By Simon Kerr, Publisher of Hedge Fund Insight

When I received the press release headed “IndexIQ Announces December 2015 Performance of Its IQ Hedge Family of Investable Benchmark Hedge Fund Replication Indexes” I thought I would have a look at the (relative) returns.

According IQ “the IQ Hedge™ Indexes comprise the first family of investable benchmark indexes covering hedge fund replication/alternative beta strategies and they are designed as investable benchmarks that replicate the performance characteristics of sophisticated hedge fund strategies.”

IndexIQ state that their philosophy is to democratize investment management by providing all investors with cost-effective access to the types of high-quality, sophisticated investment products that typically have been reserved for institutional and ultra high-net-worth investors. Further, IndexIQ’s mission is “to take indexing to the next level by combining the best attributes of both passive and active investing, and make strategies available to investors in low cost, liquid, and transparent products.”

Potential investors are made aware by IndexIQ that Index performance does not reflect charges and expenses associated with the Funds or brokerage commissions associated with buying and selling ETF shares.

The IndexIQ website states that the Hedge Fund Replication Indexes are based on rigorous academic and proprietary research, and that IndexIQ has created a suite of hedge fund replication strategies that seek to capture the risk and return performance characteristics of leading hedge fund investment styles. To do this IndexIQ “employs a proprietary, rules-based investment process that selects components from a wide array of ETFs that cover commodities, currencies, stocks, bonds and real estate. This ETF-based approach allows us to bring the strong risk-adjusted return potential of hedge funds to all investors in low cost, highly-liquid and easily tradable products.”

The stated benefits include:

- Access for all investors

- Daily liquidity — no lockups

- Low correlation — powerful portfolio diversification tool

- Portfolio transparency — clarity into what the investor owns

- Rules-based methodologies — limits manager subjectivity

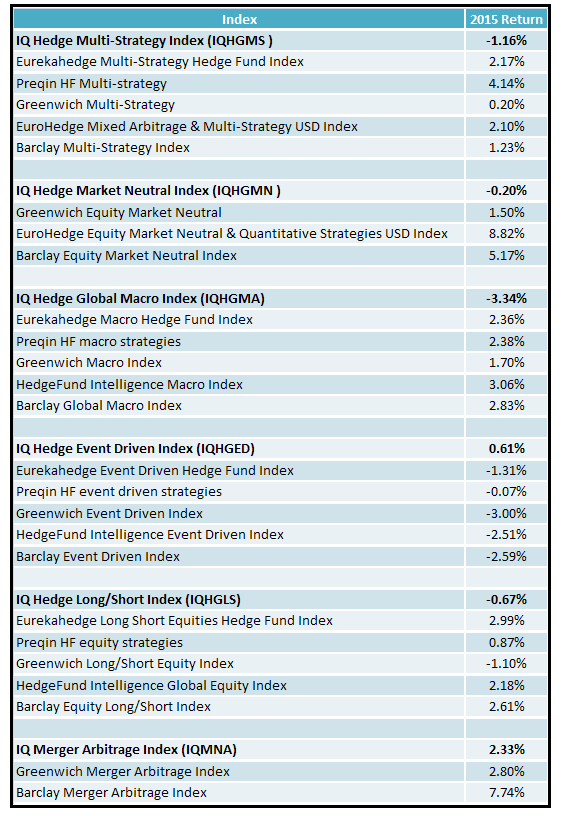

For comparison HF Insight has chosen hedge fund indices that have the closest investment strategy match to those of IndexIQ. You can read the actual definitions of the IndexIQ indices here. Where there is an equivalent index available from the five other providers it has been included here – that is the comparitors have not been adversely or positively selected. For example , only two of the index providers had merger arbitrage indices at all.

The results in the Table below reflect data captured by the index/database providers at today’s date or as sent to Hedge Fund Insight. You should be aware that as more of the universe reports to databases the return data becomes a more accurate reflection of average or typical strategy returns. However later (and final) returns per index will vary from returns given below by a small amount, and not significantly for the purpose which they are shown below.

So how has hedge fund replication done in 2015?

-

There are six hedge fund investment strategies in the IQ series. For only one of them, the hedge fund strategy of the six with a negative return last year, event driven, does the IQ index beat the other indices.

-

For five of the six strategies the IQ index returns for calendar 2015 were below the returns given at the index level by other providers.

-

For four of the six strategies the IQ index return is negative when the index return for 2015 for the other providers are either mostly positive absolute returns or all positive (multi-strategy, market neutral, and macro).

-

For the most part the size of difference between the replication indices returns and the strategy level indices from other providers is not just significant but large.

Of course the above table reflects the returns of one calendar year and the IQIndices have more than 5 years of history, and hedge fund replication strategies have been around for a lot longer than that, and there are other providers of replication strategies. But still and all we have to ask

Is this what hedge fund replication is supposed to look like?

E&OE

Related articles:

Hedge Fund Beta Exposure of Towers Watson Clients

Replication out at AHL