By Hedge Fund Insight staff

Japanese institutional investors have longer experience investing in hedge funds than institutions in other regions of the world. In addition absolute return strategies have had significant allocations from Japanese investors for a long period – the Japanese economy has suffered from low interest rates and bond yields for a lot longer than the rest of the world. The latest survey of Japanese investors commissioned by AIMA (Japan)* shows that over 32% of assets are in hedge funds, with just under a quarter of that exposure in funds of hedge funds, and just over three-quarters of the exposure in single manager hedge fund investments.

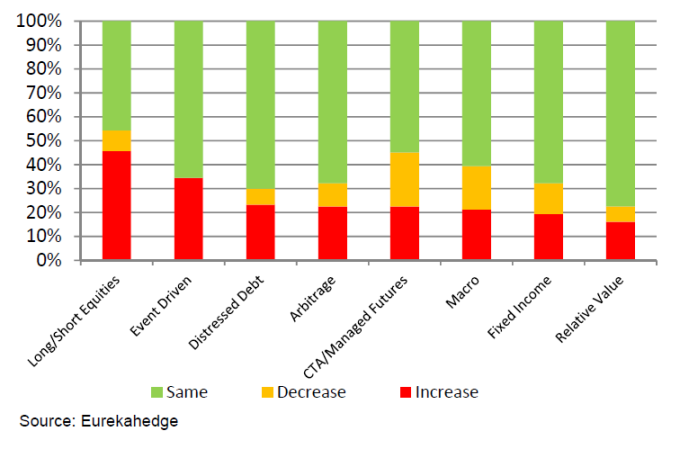

Respondents were asked which strategies they are interested in allocating to in 2014. The responses have been collated in the graphic below.

Expectations of Strategy Allocation Change in 2014 of Japanese Investors

The most positive response came for the equity long/short strategy. 45% of the Japanese investors surveyed expected to increase their exposure to the strategy. So with 8% expecting to reduce their allocations, a net 37% of investors expected to increase their exposure to equity long/short.

Event driven strategies had the second most positive response with none of the Japanese investors surveyed expecting to decrease their allocations to event driven funds, and 34% of them expected to increase allocations.

The hedge fund strategies to which Japanese invests had the least positive expectations of capital allocations were managed futures and macro.

Only in the last strategy, global macro, are the respondents in this survey showing different attitudes to investors elsewhere, as expressed in surveys.

*The survey was conducted by Eurekahedge from end of March to April 2014 to gauge insights into market sentiment, investment trends and key regulatory challenges facing the Asian asset management industry, with a particular emphasis on the outlook for Japan. The survey is based on responses submitted by a total of 131 survey participants. As for the investment advisors who participated in the Survey, they are collectively advising and/or managing assets in excess of US$3.8 trillion.