From Lyxor Asset Management*

Hello,

Please find attached this week’s Lyxor Weekly Brief. This is a weekly report from Lyxor’s Cross Asset Research team, focused on hedge fund flows, performance and positioning. It aims at identifying trends in hedge fund investing every week, while leveraging on the proprietary information accessible through the Managed Account Platform.

How Do Hedge Funds Position Ahead of the Atypical French Elections?

Hedge funds generated alpha last week. Global Macro funds outperformed thanks to higher dollar and oil prices. Amid slightly negative global equities, L/S Equity funds succeeded in extracting excess returns, especially in Europe thorugh relative trades.

Two weeks and counting before the very atypical French presidential elections, hedge funds are displaying disparate stances on this event.

Global Macro funds at Lyxor seem to be prudently positioned. After the UK referendum and the U.S. election surprises, they are more cautious. While they do not seem to be taking a particular stance on the elections, they are de-risking portfolios and favor relative value trades. Their net total exposure to equities and FX (in USD) are both below 20%.

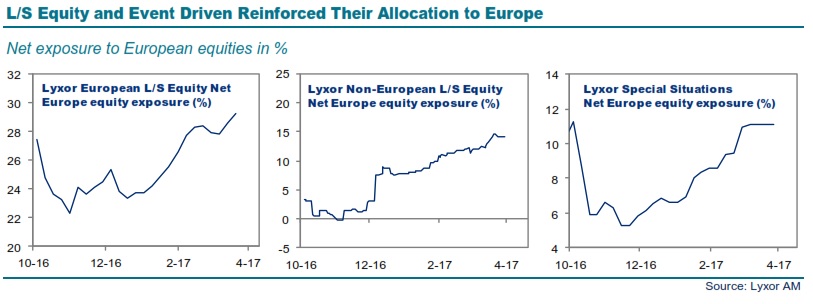

Event Driven funds have marginally increased their European exposures since the end of 2016, however, portfolio additions are company-specific. They include merger, post-merger and recapitalization situations.

Non-European L/S Equity funds steadily increased their allocation to Europe over the last six months with little influence from trends in polls. Such funds seem to play the European recovery. Accounting for a third of their exposure, their European stakes do not seem to be abnormally hedged.

European L/S Equity managers also seem to play the recovery but with protections layers. They raised their net exposure by a third since the end of 2016, favoring cyclical sectors such as industrials, tech and materials, as well as small caps. That is not to say that they shrug this risk-off. Since the end of January, when the election stress stepped up, they reduced financials and EU-domestic stocks. Additionally, they reinforced the defensive sectors and moved toward non-EU/EMU European markets. They also maintained their short on indices futures implemented back in November 2016.

Finally, CTAs seem to be more aggressively exposed to Europe. Their long equities account for the bulk of their current directional exposure, a third of which in Europe. It is partially hedged with long Euro-bond, short EUR, short U.S. duration (all of relatively small size).

*from the Lyxor Weekly Brief from Lyxor’s Cross Asset Research team