By Hedge Fund Insight staff

Life settlements are set to see their best year ever as an asset class in 2021, according to Managing Partners Group (MPG), the international asset management group. Life settlements are US-issued life insurance policies that have been sold by the original owner at a discount to their future maturity value and are institutionally traded through a highly regulated secondary market. The market increasingly includes high profile institutional investors and service providers, including Apollo Global Management, GWG Life, Vida Capital, Red Bird Capital Partners, Partner Re, SCOR, Berkshire Hathaway, Wells Fargo, Bank of Utah, Wilmington Trust and Suisse Life Settlements LLC.

Jeremy Leach

Asset managers that are looking to diversify from core asset classes have raised the enquiry rate at managers of Life settlement products. Jeremy Leach, Chief Executive Officer, Managing Partners Group, commented: “Strong demand is driving the asset class’s performance going forwards. Investors globally are turning away from fully priced bonds and equities and the steady, incremental returns offered by life settlements are highly attractive to them.”

He continued, “any reduction in US life expectancy clearly raises performance too, and while COVID-19 had limited impact on this in 2020 we expect the full effects to come out in 2021. This will not just be in terms of reducing the life expectancy of 80-plus year olds, who are most affected by the virus and common vendors of policies. The increase in unemployment caused by the COVID pandemic and the depleted income on savings because of low interest rates will also drive more policyholders to sell their policies, increasing market supply.”

Life settlements are seeing increasing interest from institutional investors and wealth managers in the US, Europe – especially Switzerland – and Asia. MPG estimates that the face value of new policies coming onto the market rose by 10% in 2020 to $4.6bn and is set to rise to in excess of $5bn in the New Year.1

The volume of new life settlements coming on to the market has risen annually since 2016, when investors began showing renewed interest in the asset class, although it is still some way below the peak of $12.2bn seen in 2007. The total face value of in-force life settlements was estimated to be $21.6bn in 2019.1

The key drivers of growth in the US’ life settlement market include:

- Investors are seeking above-average returns in the current low interest rate environment.

- The regulatory environment governing life settlements is established now and new legislation continues to support market growth. Several states are making it compulsory for insurers to inform policyholders wishing to lapse their policies that there are more lucrative opportunities to settle instead, for example.

- An increasing number of baby boomers are seeking ways to pay for retirement or care. The US Census Bureau predicts a 37% increase in those aged 65 years and older to 78m by 2035, for example.

- Retirees relying on income from savings have been badly affected by low interest rates that have depleted income and caused erosion of capital.

- The increase in unemployment and negative impact on retirement funds caused by the COVID pandemic will spur more policyholders to sell their policies.

- The current policy pricing sweet spot is at an extremely attractive level for both buyers and sellers and is therefore a potent market driver. The current pricing range is optimal to generate stronger values for policy sellers than we have seen for some years, which is set to increase market supply, whilst IRRs of 13% enable life settlement funds the opportunity to deliver significantly higher returns than the risk-free rate, which in turn will continue to increase investor appetite for the asset class.

MPG’s High Protection Fund, which invests in life settlements, is an absolute return vehicle that aims to deliver long-term capital growth of between 8-9% per annum by investing in a portfolio of life settlements.

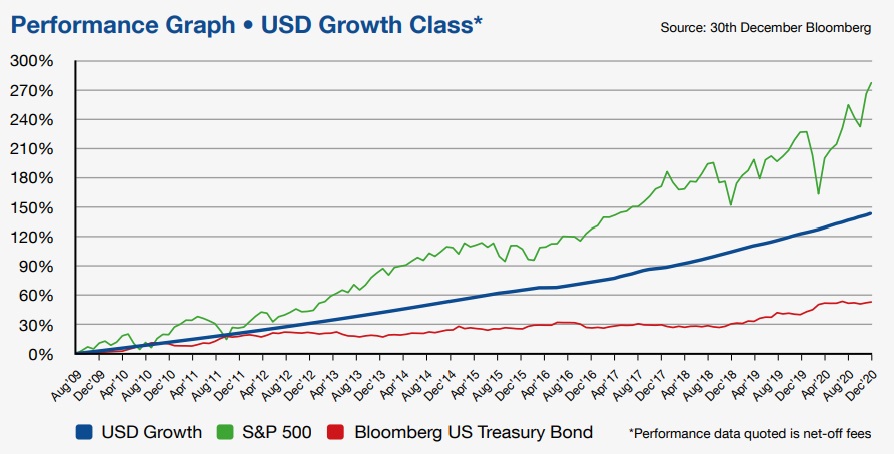

The High Protection Fund (the blue line in the performance graph above) recorded its best year in 2020, delivering 9.91% net of fees over the calendar year with no drawdowns in any month.2 It has returned 145% since it was launched in July 2009. The standard deviation of returns has been 0.19% since launch and its Sharpe Ratio of 2.7 reflects consistent outperformance of the risk-free rate. The fund has no initial or performance fees which has given it an edge in outcomes versus competing funds within the life settlement sector.

MPG expects 2021 will be an even stronger year for the life settlement asset class, which is in a sweet spot of supply and demand. Internal Rates of Return on policies are currently around 13%.3 So they potentially offer inflation-beating returns with less volatility than equities, whilst prices are sufficiently high to encourage more policyholders to sell their policies, thereby boosting market liquidity.

About Managing Partners Group (MPG).

MPG is a multi-disciplined investment house that specialises in the creation, management and administration of regulated mutual funds and issuers of asset-backed securities for SMEs, financial institutions and sophisticated investors. It currently manages funds with a gross value of $500m. MPG was awarded as Most Outstanding Asset Management Company – Europe 2020 by Acquisition International Global Awards. The High Protection Fund won Best in Insurance-Linked Investments category for three years’ running in the 2019, 2020 and 2021 by Corporate America Today Awards. For more information on Managing Partners Group see: www.managingpartnersgroup.com

related article