From Eurekahedge/Hedge Fund Insight staff

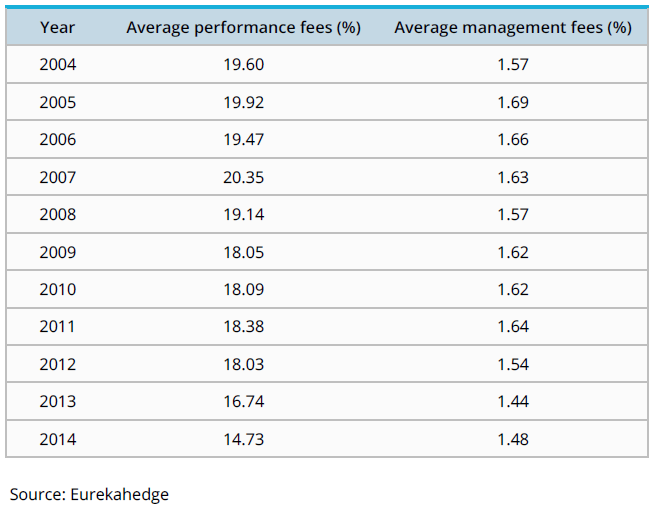

Table 1 details the average performance and management fees charged by North American hedge funds based on their year of inception and serves to give an idea of how the fee structure for hedge funds has evolved over the last 10 years. Historically hedge fund performance fees have remained above 19%, but in the aftermath of the global financial crisis these have come down. Although hedge funds outperformed underlying markets in 2008, the majority of managers posted significant losses and as a consequence their fee structure came under serious scrutiny as they were considered too costly (and illiquid) in comparison to other investment vehicles.

Table 1: Average North American Hedge Fund Fees by Launch Year

Another trend that has put downward pressure on fees has been the preference among large institutional investors to allocate to the larger hedge funds in comparison to their smaller sized peers. As a result, newly launched hedge funds with a small AUM base have lowered their fees in order to attract investors and secure more funding, which is imperative to cover the increasing administrative and regulatory expenses and ensure a fund’s survival in the long run.

Thirdly launching a hedge fund is a competitive business, and new funds compete with each other to attract capital. The number of launches has an impact on the average level of fees that can be charged. It is particularly competitive for long/short equity hedge funds in North America. Since 2008 there have been 1260 launches of long/short equity funds, of which 238 came in the last year.

The fee levels given in Table 1 are as reported to a database. The actual fees paid by investors will often be at a discount to this rack-rate. So the reported fees can be though of as a ceiling for the actual rates paid.