By Hedge Fund Insight staff

Harvest Capital Strategies LLC, a San Francisco-based, SEC-registered investment adviser with approximately $1.6 billion in alternative assets under management, has seen a near doubling of hedge fund performance fee income in the last year. Harvest Capital Strategies is part of publicly owned investment banking and alternative asset management firm JMP Group LLC.

Harvest invests through long-short equity hedge funds, private equity and middle-market lending. The firm has a specialist focus on technology, agriculture, financial services and small-cap equities. Philosophically the management at Harvest Capital Strategies believe that portfolio managers who have demonstrable domain expertise are better equipped to exploit market inefficiencies because of their abilities to source and interpret information. This appears to have paid off in a couple of regards in 2014.

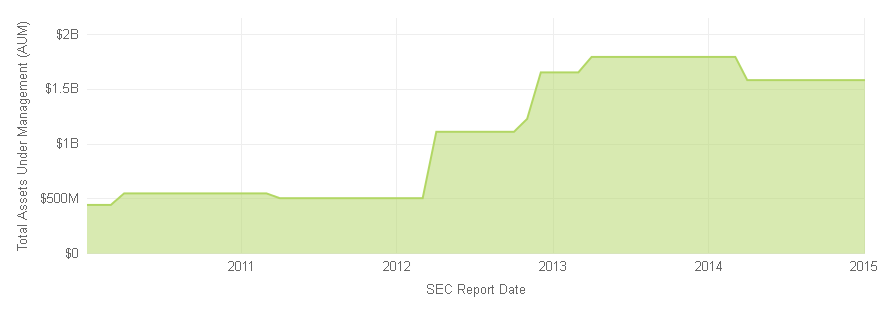

The firm started the year with a $849m in AUM in the long short equity portfolio, according to SEC filings. The same source shows that AUM had grown to $1.3bn at the end of the 1Q, and as much as $1.85bn halfway through the year. At the last SEC filing date (at the end of September 2014) the long/short fund was back to $1.2bn AUM. So AUM in the equity hedge fund were up over 50% in 2014.

Harvest Capital Strategies Total Assets Under Management

as reported to the SEC

The change in size of assets in assets and investment return of the assets have both contributed to the performance fee rise. Hedge fund incentive fees rose last year to $23.3m from $12.3m in 2013.

The investment strategies of Harvest Capital Strategies have, for the last several years, been incorporated into the multi-manager products of Altegris. Altegris Multi-Strategy Alternative Fund (MULAX) includes the financials and agriculture/consumer strategies of Harvest, and the $145m Altegris Equity Long Short Fund (ELSNX) has three sub-advisors (Chilton, Visium and Harvest). ELSNX is invested in Harvest’s flagship Opportunity strategy, which is very financials-focused.

Further information on the funds managed by Harvest Capital Strategies can be found on Financial Diligence Networks LLC. FDN is a growing private network for the alternative investment industry.