Around three-quarters of the capital in the European hedge fund industry is managed out of London. So looking at the health of the British hedge fund industry effectively reflects the European industry, even taking account of leakage to Switzerland at the margin.

Corporate finance firm Imas Corporate Advisors has done some good work in tracking the investment professionals at hedge fund firms that are registered as Approved Persons with the FSA. Most senior and middle tier staff fall into that category, and it includes everyone that takes investment decisions and those with responsibilities for the direction of the individual firms.

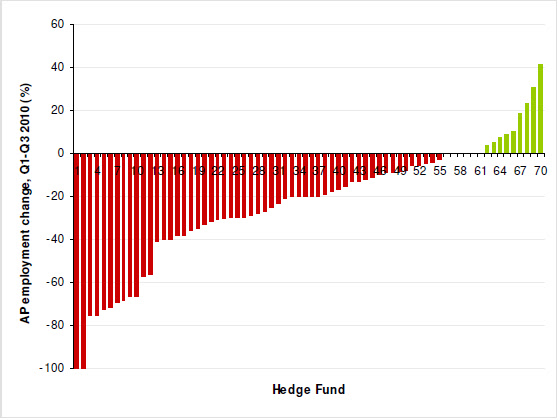

The analysis done by Imas focused on middle-sized and large hedge fund management companies – all those with 10 or more Approved Persons on their staff, amounting to 70 firms. These top firms by size account for the majority of hedge fund assets under advisement in London, as the industry is fairly concentrated.

The result of this collation is given in graphic 1 below:

Graphic 1: Approved Person Employment Change, Q1-Q3 2010, in Larger Hedge Funds

source: IMAS Corporate Advisors/Financial Service Authority

So of the 70 largest firms, nine increased their staff during the first nine months of 2010, six held their investment staff at the same level and 55 firms reduced their staff numbers. Totting all the numbers up gives a decline in aggregate from 1288 to 989 in the year-to-date period covered – not much of surprise given the migration of staff at BlueCrest and Brevan Howard and the like to the Continent.

The second point to arise out of this part of the research carried out by Imas is that nearly half the top tier of hedge fund management companies in the UK are owned by foreign entities. Given the way that some of the very top tier of global managers downsized in 2008-9, it won’t be a surprise that the firms owned by foreign entities and nationals cut investment staff numbers slightly more than their UK counterparts.

The second area examined in the research was regulated company formations. From Graphic 2 it can be seen that the recent low point for hedge fund management company registrations with the FSA was a year ago – the hedge fund industry bottoming just before other financial sectors on this analysis of growth from the bottom up.

Graphic2: Quarterly FSA Firm Authorisations by Sector (2009-2010)

source: IMAS Corporate Advisors/Financial Service Authority

Since then there has been a run rate of around 19 new hedge fund management companies a quarter being approved for registration with the FSA, until the last quarter. The third quarter of 2010 showed a pronounced increase in the number of new hedge fund management companies being approved by the FSA. This looks to be a conseqence of the Volcker Rule, whereby banks must separate own-book risk taking from other activities, whether within the hedge fund format or proprietary capital. The second driver of hedge fund formations in London is the ongoing second-generation effect, as staff spin out of the orbit of brand name hedge fund companies to strike out on their own. Between them these two categories account for 22 of the 28 hedge fund management companies approved by the FSA in the 3Q.

Net net hedge fund employment at the level of Approved Persons in the UK is down on the year to date, through September. Most of the hedge fund jobs lost to Continental Europe will not return to the UK in short order because the tax disincentives look like they will remain in place for some years. In addition the strategic thrust of the global hedge fund management companies is expansion into Asia ahead of a return to Europe. That written, single manager hedge fund assets across the whole of the hedge fund industry are near record levels, and more funds of funds are expected to receive net positive capital flows after the year-end re-shuffling of portfolios of hedge funds. So shortly the nadir will have been passed for most of the industry by assets, if not by number of funds, as the long tail of the industry lingers on.