By Hedge Fund Insight staff

The composition of the hedge fund industry is always changing at the margin through two causes – subscriptions and redemptions and investment performance. Seeing the occasional snapshot, a moment in time, does not reflect the trends, the change. Recent data from Eurekahedge showed a trend that has been little reported – that investing in non-core geographic mandates has become an increasingly peripheral activity.

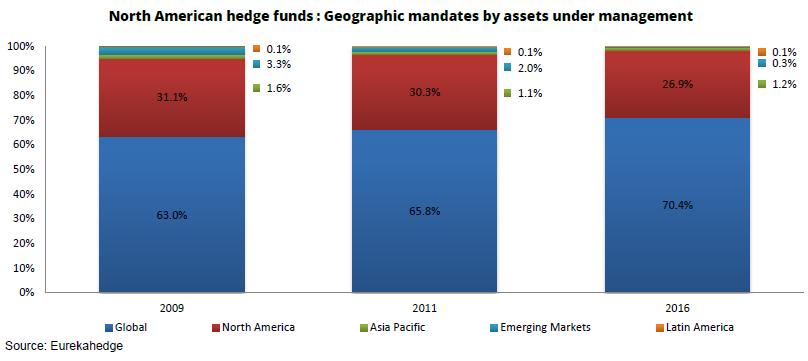

In the graphic above the split of geographic mandates of North American hedge funds are shown at three points in time.Unsurprisingly the largest proportion of hedge funds based in America run either a global investment mandate or a North American investment mandate. Investors tend to invest in globally-mandated hedge funds as core hedge fund holdings, and so they are the largest constituent with a share of 70.4% in September 2016.

Even in the home of the hedge fund, the proportion of AUM dedicated to the world’s largest stock market and deepest bond market has shrunk. Increasingly hedge fund assets run by North American managers are run on a global basis.

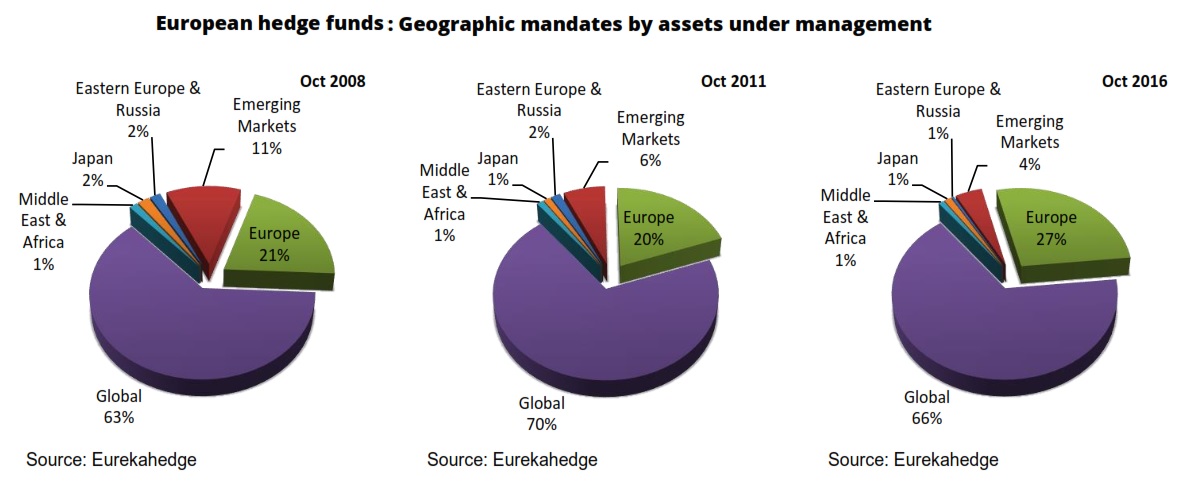

Our second graphic below, reflecting the European hedge fund industry, tells a slightly different story. The majority (by assets) of funds managed from Europe are invested globally, but the distinctive, the local flavour (European invested hedge funds) have increased as a proportion of the European hedge fund industry’s assets in the last eight years.

What is common to the two largest regions of the global hedge fund industry – and North American- and European-based hedge funds account for 89.96% of the industry’s assets – is that the core investment mandates are increasingly dominant. The other geographic mandates – Emerging Markets, Asian, Latin American, Russian and Eastern European and Japanese funds – have all shrunk relative to the rest of the industry.

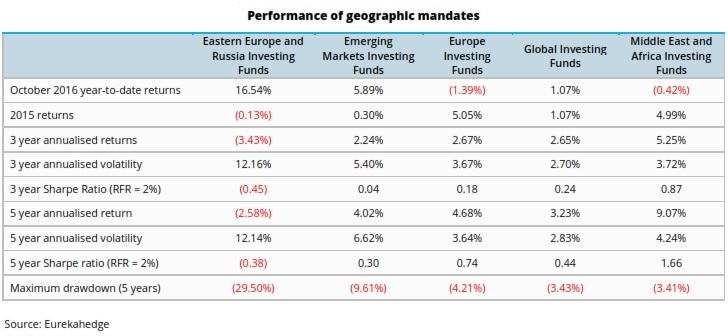

There are multiple reasons for investors to subscribe to specific funds or types of hedge funds, but there are fewer reasons for redemptions. They tend to be dominated by the characteristics of the return series, though there are a few others. Here are the three and five year returns of hedge funds of various geographic mandates:

Absolute return, return relative to underlying markets, correlation of return to benchmark index of investor (usually the S&P500 or a composite pf stocks and bonds), pattern of return, consistency of return, cyclicality of return, frequency of losses, size of worst monthly loss, drawdown, and recovery of losses are all taken into account in assessing how hedge funds have done. Having given a variety of measures to assess how a hedge fund has done, the table above gives only the returns, volatility and maximum drawdown outcomes for various geographic mandates of hedge funds. But it is difficult to conclude anything other than investors in hedge funds have been logical in backing hedge funds who invest outside the biggest global regions or outside those that invest globally less and less over the medium term.