From Hedge Fund Insight staff and Surveygoo.com

The staff of Hedge Fund Insight have taken the view that just publishing the info-graphic below without some context would leave too many readers baffled as to the relevance. There will be readers that do not get the significance of market research for hedge funds. In an era when it is increasingly difficult to get an information edge, many hedge funds have turned to commissioning their own research. This can take a variety of forms.

The most obvious example across all hedge fund strategies is the use of expert networks. Expert networks may corroborate or disprove an emerging investment thesis, or simply be used for bottom up channel-checking information.

A very common input to large hedge fund firms is a Washington political advisor or lobbyist. Changes to spending plans, tax raising, and new legislation and regulations will impact specific industries, and, as we see with the debt ceiling deadline periodically, will impact at the macro-economic and market level periodically. Political decision-making and the probabilities attached to outcomes are very hard for non-specialists to call. So a good insight on the goings on in the Beltway can be a valuable resource.

A similar benefit can be derived from the use of dedicated Fed watchers. The investment banks and brokerages, and boutique economist firms will employ macro-economists that will have a view on what Fed action should be. Some are good at interpreting the Fed., some not so adept. Bloomberg surveys and short term Fed Funds futures give market consensus and implied views respectively on where rates are going. But Fed watching is a subtle business, and some former Fed staffers with their own consultancies (and several journalists) seem to be better than most at interpreting what changes in attitude are reflected in the tone of commentary, both official and unofficial, that comes from the Governors of the regional Federal Reserve Banks. The movements in mindset of officials are what will move markets ahead of policy setting meetings and policy announcements.

Sometimes a hedge fund firm will co-opt external consultancies and leading academics for specific projects or as a component of the on-going research effort. For example Tudor Investment Corporation has used modelling and forecasting firm Macroeconomic Advisers LLC to run scenarios on the consequences for growth and unemployment of different policy approaches.

Market research at hedge funds can be an internal resource, run by staff members, or an external resource, whereby hedge fund managers ask dedicated market research firms to conduct research on their behalf. A prominent example of the former is Nicolai Tangen’s AKO Capital. The $10bn firm has an internal market research team that speaks a total of sixteen languages, enabling them to collect proprietary information globally. For example, when AKO owned positions in the two lift manufacturers Kone and Schindler the manager wrote:

“Given the importance of China, our market research team carries out regular channel checks with installers in the region. The most recent survey suggested a slight slowdown in terms of market order growth into Q3, mirroring comments from the companies themselves. However, orders were still indicated to be up YOY and installers maintained a relatively sanguine outlook for the rest of the year. Additionally, both Kone and Schindler (to a lesser extent) were noted as continuing to gain share, with current market leader Otis losing ground.”

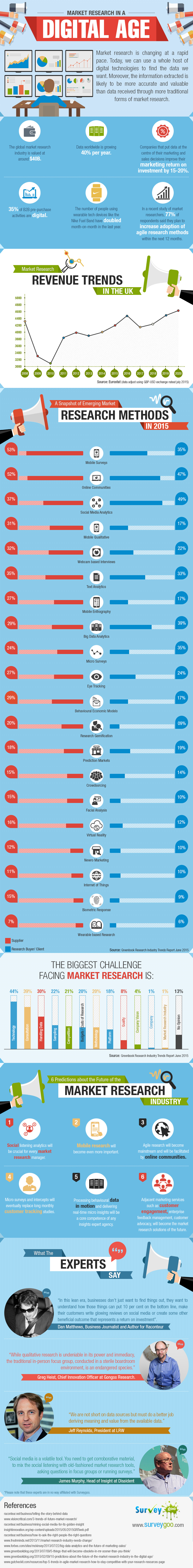

AKO Capital also employs social media research as part of its efforts to understand how a company is performing within its industry. Which is one of the reasons why this info-graphic from Surveygoo.com is relevant to hedge funds:

For more on Surveygoo please go the their website Surveygoo.com and contact Managing director Neil Cary.

Related articles:

Organising Research & Staff Development in Equity Hedge – A Podcast with Stuart Mitchell (Oct 2015)

Hedge Funds’ Access to Investment Research Under Change (Oct 2015)

10 Ways Hedge Fund Managers Can Improve Their Research Using The Web (July 2014)