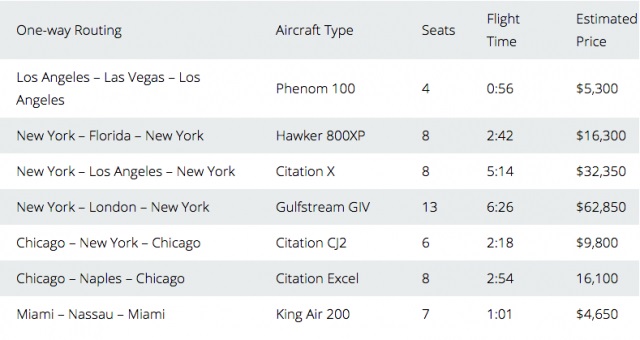

Costs of Private Jets*

source: Stratosjets (2017 prices) *These are popular routes and prices vary with how advanced the booking

Analysis of industry data by Colibri Aircraft reveals that the number of private aviation flights in Q4 of last year was only down 16% in the US when compared to the same period in 2019, and the corresponding figure for Europe was a fall of 21%. For commercial flights, there were 63% fewer in the US during Q4, and a fall of 82% in Europe.

(1) source LCH Investments

For any hedge funds looking to buy their first business aircraft, Colibri Aircraft has developed a free guide, which can be downloaded here. https://www.colibriaircraft.com/first-time-buyers-guide/

About Colibri Aircraft Ltd

Colibri Aircraft Ltd specialises in the marketing, resale and purchase of pre-owned private aircraft around the world. It was launched in 2011. It offers the following specific services for clients:

- For sellers – marketing and resale, 2. For buyers – acquisition, 3. For owners – aircraft counsel, 4. For lenders – asset consultation.