From Northern Trust Hedge Fund Services

In the wake of the 2008-2009 global financial crisis, governments around the world raced to put regulations in place to protect investors and reduce the likelihood of a future crisis. The result was a flood of new regulation on a scale not seen since the Great Depression and the New Deal. These regulations typically fell into two camps: they either changed market practices to limit what market participants can do, or they demanded more disclosure as a means of managing systemic risk. As a result, popular consensus holds that investors universally favor regulation while fund managers uniformly oppose it.

Dig a little deeper, however, and you will discover a far more nuanced and complex picture. We did just that in our survey of hedge fund managers and investors.

MANAGERS AND INVESTORS HAVE SURPRISINGLY SIMILAR VIEWS ON REGULATION

In late 2014, we surveyed both hedge fund managers and investors to learn more about their views and outlook on the industry. In doing so, we discovered that when it comes to regulation, both groups shared very similar views on the effectiveness of recent regulations.

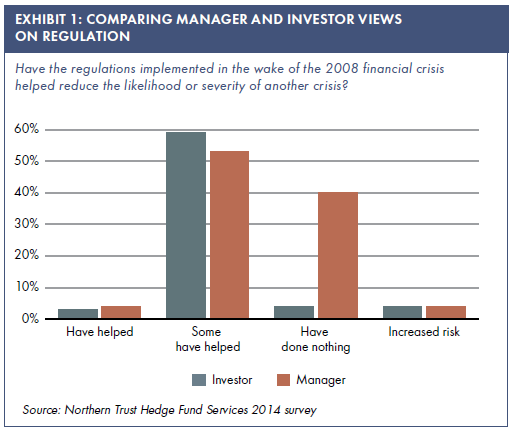

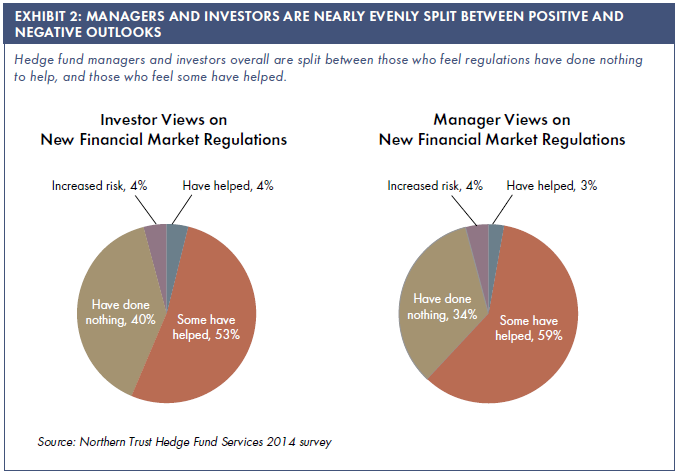

The survey revealed that managers felt more positive about the effectiveness of the regulations passed in the last five years than investors did. While very few respondents from either group felt the regulations were overwhelmingly beneficial (3% of managers and 4% of investors), the majority felt that some of the recent regulations have helped decrease the likelihood and severity of another financial crisis.

In our survey, 59% of the managers felt that some of the regulations passed in the last five years have helped to decrease the likelihood and severity of another financial crisis, while others have not – hardly a picture of a uniform opposition. Conversely, only 53% of investors indicated those same feelings, while a larger percentage (40% vs. 34% for managers) stated that new regulations have done nothing to reduce the likelihood and severity of a future crisis.

So the hedge fund managers who participated in our survey were slightly more optimistic about the effectiveness of the new regulations than investors were. Even those managers who feel the regulations have been generally effective had a more nuanced view. As the chief operating officer (COO) of one fund manager in the United States said, “In light of regulations such as Basel III and the resulting deleveraging of banks in the United States and Europe, the likelihood of another financial crisis in either region seems highly unlikely.” But the COO went on to say, “Other parts of the world like China concern me as there is little transparency, but significant potential downstream impact if a crisis were to occur, as we saw late this summer when China’s stock market plunged, impacting global markets as a result.”

