By Hedge Fund Insight staff

One of the best surveys in the hedge fund industry comes from the consultant Aksia. The 2015 survey, conducted during November and early December of 2014, includes responses from 187 managers representing over $1 trillion in hedge fund assets under management. What makes it particularly worth reading is that the questions posed vary each year to take account of the areas of interest and concern at the time the survey is conducted.

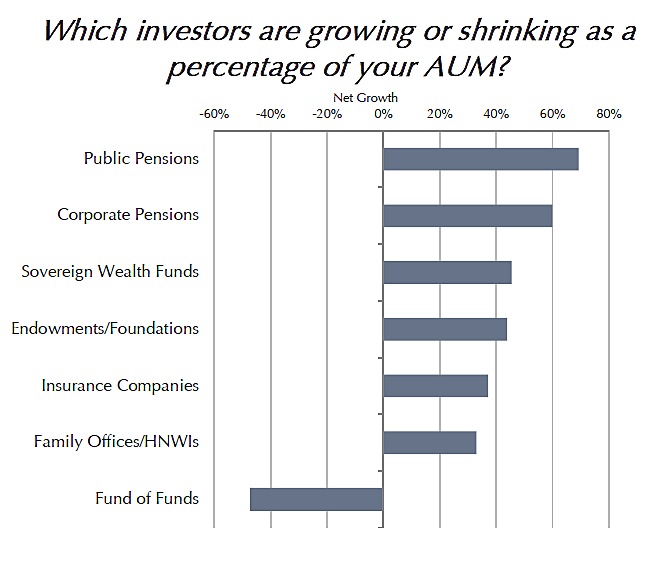

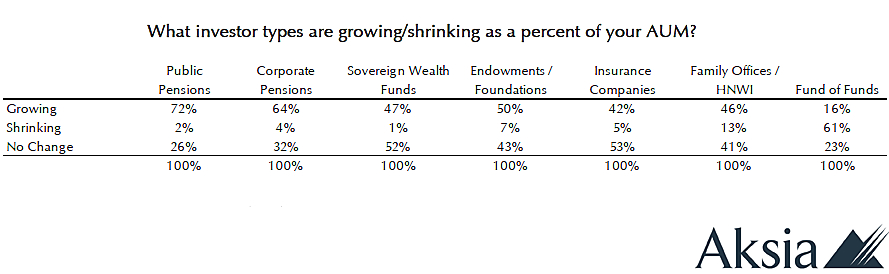

The 2015 survey asked about the dynamics of the assets coming from different investor types.

The underlying data responses are shown in the Table below.

The underlying data responses are shown in the Table below.

Parenthetically, Asia-focused managers report the least growth from public pensions, with 40% reporting growth and 13% saying public pension investment was shrinking.

Parenthetically, Asia-focused managers report the least growth from public pensions, with 40% reporting growth and 13% saying public pension investment was shrinking.

Aksia Related Articles:

Elevated Expectations of Hedge Fund Advertising Come Down To Earth(Jan 2014)

The Hedge Fund Hot 100 2013(Feb 2013)

One Response to “Pension Plans Increase Proportion of Hedge Fund Assets They Hold”

Read below or add a comment...