By Simon Kerr, Hedge Fund Insight

I recently received a commentary from the manager of a junior gold miners funds.

He has written: “We believe that the loss of value witnessed in small and mid cap producers is due to lack of investor interest in smaller gold mining shares, and concerns that they cannot prosper in the current environment. Selling has been indiscriminate, ignoring companies’ ability to generate profits with gold prices at current levels. While it is true that many undercapitalised explorers and promoters of marginal assets may disappear in the current malaise, we remain confident in the fundamental strength of our gold mining investments and, therefore, in their recovery potential.”

There are two massive shortcomings in this argument – time scale and directionality.

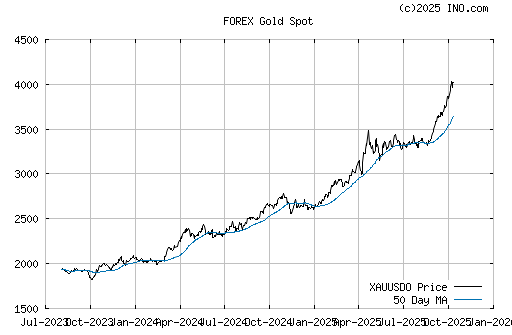

Firstly on the price of the yellow metal itself. A traded commodity which has exhibited price action like the one in this graphic below do not recover quickly to previous highs. There is now enormous overhead resistance around $1550.

In order to work off the psychological effect on the traded market of the fall out of a multi-year trading range the commodity has to spend TIME building a base in a new (lower) range. A trading tool not used enough is a diary. You can put a note in your Outlook calendar or Filofax to come back in 9 months to a year to this commodity before you need to take a view on its upside potential beyond $1550. That means there is no hurry to take a long-only view now.

This does not mean that the barbaric relic is uninteresting for taking views on, but they should be non-directional views.

A decent trader will calculate the scope for the dead-cat-bounce rally using their favourite price and momentum tools, and use the top of the new perceived trading range to put on over-writing strategies. A trader could go short outright, but the newly-exhibited volatility of the commodity will put the advantage in selling rich option premium. When the gold price conducts a re-test of the recent floor over the next few months there will be a good opportunity to sell put options – the traded volatility will be much lower than currently but the probability of being right will be much higher after a re-test. The result will be a trading range strategy that benefits from the passage of time (unlike an outright directional long at this point).

My second point of issue with the manager of a junior gold miners funds relates to his point that a commodity price fall, as has been seen recently in gold, will beat up mining shares indiscriminantly. The opportunity created in the equity markets by sellers taking all related counters down whatever their quality is a relative performance one, not an absolute one.

Now is a great opportunity to put on baskets of mining shares long and short, or pairs of miners long and short because there has been a visceral de-risking in the equity markets for gold miners. Whilst the commodity price may not be a great hindrance from here (looking out a year) it will not be a great help either, as it establishes a new price range. Now is a chance for a long-only manager to improve the quality of his gold related holdings, but the bigger opportunity to extract purer alpha is to put on relative performance positions. A hedge fund manager with good knowledge of the sector (Passport Capital or Baker Steel) will be able to gross up in the gold miners sector, take little more net risk and has the chance to deliver positive returns from relative performance.

Jimmy Rogers was recorded as saying in “Market Wizards” “Be aware of change. Buy change.” The gross changes in prices of gold mining shares are an opportunity, but because of the limited scale of potential directional commodity price movement the opportunity is best seized by very nippy directional traders, or those versed in taking relative performance bets. Both are more commonly found in hedge funds than in long-only management businesses.