An EMEA-based market neutral manager shared this insight. “I think some regulation has decreased the likelihood or severity of another crisis. The greater scrutiny paid to U.S. and European futures margins is beneficial, and the EU Banking Resolution Directive should help prevent another Lehman-style insolvency process in Europe. And while Basel III has its critics, it does solve some of the problems with Basel II and probably will make banks more resilient.

“But I don’t believe the rest of the huge volume of regulation will change a thing in the next crisis. The regulation has been aimed at the perceived causes of the LAST financial crisis, where that perception was a politically convenient one. Nobody knows what will cause the next financial crisis, and history tells us that it will be a surprise foreseen by only a few lone voices.”

The responses show both that no real line of demarcation exists between investors and managers in their views on regulation, and that they have a nuanced and diverse range of opinions.

NOT ALL REGULATIONS ARE CREATED EQUAL

Regulations vary widely both in terms of whom they affect and how they were implemented. These differences also have an impact on how market participants on both sides view them. Some are seen as offering benefits to managers and investors alike, and are more universally viewed with favour. Others are complex and seem to provide little direct benefit to either managers or investors.

We have found that most fund managers we work with favour electronic execution and central clearing for over-the-counter (OTC) derivatives. These regulations, implemented as part of Dodd-Frank in the United States and through European Market Infrastructure Regulation (EMIR) in Europe, were designed to add stability to the derivatives markets, and to increase transparency. These regulations have made the process more efficient, which benefits everyone.

We have found that most fund managers we work with favour electronic execution and central clearing for over-the-counter (OTC) derivatives. These regulations, implemented as part of Dodd-Frank in the United States and through European Market Infrastructure Regulation (EMIR) in Europe, were designed to add stability to the derivatives markets, and to increase transparency. These regulations have made the process more efficient, which benefits everyone.

Where we see less favorable opinions is where multiple regulators are trying to regulate the same activity. A U.S.-based distressed credit manager explained, “One of the challenges with the regulatory reporting requirements imposed by different regulators is the inconsistency across reports, each of which requires detailed information. Coordination among regulators to harmonize definitions, formats and reporting schedules could lighten the reporting burden.”

The central repository requirements for derivatives are an example. In this case, regulators are taking the markets’ most complex and sophisticated instruments and attempting to monitor their activity piecemeal. Each country or jurisdiction has its own rules and procedures, which makes compliance extremely complex, while also working against the goal of having a clearer picture of systemic risk.

Because of the complexity, most fund managers are forced to outsource their central repository processes. These rules also effectively raise the barriers to entry, making it much more difficult for smaller – potentially more innovative – players to get started. While the rules are intended to limit risky practices, they can also dampen potential innovation.

In some cases, the lack of global consistency in regulation and reporting has become a self-sorting process. For instance, anyone who markets an alternative investment fund in the European Union falls under the Alternative Investment Fund Manager Directive (AIMFD) regime. So while a global trigger defines what triggers the Directive, each of the 27 countries implements the rules differently. Each has different timelines and approval and comment processes. Some countries have made it simpler and have worked out the rules more quickly. Others are lagging in implementation or their requirements are unclear, so managers either aren’t marketing their funds in those countries or are doing so without clear guidelines.

REDUCING THE EFFORT OF MEETING REQUIREMENTS

The regulatory environment shows no sign of slowing the pace of change, and while both investors and managers work to keep up, there are some positive signs on the horizon. Regulators seem to be acknowledging the benefits of taking a more coordinated approach to global requirements, which could minimize some of the frustration for managers operating in multiple jurisdictions. In the meantime, service providers continue to work to find ways to make meeting the regulatory requirements and collecting the required data easier for the managers they work with.

LEARN MORE

If you would like to learn more about how Northern Trust Hedge Fund Services can help you better meet the regulatory requirements your fund faces, e-mail us at hfs_info@ntrs.com, or contact your Northern Trust representative.