From the Research Note “Hedge Fund-ing the Pension Deficit” by Cambridge Associates

Research Note Conclusion

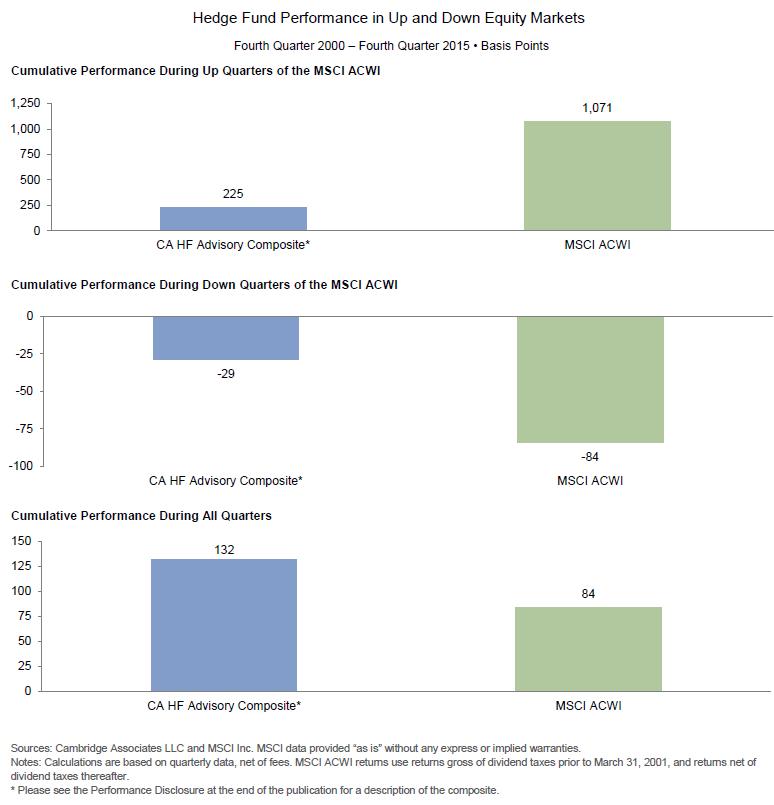

Growth assets that can deliver attractive long-term returns with beneficial effects on total portfolio risk have clear value to plan sponsors, particularly as plans seek to recoup recent funding losses without increasing the portfolio’s risk level. Low beta–high alpha hedge funds may fulfill this role and contribute meaningful diversification to equity-biased growth portfolios, which is especially important in today’s markets where many traditional assets are overvalued. High conviction hedge funds that generate returns from less directional strategies than long-only equities or face less interest rate risk than traditional bonds are particularly attractive.

Building a diversified and differentiated portfolio of strategies and managers that complement the rest of a plan’s portfolio represents a significant hurdle. These challenges notwithstanding, an allocation to low beta–high alpha hedge funds can play a powerful role in enhancing a plan’s risk-adjusted returns, and should be emphasized in the context of holistic pension risk management strategies.

You can read the whole 15-page report at http://www.cambridgeassociates.com/our-insights/research/hedge-fund-ing-the-pension-deficit/