From Hedge Fund Insight staff

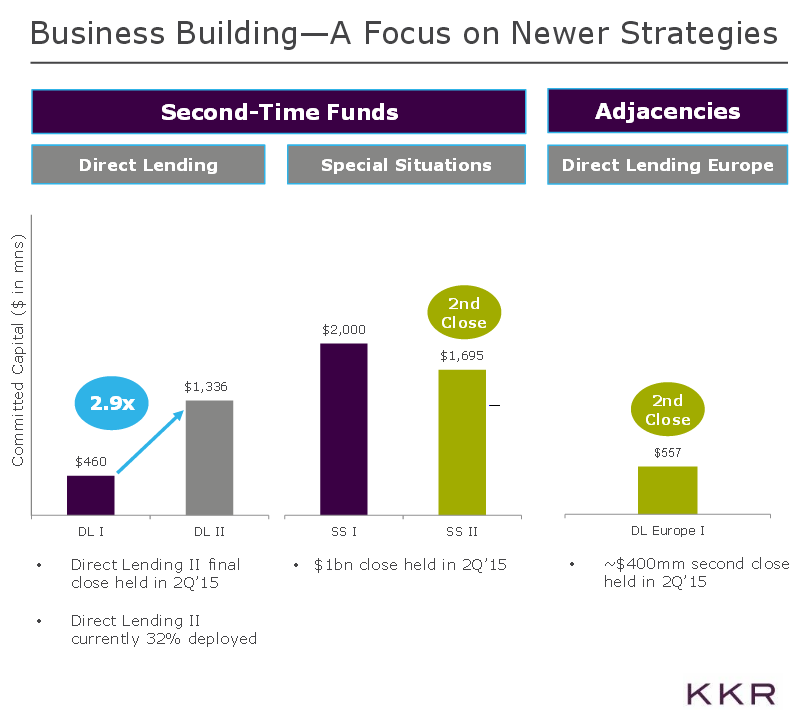

With the 2Q Earnings Release from KKR & Co LLP came evidence of how alternative financing businesses (including hedge funds) are replacing bank financing. In the Investor Update accompanying the Conference Call KKR presented some data on their newer strategies which will power future earnings. Direct Lending featured strongly:

In the 2Q alone KKR raised nearly $600m to apply to Direct Lending strategies. KKR have taken the strategy to Europe and over half the new capital raised in the quarter for this strategy is going to be loaned to European borrowers. In total KKR has $2.35bn of capital available for Direct Lending, equivalent to 2.31% of firmwide assets under management at the half-year stage. Other Private Equity groups with Direct Lending operations are giants CVC Capital Partners and TPG Capital, and Stockholm-based private equity firm EQT Partners.

In the 2Q alone KKR raised nearly $600m to apply to Direct Lending strategies. KKR have taken the strategy to Europe and over half the new capital raised in the quarter for this strategy is going to be loaned to European borrowers. In total KKR has $2.35bn of capital available for Direct Lending, equivalent to 2.31% of firmwide assets under management at the half-year stage. Other Private Equity groups with Direct Lending operations are giants CVC Capital Partners and TPG Capital, and Stockholm-based private equity firm EQT Partners.

Turning to hedge funds, Cerberus Capital Management is thought to be the amongst the first hedge fund groups to engage in Direct Lending. Highbridge Capital Management, Avenue Capital, and Czech Asset Management are now involved, and Napier Park Global Capital are planning to join in. Among the European hedge fund groups to be involved in Direct Lending are BlueBay Asset Management, Omni Partners and Chenavari Credit Partners Llp.