By Thomas F. Kirchner, Portfolio Manager, and Paul Hoffmeister, Portfolio Strategist of Quaker Funds, Inc.

The market environment for event driven strategies

The market environment for event driven strategies

Credit conditions remain highly favorable for corporations to execute and complete corporate transactions.

We expect the current environment, the result of two years of relative macroeconomic calm, to continue during the near-term. Hostilities in Ukraine are being contained; risks to China’s banking sector remain subdued; and emerging market risks are normalizing.

Of course, macroeconomic uncertainty always exists. We are particularly mindful of changes to U.S. monetary policy, which could create some overall risk aversion if a more hawkish interest rate outlook develops. Additionally, Argentina’s failure to make payments on bonds may raise investor wariness towards sovereign risk and/or emerging economies. We view both risks as transitory in nature.

We continue to have a positive view of the risk-taking environment and opportunity sets within the event-driven asset class. Consequently, the Fund is maintaining its meaningful exposures to activist and special situations, as well as distressed investments, and its limited exposure to classic merger arbitrage.

Outlook for event and arbitrage strategies

While several corporate mergers motivated by tax strategies made headlines, overall M&A activity has been driven by a variety of strategic objectives. Nevertheless, classic merger arbitrage spreads remain driven by low interest rates and, as a result, are unattractive. In contrast, event-driven merger arbitrage opportunities with more attractive risk/return profiles provide better investment candidates for the Fund. Overall, merger activity by volume this year has reached a post-crisis high, although we doubt that this will translate into an increase in classic merger arb spreads due to the current low interest rate environment.

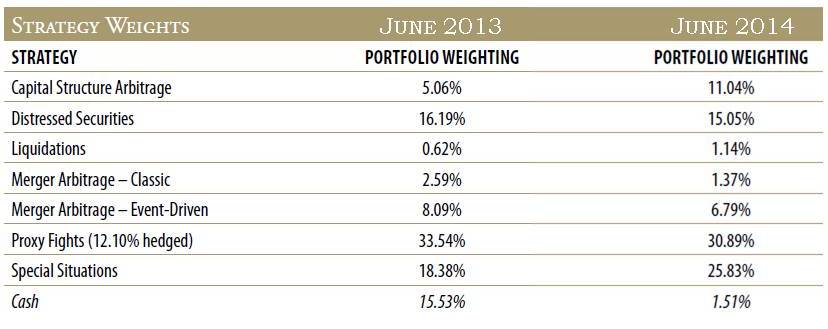

STRATEGY WEIGHTINGS OF THE QUAKER EVENT ARBITRAGE FUND

A new era of activism?

Activist situations remain our favorite strategy. Activists remain successful in their engagements with target companies. In a new development this year, one activist investor has teamed up with a large strategic buyer to agitate for the sale of a company. While some observers view this as the beginning of a new era of activism, it remains to be seen whether this is a unique situation. We continue to find supply of new distressed corporate investments with attractive risk/return profiles. In particular, the financial sector in Europe continues to provide attractive distressed opportunities.

The investment process currently leads our team to overweight activist situations, seek out opportunities in distressed investments and put little emphasis on classic merger arbitrage. As always, weightings are a function of the opportunities available in the various sub-strategies and events, as well as the overall macroeconomic assessment.