By Hedge Fund Insight staff

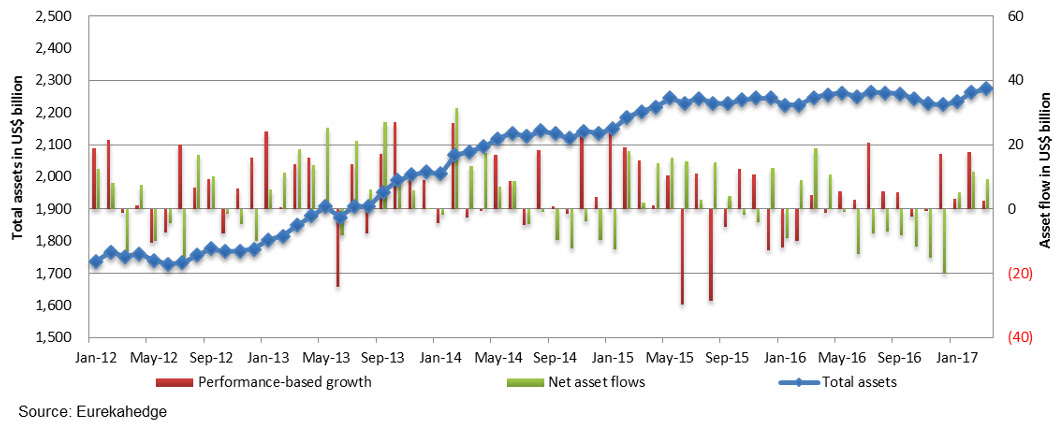

The latest data from Eurekahedge shows the best flows into the hedge fund industry for a number of years for the first quarter of 2017.

Preliminary net asset flows were positive in March with US$9.3 billion of inflows into the industry. Investor subscriptions have picked up pace since the start of the year, with net inflows coming in at US$26.1 billion. Most of the flows came from American institutions and went into hedge funds managed from North America. Year-to-date investor subscriptions into American hedge funds stood at US$23.9 billion.

In terms of investment strategy, over 60% of the net subscriptions to the industry this year have gone into CTAs ($16.4bn in absolute terms). This is striking for a couple of reasons – one point on CTAs themselves and one on global macro. Last year CTAs had a positive return in the first half of the year and then lost that gain over the rest of the year. Net subscriptions for CTAs were insignificant through the year, but were better than the rest of the industry. That is investors resisted the temptation to redeem in the second half of 2016 as returns came in negative. The inference is that investors were broadly content with their overall exposure to managed futures. That relatively positive view from investors in 2016 has become more constructive in 2017. and investors have added to their holdings in CTAs this year. It has been suggested that investors may have looked to increase the diversifying/hedging elements of their hedge fund exposures this year as risk has been perceived to have increased.

A related curiosity has been the flows into global macro strategies. Net flows into macro funds were a very small negative amount for 2016 (Eurekahedge estimates net redemptions of $1bn or around 60 basis points of strategy AUM). Since the turn of the year a couple of large surveys of investors have been released. When asked which hedge fund strategies they were interested in adding to, investors have ranked global macro top: in the Deutsche Bank Alternative Investment Survey (on a net basis) 27 percent of investors plan to increase their exposure to discretionary macro over the next twelve months. Flows to global macro funds so far in 2017 do not match the stated intentions in the surveys.

Since the start of the year macro funds have lost $1.7bn through redemptions. This is only 1.1% of the assets under management at the start of the year, but that there should be net redemptions at all, given the stated intentions of investors in response to survey questions is noteworthy.